Making sense of Bitcoin’s broken 4-year cycle

Bitcoin deviated from its typical four-year cycle. Can its course be corrected?

Elisabeth Coelfen/Shutterstock modified by Blockworks

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

A pump to restore order

Bitcoin is a highly calibrated system that mostly regulates itself.

For miners especially, that means the playing field constantly changes. Usually, it gets more difficult.

It’s not just the halving every four years that moves the needle. A wave of mining rigs could join or rejoin the network at any given moment, shrinking the odds that existing miners may find the next block.

If too many rigs join at once and start finding too many blocks too quickly (speeding up issuance), then the Bitcoin system will automatically make discoverability more difficult, a setting that changes autonomously every two weeks.

That generally means miners must spend more energy to mine the same amount of bitcoin. More energy means more money.

Luckily, the Bitcoin blockchain itself doesn’t care about the price of bitcoin. It doesn’t even know what it is. One bitcoin equals one bitcoin.

But until hyperbitcoinization prices the whole world in ultra-expensive BTC over worthless fiat — the price of bitcoin will matter a lot. Especially to bitcoin miners, who still pay their power bills in regular dollars.

That explains all the doomerism around halvings, the latest of which happened in April. Halvings may mess with the economics of bitcoin mining — leading to bankruptcies, acquisitions and other kinds of demises — but the network itself chugs on unaffected.

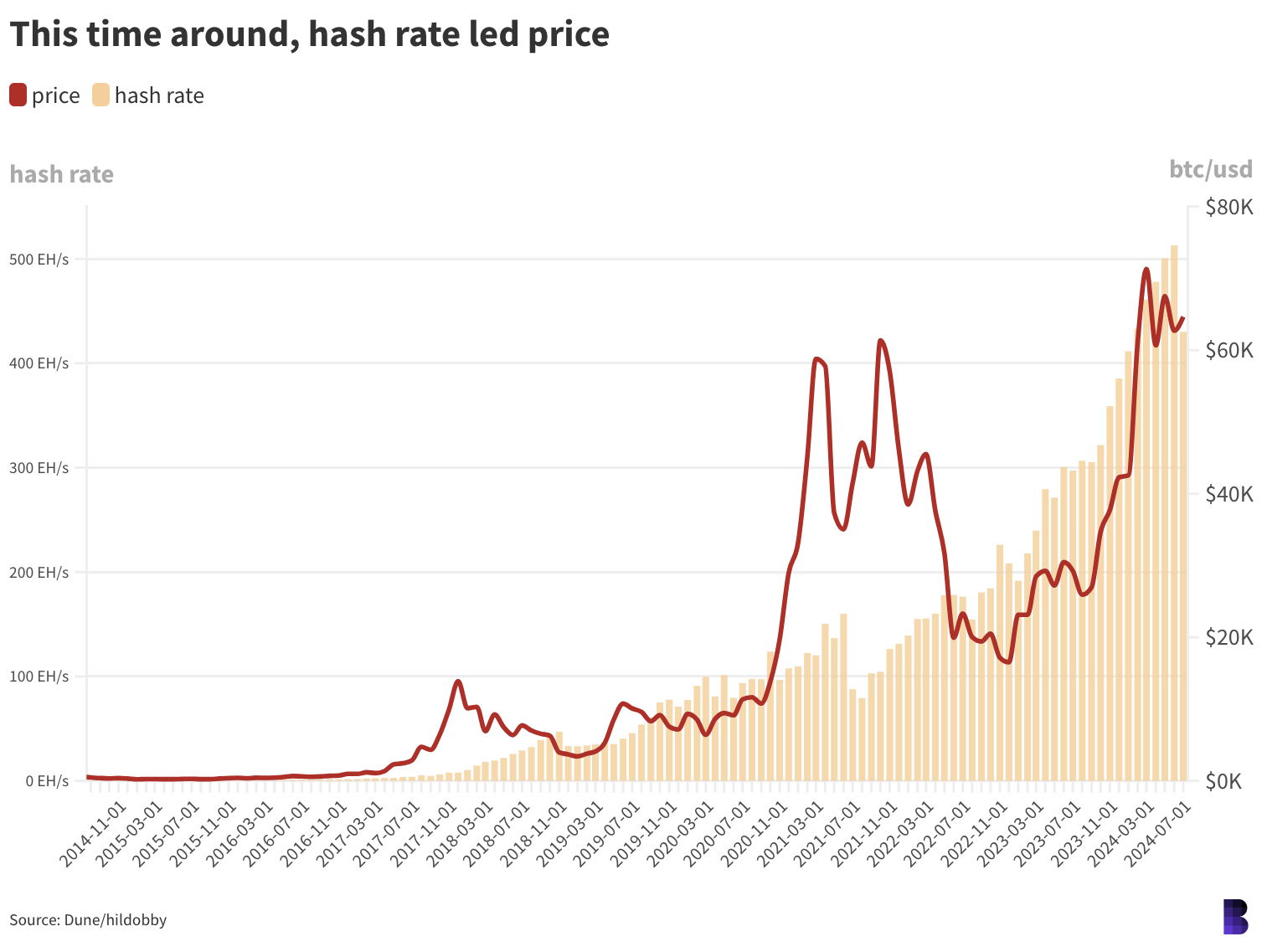

Besides a major drop in 2021, bitcoin’s hash rate has been steadily rising – sometimes faster than prices.

Besides a major drop in 2021, bitcoin’s hash rate has been steadily rising – sometimes faster than prices.

Still, mining firms feel the impact. Some miners take out loans or sell bonds to finance the acquisition of more miners, leading to big repayments that can become unwieldy if the price of bitcoin falls too low. Galaxy found in its latest report, though, that debt is no longer a primary source of capital, with bitcoin and equity sales the new norm since mid-2022.

Bitcoin’s price, luckily, tends to go up more than it goes down. Sans the immediate shock of mining 50% fewer bitcoin for every block, the price of bitcoin has always ballooned enough after halvings to plug the gap.

Prices have also historically led to massive surges in demand for blockspace. More demand means higher transaction fees, converting to more revenue for bitcoin miners.

The combination of new record highs and increased fee revenue has so far outweighed the slashed block rewards. But this time around, things are panning out differently.

You probably know that the price of bitcoin set a new price record before the halving, which had never happened before. It flipped the natural order of bitcoin’s four-year cycles on its head.

The previous three occasions had gone: halving, price rally, fee surge. This time, we have a price rally, fee surge, halving. And even though bitcoin’s recent rally has stalled, it’s still only 12% below its March all-time high.

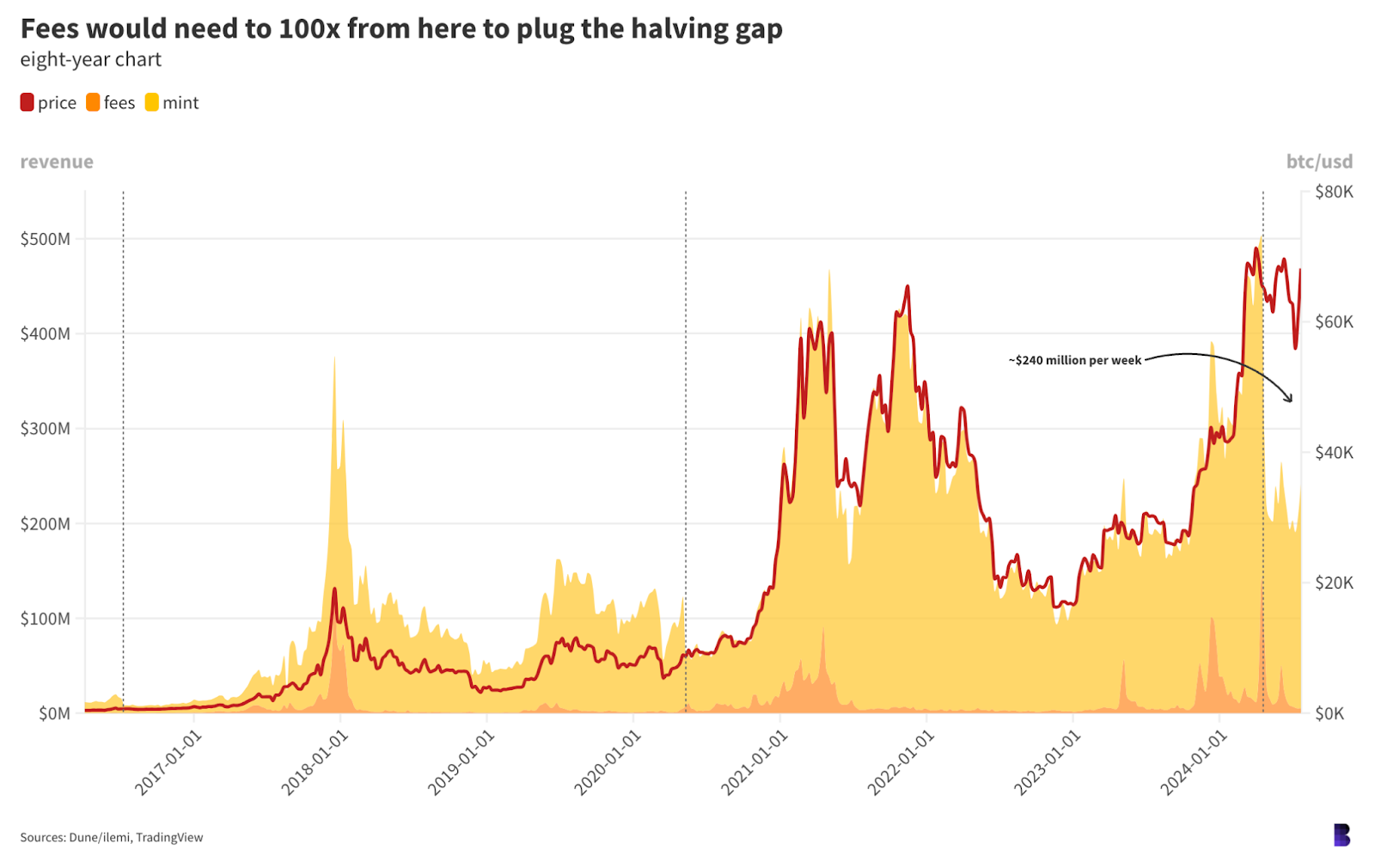

So, there is now a massive distance between miner revenue and the price of bitcoin, for the first time in at least a decade.

Halvings are marked by the dotted lines. Notice the orange area (miner revenue) rarely disconnects from the price of bitcoin – until the latest halving.

Halvings are marked by the dotted lines. Notice the orange area (miner revenue) rarely disconnects from the price of bitcoin – until the latest halving.

Miners currently earn about $240 million per week. But because 98% of that revenue is block rewards, they’re down almost an equivalent amount since the halving.

Inscriptions, Runes and other memecoins (BRC-20s) had the potential to bridge the gap, in the same way that a 50% price rally would, although that hasn’t yet panned out. Galaxy found that while Inscriptions, Runes and BRC-20s made up 50% of all Bitcoin transactions since the start of the year, 67% of fee revenue has come from standard transactions.

And 19% of total fees year to date were made on halving day and the three following days — when Runes hype was at its highest and fees were briefly out of control.

All this isn’t to say that mining bitcoin isn’t profitable. It generally is for larger outfits. Galaxy calculated that a bitcoin price between $65,000 and $70,000 could support a hash rate of 741 EH. Currently, it’s at $64,500 with 664 EH hash rate — which suggests miners could still add rigs and retain profitability.

AI and other high-performance compute sectors are increasingly offering even more attractive margins. And by all accounts, switching from bitcoin mining to powering AI models is a time-consuming process that’s not easily reversed.

If major mining operations do make the jump, Bitcoin will be just fine — but the same can’t be said for the natural order of its four-year cycles. Only a major bitcoin rally from here could fix it.

— David Canellis

The Works

- Talen Energy is reportedly looking to sell its stake in Nautilus, a nuclear-powered bitcoin mining site in Pennsylvania.

- ETH ETFs have reached net outflows of $483.6 million since their launch last Tuesday.

- BlackRock’s ETHA has attracted $623.2 million to date while Grayscale’s Ethereum Trust has lost $1.977 billion.

- Tether reported net profits of $5.4 billion last quarter, up from $1.3 billion in Q1.

- Senator Lummis officially lodged a bill to establish a national bitcoin strategic reserve.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.