Bitcoin Faces Resistance at $36,000: Markets Wrap

According to a recent JPMorgan report, staking could generate $9 billion in revenue for cryptocurrency as an industry.

Source: Shutterstock

- Visa reports over $1 billion of cryptocurrency was spent using their crypto-linked cards in H1 of this year.

- UFC partnered with Crypto.com to place the company’s branding on apparel worn by MMA athletes.

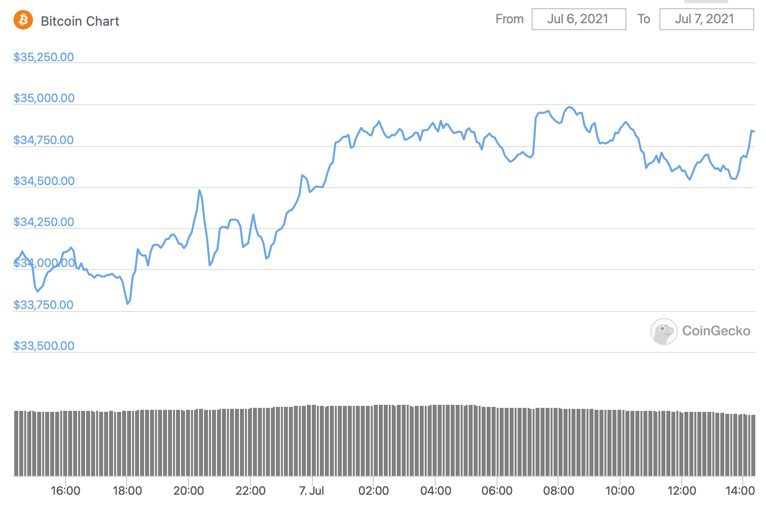

Bitcoin holds support but faces some resistance at $36,000 as the digital currency consolidates amid a slew of mixed news about the asset-class at large.

Visa announced that over $1 billion of cryptocurrency was spent using crypto-linked cards in the first half of 2021 on Wednesday. A recent JPMorgan report predicts that staking could generate $9 billion in revenue for cryptocurrency as an industry, a note circulated last week from the bank revealed.

In sports, the UFC made Crypto.com their crypto platform partner while Voyager Digital also announced a partnership in the upcoming inaugural Players Symposium.

In bearish news, UBS released a skeptical report, warning investors to “stay clear” of cryptocurrencies, adding that regulators will “crackdown” on the digital asset. The note from Switzerland’s largest bank, which denounced the digital token, was backed by opinions from various central bankers. Data indicated that almost 60% of surveyed officials said they did not think cryptocurrencies would have a significant impact on their operations.

Most big-name cryptocurrencies like bitcoin and ether inched up roughly 3%, maintaining under $35,000 and $2,300, respectively. Bitcoin has been trading between $30,000 to $40,000 roughly for the past seven weeks, seemingly unbothered by the onslaught of announcements.

Crypto

- Bitcoin is trading around $34,496.18, up 2.18% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,357.92, inching up 3.07% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.0683, up 0.74% at 4:00 pm ET.

- VIX fell -1.46% to 16.20 at 4:00 pm ET.

Insight

Joshua Scigala, co-founder of The Standard.io, weighed in on the recent UBS report which voiced central bankers’ thoughts on cryptocurrencies.

“The whole point of bitcoin and cryptocurrencies, in general, was to create actual alternative competition to central banks. As they say in Australia, competition keeps the bastards honest!” Scrigala said in a note. “Programmable money that is a bearer-based asset and is orders of magnitude more flexible than central bank-issued fiat currency has arrived, and the legacy banking system hasn’t even bothered to understand this existential threat to their model.”

Stocks continued to advance after the Federal Reserve minutes from the FOMC meeting were released on Wednesday, indicating further uncertainty in tapering back debt purchases. Despite the most recent Fed meeting shaking major indices back in June, cautiously optimistic investors traded in thin margins and all made modest gains on Wednesday afternoon.

Equities

- The Dow was little changed, up 0.30% to 34,681.

- S&P 500 rose 0.34% to 4,358.

- Nasdaq was up 0.01% to 14,665.

Insight

“Various participants mentioned that they expected the conditions for beginning to reduce the pace of asset purchases to be met somewhat earlier than they had anticipated at previous meetings in light of incoming data,” the minutes from the meeting read.

OPEC+ chaos has left investors wondering if oil production will increase or not, resulting in volatile trading sessions. The commodity fell for a third day in a row on Wednesday.

Commodities

- Brent crude is down to $73.30 a barrel, shedding -1.65%.

- Gold is up 0.54% to $1,803.90.

Fixed Income

- The US 10-year yields 1.321% as of 4:00 pm ET.

Currencies

- The US dollar strengthened 0.18%, according to the Bloomberg Dollar Spot Index.

In other news…

UFC partnered with Crypto.com to place the digital asset company’s branding on apparel worn by MMA athletes, Blockworks reported on Wednesday. The announcement comes a week before the MLB All-Star Game where the umpires are anticipated to wear an FTX.US patch on their uniform.

Insight

Chief Marketing Officer at Coindirect Maggie Ng: “Marquee sports events have a global footprint, which suits firms with international ambitions, and the typical sports audience also suits crypto firms with the prevalence of young males,” she told Blockworks. “The recent tie-ups in the space make absolute sense and will benefit the whole sector in demystifying it, and making it a more familiar and approachable proposition.”

We’re watching out for …

- Twenty central bankers and finance ministers will meet on Friday.

- China PPI data will be published on Friday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.