Axie Infinity Developer Scores $152M In Series B Funding, Nearing $3B Valuation

DappRadar’s Modesta Jurgelevičienè: “The play-to-earn movement became a key driver in the space, NFTs turned towards greater utility and secured record volumes.”

Sky Mavis co-founders Jeff (Jihoz), Andy, Trung, Tu (Masamune), and Aleks (Psycheout); Source: Sky Mavis

- The round was led by Andreesen Horowitz with participation from Accel and Paradigm

- Axie Infinity breached $2 billion in all-time trading volume in September, according to DappRadar

Sky Mavis, the company behind blockchain-enabled video game Axie Infinity, announced a $152 million Series B funding round on Tuesday. The raise brings Axie’s parent company to a total valuation of almost $3 billion, according to a recent report in The Information.

Led by Andreessen Horowitz (a16z), the capital will be used towards staff expansion, scaling infrastructure and to build its own distribution platform. Other participants in the round include Accel and Paradigm, according to Axie’s Substack.

Arianna Simpson, a general partner at a16z, described the NFT-based game’s growth as a “phenomenal testament to the power of the [play-to-earn] revolution” in a recent blog post detailing the venture capital firm’s investment.

“Axie embodies a new generation of games, where game creators are not operating from a place of fear but rather as an open, free market economy that allows players to move freely in and out of,” Simpson added.

“What this means for the future of games, and really the web as we know it, is as big as your imagination will allow.”

As a play-to-earn (P2E) game, Axie Infinity players can earn crypto rewards that can later be sold and traded on secondary marketplaces. Founded in 2018, Axie users can trade, breed and battle non-fungible token (NFT) characters in the digital world.

Axie Infinity previously reported a $7.5 million Series A funding round in May, according to Crunchbase.

The funding news follows a string of announcements from Axie Infinity, including the launch of its staking program, an airdrop of $60 million worth of its token (at that time) to early users of the game and more.

“I’m bullish on NFT’s,” tweeted Youtube’s Head of Gaming Ryan Wyatt. “I believe play-to-earn is the next major gaming model, as well as an open market for in-game digital items; most in-game assets are illiquid, which is insane to me. All of this will change long-term through blockchain and NFT’s.”

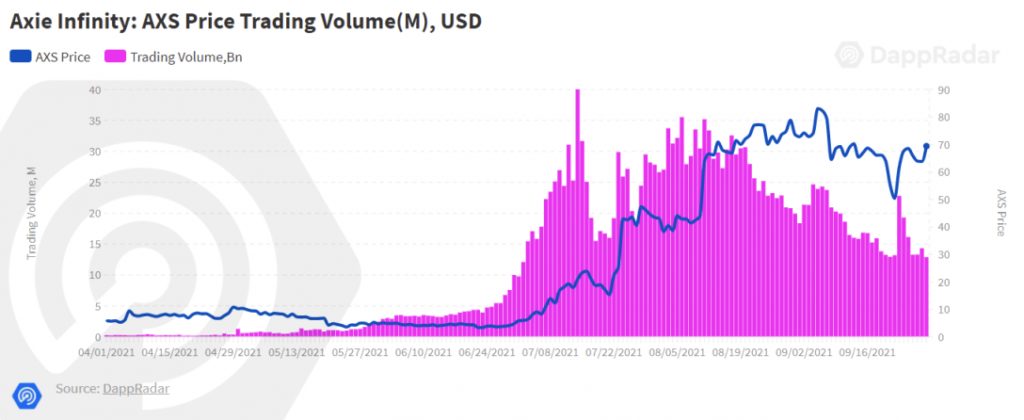

Axie Infinity has surpassed 1.5 million active users during Q3 and has generated over $776 million in revenues. The game “became the most traded NFT collection ever”, breaching $2 billion in trading volume in September, according to a recent Dapp Industry Report. But, as Blockworks previously reported, revenue has been declining in recent months, potentially due to a change in the cost to breed the in-game characters and steadier user growth.

Source: DappRadar

Source: DappRadar

The P2E Revolution

Last week, DappRadar released a report on industry-wide developments in the blockchain ecosystem, which includes data for NFTs and gaming from Q3 2021.

The report described Axie Infinity as “the spearhead of the P2E movement” that “dictates the pace of the game sector and it looks like it will just become stronger.”

“If I were to sum up Q3 in a single word, it would be ‘diversification,’” Modesta Jurgelevičienè, Head of Finance & Research at DappRadar, said. “The play-to-earn movement became a key driver in the space, NFTs turned towards greater utility and secured record volumes.”

Overall, the non-fungible token space generated roughly $10.7 billion in trading volume, up 704% since the previous quarter. Axie Infinity’s $AXS token notched an all-time high on Monday of $155.88, but is down almost 15% from the peak, trading at $132, as of press time.