Blockchain Applications and the Rising Digital Asset Class

Separating hype from facts has helped corporations identify outstanding blockchain applications that drive real-world activity

Blockworks Graphic by Crystal Le

- Blockchain as a payment rail and cryptocurrencies as a tool for money transfer is arguably among the best technological innovations

- Traditional payment institutions are already investing heavily in payment-focused blockchain applications, including Mastercard and Visa

The digital asset industry is at the threshold of mainstream adoption. After spending the majority of the first decade on the sidelines, major institutions are now keen to support the growth of this emerging asset class.

Institutions increasingly invest in blockchain and digital asset applications that satisfy the most comprehensive market fit. This trend has seen the number of institution-related crypto and blockchain patents reaching a new all-time high in the past year and developer activity increasing simultaneously.

TaxBit, a company recently named a leading tax and accounting provider for the tokenized economy by CB Insights, believes that the industry is entering a new phase of growth. They are tracking the swift evolution of many new use cases for digital assets and advising organizations on transforming ideas into functional systems.

This guide will review the different real-world blockchain applications and compare their institutional support. It reveals that the future is bright for the digital asset class, and the industry is on the path to reaching the one billion user milestone.

Real-world blockchain applications and institutions driving adoption

The value proposition of digital assets reaches far beyond their speculative value. Separating hype from facts has helped corporations identify outstanding blockchain applications that drive real-world activity. Learn how the world’s biggest institutions are positioning for the inevitable adoption of digital assets.

Crypto in payments and money transfers

Blockchain as a payment rail and cryptocurrencies as a tool for money transfer is arguably among the best technological innovations. The benefits include near-instant settlements and significantly lower fees than traditional systems, especially for cross-border payments.

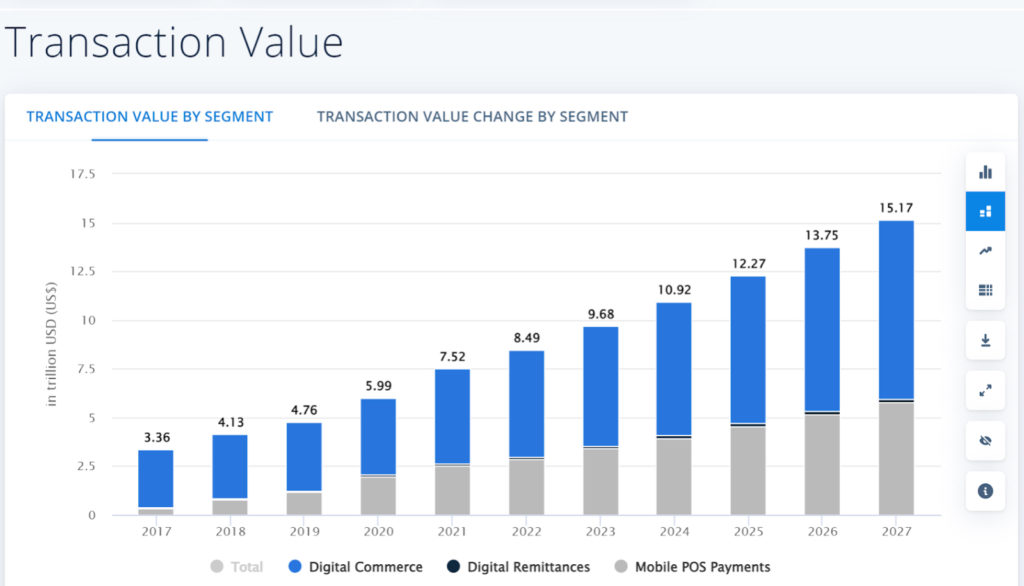

Many consumers already recognize the role of digital assets in payments, with an estimated six million US residents using crypto to buy things online in the past year. Meanwhile, the total transaction value of the global digital payment sector is currently at $8.49 trillion and is expected to double over the next five years.

Source: Statista

Source: Statista

The unique properties of digital assets make them an exciting prospect for the global payment landscape. Traditional payment institutions are already investing heavily in payment-focused blockchain applications, building custom solutions, and partnering with crypto-native companies to accelerate consumer adoption.

Mastercard (with 2.5 billion issued cards) and Visa (with 1.8 billion cards issued) have been at the forefront of such adoption initiatives. Both companies already offer a card program allowing cryptocurrency exchanges to provide crypto-backed debit cards. Card users can seamlessly spend cryptocurrencies at payment points globally where merchants accept Visa and Mastercard.

Some of the world’s largest digital asset trading platforms, including Binance, Coinbase, FTX and Crypto.com, use Visa and Mastercard infrastructure to offer crypto-backed cards to a combined user base totaling hundreds of millions of customers. Mastercard is also enabling banks to offer cryptocurrency trading to customers through a newly launched program. This trend accelerates consumer adoption of digital assets and will bring massive value for institutions allocating resources to payment-focused blockchain applications.

Metaverse and NFT experiences

The metaverse — an emerging network of interconnected digitally enhanced experiences — has quickly emerged as a market in demand for blockchain applications. Innovators are using blockchain technology to enable decentralized identities that can be used across different platforms. The same foundational technology is used to create non-fungible tokens (NFTs) and cryptocurrencies. These assets enable users and creators to exchange value within a growing digital economy.

The metaverse has been dubbed a $5 trillion opportunity, and many institutions are aligning their investment strategy to tap into future growth. Nike, for instance, has already launched its Nikeland Metaverse on the popular Roblox platform for fans to enjoy exciting social experiences. Nikeland hosted 7 million users within its first six months, silencing any claims that the metaverse is only a fad.

Meanwhile, Nike also spent an estimated $1 billion on acquiring RTFKT Studios, a startup that creates NFTs for use in the Metaverse. The move boosted Nike’s Metaverse play and came at a time when Mark Zuckerberg’s Meta is doubling down on a similar initiative. Meta invested $10 billion in 2021 to build its metaverse and continues to channel the company’s primary focus towards dominating the emerging niche. US-based users can already share NFTs across both Facebook and Instagram, with this functionality expected to roll out to other countries soon.

Another corporation that has made its mark on the metaverse is the streaming video-on-demand (SVOD) platform Netflix. The platform advertised in the metaverse through NFT drops representing artwork from its popular series “Love, Death & Robots.” Blockchain applications centered around the Metaverse and NFTs bring more exciting experiences for users and look set to gain traction in the coming years.

Customer loyalty

The loyalty management industry, valued at $5.5 billion, is another niche seeing real-world blockchain applications. Blockchain provides a solution for companies to track customer activity in a decentralized fashion and reward users based on predefined loyalty objectives. Brands can also create NFTs and other digital experiences to incentivize loyalty in previously impossible ways.

Coffee giant Starbucks is one company that is tapping into this use case. Starbucks partnered with Web3 startup Polygon Technology to launch Starbucks Odyssey. The new loyalty program is an improvement to the current Starbucks Rewards loyalty program, where users earn “stars” redeemable gifts like free drinks. In an enriched digital experience, customers will earn or purchase collectibles issued by Starbucks, while employees can receive collectibles that unlock new benefits and coffee rewards.

Blockchain applications solve notable pain points facing loyalty programs. For instance, blockchain’s transparency eliminates the chances of users cheating the system through fake transactions or identities. It also makes loyalty programs more valuable and attractive to customers, as anyone can easily exchange rewards for other digital assets.

Accounting and tax solutions

The global accounting industry is currently valued at $133 billion, with the US tax preparation sector also worth an estimated $12 billion. Another institutional-grade blockchain application is bringing advanced accounting and tax solutions to the digital assets industry.

Big four accounting firms (Deloitte, Ernst & Young, PwC, and KPMG) now have blockchain and crypto-dedicated teams to handle client demands. On-chain data provide unique and transparent insight into an organization’s financial standing and allow auditors to evaluate internal records accurately.

TaxBit is another top-tier tax and accounting solutions provider servicing individuals, institutions, and government agencies with exposure to digital assets. Their platform helps clients navigate complex accounting and tax requirements of the industry, and also leverage on-chain data to optimize business finances.

The complexity of digital asset compliance has more companies outsourcing their accounting to digital asset experts in the space. TaxBit and Deloitte recently announced a strategic alliance in their efforts to meet this growing demand.

Blockchain’s unique value spells a bright future for digital assets

The speculative nature of digital assets has helped drive mainstream awareness and industry growth. Yet, the underlying blockchain technology has been at the forefront of onboarding mainstream consumers.

Institutions already recognize the vital role that blockchain applications could play across different sectors and are increasingly adapting their investment strategy to meet market demands. Over time, the digital asset industry will see more growth and reach its full potential to disrupt global finance and benefit early investors immensely.

This content is sponsored by TaxBit.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.