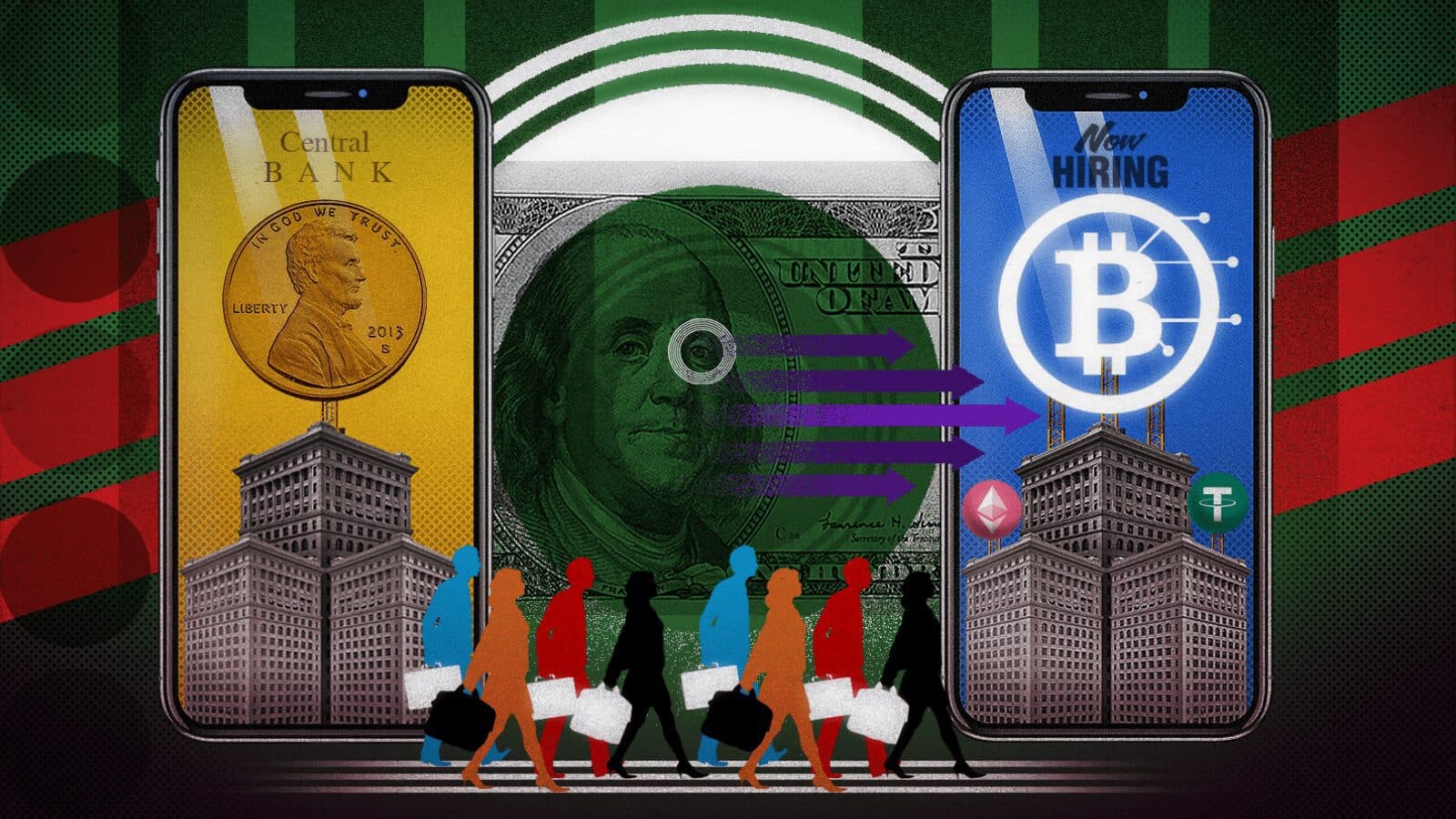

Latest in Crypto Hiring: Firms Fill High-profile Roles as Layoffs Continue

Uniswap brings in former NYSE president, BitPay adds an attorney

blockworks exclusive art by axel rangel

- Executives remain mostly shielded from crypto’s job squeeze

- Deep-pocketed traditional and decentralized finance firms announce job openings as struggling crypto firms make cuts

Decentralized trading platform Uniswap Labs brought on Stacy Cunningham, former president of the New York Stock Exchange, as an adviser this week. The company hopes Cunningham’s experience in the top echelons of traditional finance will bring insight to the protocol.

CoinFund appointed Margaret Gabriel as the firm’s head of talent. Gabriel will lead CoinFund’s talent acquisition program and will advise the firm’s portfolio companies on new hires. Gabriel previously worked in recruitment roles at Gemini and Google.

Crypto payment service BitPay made Allison Raley its chief compliance officer. The hire comes as Congress weighs crypto regulation amid widespread decentralized finance (DeFi) liquidity issues. After receiving her law degree from Baylor University, Raley previously worked in digital asset compliance for an Arkansas law firm.

Kraken Product Manager Pierre Rochard has informed the company of his retirement. Rochard, who was with the exchange for almost three years, insisted on Twitter that his departure will allow him “to spend more time with family” and is not related to dysfunctional company culture recently reported by The New York Times.

Layoffs abounded in the crypto industry last week — with Crypto.com, BlockFi, Coinbase and Gemini, among others, announcing staff cuts — but several of the space’s largest funds have so far avoided downsizing and are publicizing new job openings.

Binance CEO Changpeng Zhao tweeted that the trading platform is looking to hire 2,000 new employees, and Kraken wrote in a blog post that the company is hoping to fill 500 positions by the end of 2022. FTX, OpenSea, Everstake, Polygon and Ripple all also indicated they are looking to bring on new employees.

Traditional finance firms are opening their doors to some of crypto’s recently fired. Deloitte has listed 144 crypto-adjacent job openings, while CashApp and Jack Dorsey’s Block are also looking to fill dozens of crypto positions, according to research from CryptoJobsList.com.

Layoffs are expected to continue as the market slides, but firms with the resources to weather the crypto winter will benefit from an expanding pool of available labor.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.