Binance Resumes Bitcoin Withdrawals As Transaction Fees Skyrocket

Binance bitcoin withdrawals are back, but with increased fees to help speed them up amid historic demand for blockspace

Grindi/Shutterstock, modified by Blockworks

Binance has boosted BTC withdrawal fees in response to a significant backlog of pending transactions on the Bitcoin blockchain.

The top crypto exchange by trade volume had for about an hour suspended bitcoin withdrawals early Sunday morning, and had suspended them a second time throughout the day.

Binance increased its bitcoin withdrawal fees from 00002 BTC ($5.59) to 0.001 BTC ($27.94) per withdrawal, a spokesperson told Blockworks.

“Due to an increase in the overall network fee on the Bitcoin network, the operational cost of maintaining withdrawals for BTC also increases,” they said.

“There is a need to increase the withdrawal fee charged on the Binance platform for the Bitcoin network to ensure users’ transactions are picked up by mining pools.”

Pending bitcoin transactions refer to those submitted by users but yet to be added to the blockchain by the network’s miners.

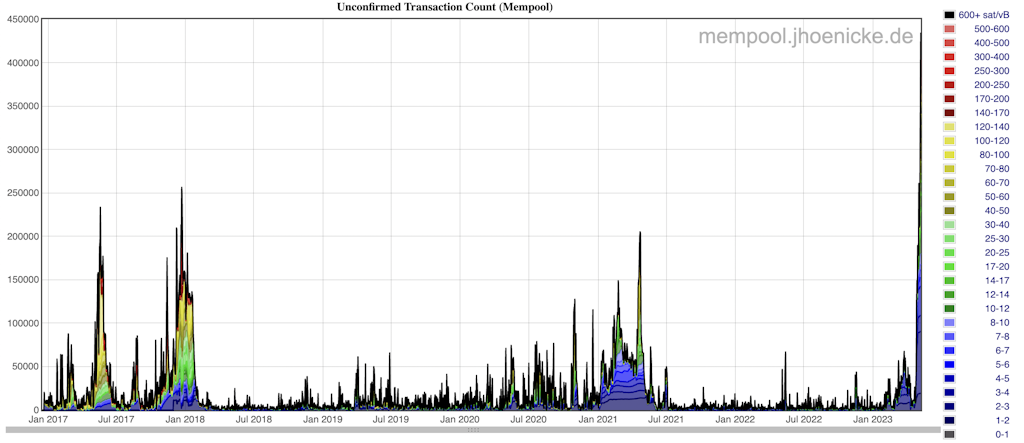

Unconfirmed transactions sit in the blockchain’s “mempool,” which on Monday morning recorded its highest ever count in its 14-year history at 444,000.

Bitcoin has blown past its previous mempool records set during the 2017-2018 bull market (source)

Bitcoin has blown past its previous mempool records set during the 2017-2018 bull market (source)

At times like these, when demand for Bitcoin blockspace is competitive, miners will opt to prioritize transactions with higher fees attached. Binance had not accounted for the demand, which led to longer withdrawal times.

The average transaction fee has surged nearly five times since March, reaching its highest point in two years. Data from YCharts shows the current transaction fee has skyrocketed to $19.21, reflecting a staggering 789% jump compared to the same time last year.

An influx of Ordinals inscriptions and BRC-20 mints have been attributed to the surge.

Binance said it was also working to enable bitcoin withdrawals on the Lightning Network, the layer-2 network intended to make transactions faster and cheaper, to help alleviate similar future scenarios.

Binance expects to provide another update once all pending transactions have been processed.

As for bitcoin’s price, it has dropped 3% over the past five days to around $28,000, but still up 70% year to date.

Updated May. 8, 2023 at 6:19 am ET: Added confirmation of Binance’s new bitcoin withdrawal fees.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.