AssangeDAO Raises $55M in Six Days to Help Liberate WikiLeaks’ Founder

The fund increased from about 67 ether on Feb. 3 to 17,422 ether on Feb. 9

Source: Shutterstock

- “The desire to achieve Julian’s liberation and uphold civil liberties,” drove the spike in donations, AssangeDAO’s core moderator Josh, who goes by the username JB87, told Blockworks

- A clock NFT was bought by the DAO for 16,593 ether, about $53 million, to help fund Assange’s defense and legal fees

A week ago, AssangeDAO launched a project to raise money for incarcerated WikiLeaks Founder Julian Assange. At the time, it had no funds, yet.

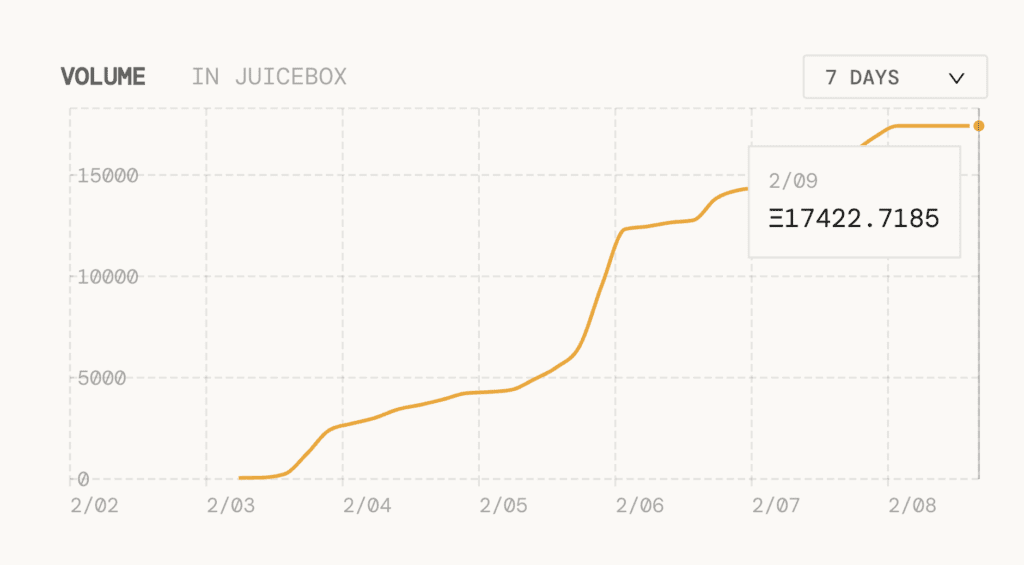

Within the first day of launching, it raised over 67 ether, about $215,000. Fast-forward six days to Feb. 9, and it increased 25,903% to about 17,422 ether, or $55 million, on Juicebox — the same platform previously used by ConstitutionDAO in its unsuccessful $49 million bid for an original copy of the US Constitution.

“The desire to achieve Julian’s liberation and uphold civil liberties,” drove the spike in donations, AssangeDAO’s core moderator Josh, who goes by the username JB87, told Blockworks.

Within the first day of launching, the fund raised over 67 ether, about $215,000. Fast-forward six days to Feb. 9, and it increased 25,903% to about 17,422 ether, or $55 million. | Source: Juicebox

Within the first day of launching, the fund raised over 67 ether, about $215,000. Fast-forward six days to Feb. 9, and it increased 25,903% to about 17,422 ether, or $55 million. | Source: Juicebox

Assange is facing extradition from London to the US for 18 criminal charges stemming from WikiLeaks’ publication of thousands of secret classified US military files in 2010. He currently resides in a London prison but is seeking the opportunity to have the US Supreme Court hear his case. If he’s extradited to the US, he faces 175 years in prison for publishing the information, the DAO shared.

Assange and bitcoin

Assange and WikiLeaks have a history with crypto. Wikileaks received contributions through a PayPal account managed by Wau Holland Foundation. The foundation managed most of Wikileaks’ funds, but its account was frozen after facing backlash for releasing confidential information that many disapproved of at the time. The group then incorporated bitcoin donations — way back in 2010 — when it couldn’t raise money any other way.

That was the first time many people heard of bitcoin. The move attracted the attention of the cryptocurrency’s illusive creator, Satoshi Nakamoto, who worried in one of his last public writings that the intertwining of WikiLeaks and bitcoin could hurt the nascent network.

“Bitcoin is a small beta community in its infancy. You would not stand to get more than pocket change, and the heat you would bring would likely destroy us at this stage,” Nakamoto wrote.

The Clock

The funds raised are intended to help fund Assange’s defense and legal fees through an auction of the Censored 1/1 Clock NFT (non-fungible token) by crypto artist Pak, in collaboration with Assange.

“The NFT gives the Web3 [and] crypto community a chance to interact with the systems that we are building, and to own a piece of art that Julian himself collaborated on,” JB87 said. “The DAO now owns this piece.”

The Clock NFT was bought by the DAO, a collective of self-described “cypherpunks,” on Wednesday morning for about 16,593 ether, or $53 million, and is updated every day to reflect how many days Assange has been imprisoned.

“This DAO represents the passion and energy that the global community feels towards achieving justice. Not just for Julian, but for the entire journalism industry,” JB87 noted.

As of Wednesday, the community-led DAO had over 16,000 followers on Twitter. The DAO, utilizes the Ethereum blockchain to distribute its JUSTICE governance token to contributors who donated ether. The tokens have no value yet but are likely to appear on decentralized exchanges and will provide community members the ability to vote on governance proposals for the DAO.

“This is tens of thousands of people coming together to show real strength — the Power of the People,” JB87 said in the AssangeDAO Discord. “In less than one week, we have shown that decentralised and distributed peoples can band together to fight injustice.”