CryptoFX/Shutterstock modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Whether or not Base would have a token has long been a discussion point ever since the L2 launched in mid-2023. On Monday at BaseCamp 2025, Jesse Pollak disclosed that Base is exploring the possibility of launching a token for the L2.

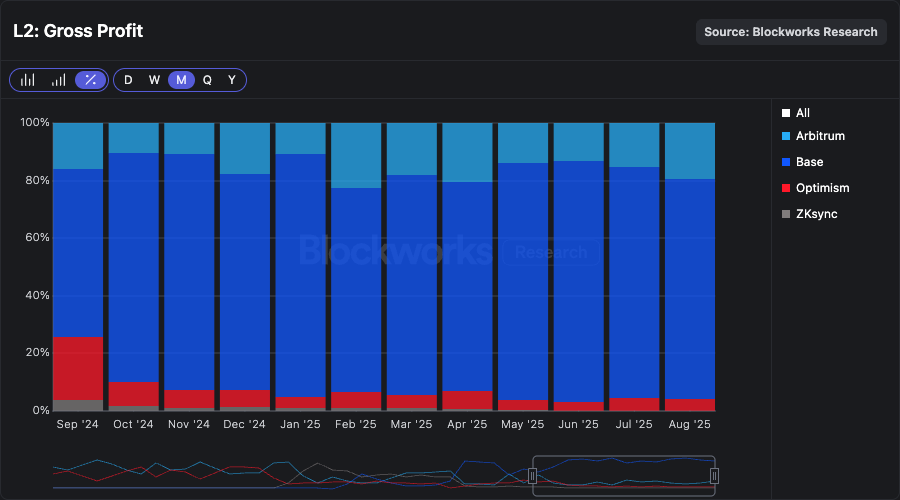

By all metrics, Base is the leading L2. It consistently accounts for over 70% of L2 gross profit, 70% of L2 transaction activity, $4.4 billion in stablecoins, and ~$20 million in monthly application revenue.

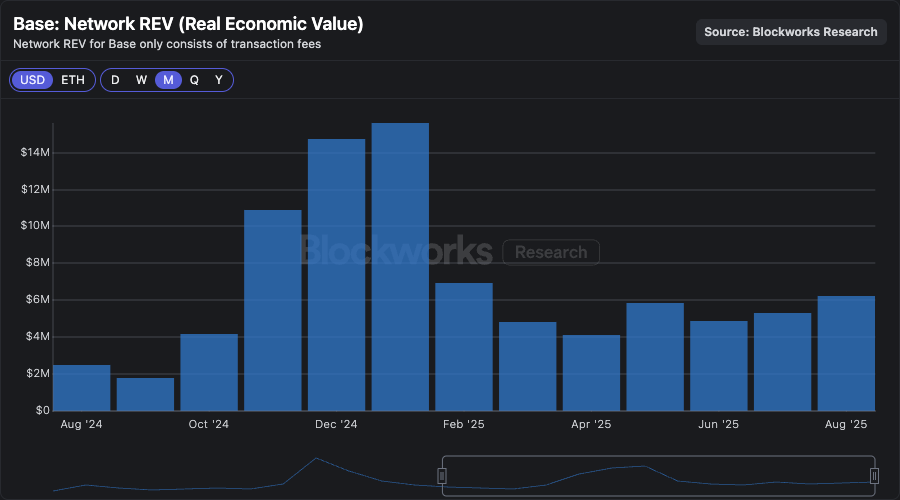

In August, Base generated $6.2 million in network REV, annualized out to $75 million. Base remains one of the only L2s without a token.

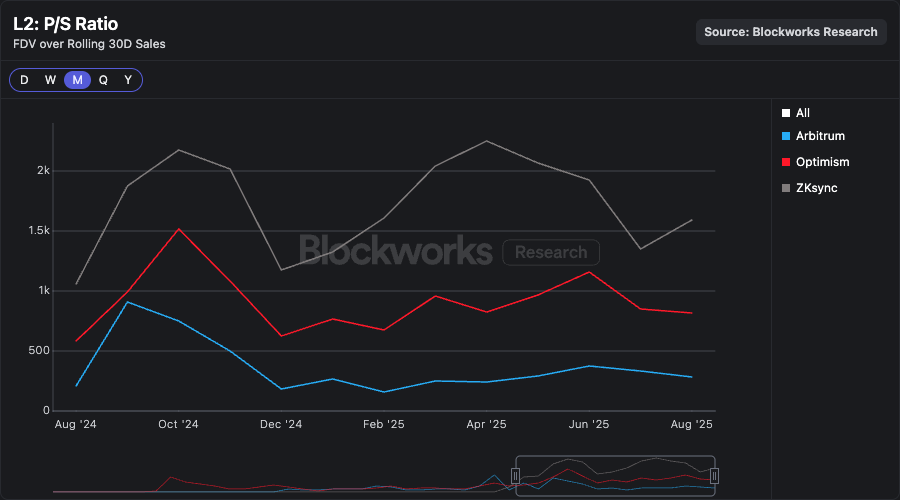

As the largest L2 generating the most in profits, what could the Base token be worth? Examining some competitor L2s (Arbitrum, Optimism, and ZKsync), show these tokens trade at lofty price-to-sales ratios of 280x, 820x, and 1600x, respectively. This puts the sector mean at a P/S of 900x.

Applying this 900x multiple to Base’s $75 million in annualized REV puts a potential FDV on a Base token at $67 billion. To be priced in line with ARB at a 280x multiple, this would price Base’s token at a $21 billion FDV. Are these projections “fair-value” for a Base token? Absolutely not. But it does go to show the market value it could command is consistent with the sector’s multiples.

The napkin math forecasts are dramatic. Could launching a token really create tens of billions in market value for stakeholders? Coinbase equity is trading at a $84 billion market cap. This puts Coinbase at 7x last quarter’s sales, annualized, while revenues from Base account for less than 1% of the company’s topline sales. Would reattributing this revenue stream from equity holders to an L2 token really deserve a 100x higher multiple? Unlikely; the multiples in the sector are outrageous to begin with.

It’s worth mentioning also that the implications of a Base token would be rife with regulatory scrutiny. Currently, the cash flows of Base’s operations are owned by COIN shareholders, a publicly-listed, registered security. Could a Base token reasonably have a claim on the L2’s cash flows without rugging existing shareholders? And, if the token has no claim, what is it really for?

Decision makers at Coinbase have likely already surveyed the valuation landscape amongst L2s, and they know full well they are sitting on the cash cow of this sector. The decision to launch a token presents tradeoffs, and tradeoffs that may actually favor shareholders. Consider this thought experiment: Say the Base token had a claim on 100% of Base’s gross profit. Coinbase could allocate itself, arbitrarily, two thirds of the Base token supply, with the remainder allocated to ecosystem users and builders. In doing so, Coinbase would forgo $25 million in annual revenue in exchange for a balance sheet asset that perhaps may be worth $14-$44 billion. Forgo $25 million annually in exchange for a one time receipt of tens of billions in token value? I’d take that trade.

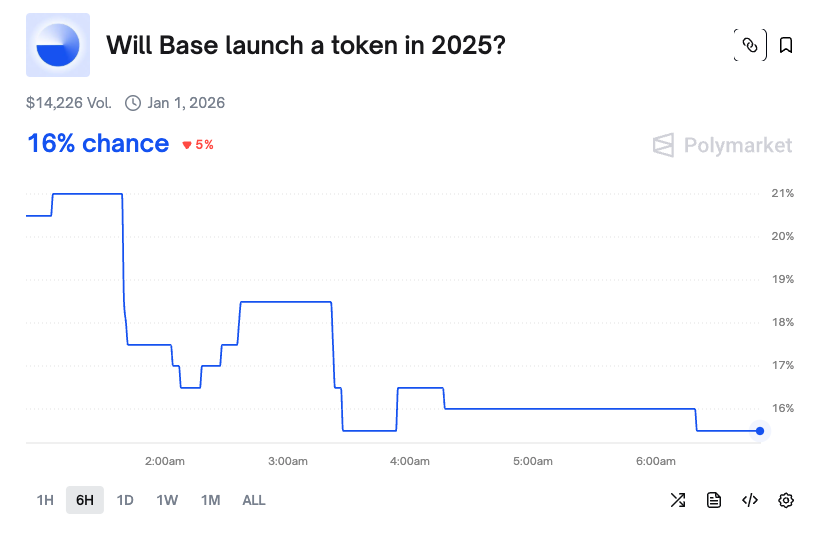

While the moonpath on a Base token, its market value, the potential wealth effect of a sizable airdrop, and the implications for ecosystem applications like Aerodrome (which traded 10% higher on the news) present a fun exercise, Polymarket’s line on a Base token is pricing the under that it will launch this year.

This market has the probability that Base will launch a token in 2025 at just 16%, suggesting these are matters for next year.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.