Binance Market Share Only Goes Up After FTX

Despite US regulators gobbling its branded stablecoin, Binance still handles more volume than any other crypto exchange

Binance CEO Changpeng Zhao | Blockworks exclusive art by Axel Rangel

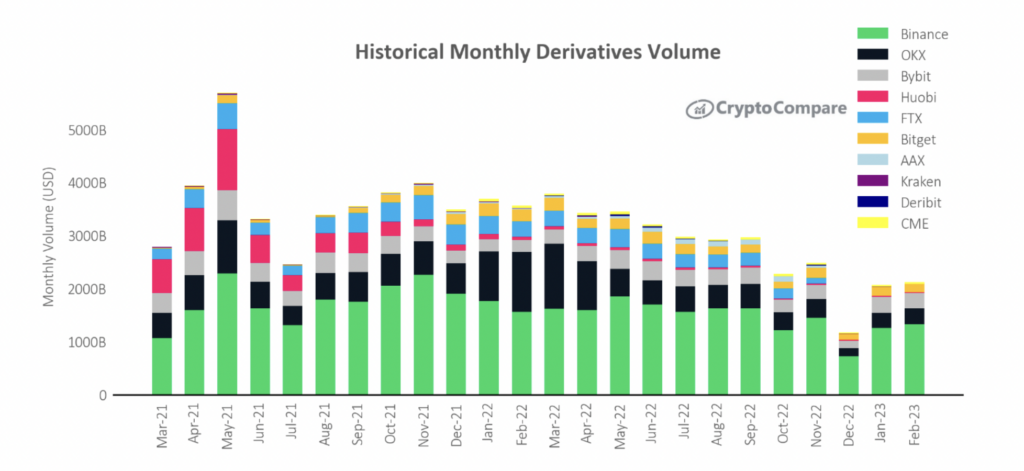

Binance makes up more of the crypto derivatives market than ever, thanks to a four-month hot streak following the collapse of rival FTX.

Binance was responsible for 61.8% of global spot trade last month, up 2.4%, after it recorded $540 billion in total volume, according to a report by CryptoCompare.

Spot volumes for Coinbase, Bitfinex and Bitstamp all saw a monthly decline in February.

Binance also topped derivatives volumes with 63% — its highest market share on record. The exchange clocked $1.32 trillion in derivatives volumes in February, up more than 5% on January’s figures, and now far ahead of Bybit and OKX.

All while Binance suffers what could be the beginning of the end for its branded stablecoin BUSD. The SEC issued its issuer Paxos a Wells Notice last month, effectively flagging intent to sue over potential securities law violations.

New York-headquartered Paxos quickly announced it would stop minting new tokens. Customers have since redeemed billions in BUSD for cash.

Still, BUSD remains the second-most used stablecoin or fiat pair across centralized exchanges, with 23.1%, per CryptoCompare. Tether’s USDT is far ahead with 72%.

Derivatives volumes are still mostly green (which means Binance) | source

Derivatives volumes are still mostly green (which means Binance) | source

“USDT proved to be the largest winner [of the Paxos situation] as its BTC trading volumes in February rose 6.66% to 11.2 million BTC month-on-month,” CryptoCompare said.

Both BUSD and USDC, on the other hand, saw declines in their BTC trading volumes.

Spot markets overall have witnessed an increase in trading activity in recent months, spurred by comparatively cheap crypto prices. More favorable macro conditions have also helped, CryptoCompare said, especially compared to this time last year.

In February, total spot trading volumes increased 10% to $946 billion, the second consecutive month of rising volumes. But they remain at “historically low levels.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.