BTC Market Starts Monday Neutral After Major Weekend Washout

Arcane Research analyst Vetle Lunde explained to Blockworks that the market moves are largely due to de-risking amidst the uncertainty of the Omicron variant as well as signals from the Fed that tapering is about to begin.

Blockworks Exclusive Art by axel rangel

- Bitcoin hit a low of nearly $46,000 over the weekend down from $57,000 Friday. Nearly $2 billion in retail long positions were liquidated, according to Coinglass

- Saturday’s liquidation cascade was the second-largest such event this year, after the Elon Musk-inspired crash in May

Bitcoin began the Asian trading day with slight price appreciation before dropping once again to the $47,500 mark as US markets approach opening time. It was a tumultuous weekend which saw nearly $10,000 shaved off the price of bitcoin and billions of retail longs liquidated.

Following a 5% decline on Friday, Saturday saw the second-largest single day event in the history of the BTC market (in USD value), after from the Elon Musk-inspired crash in May, according to data sourced from Glassnode. Bitcoin spot markets flushed to under $42,000 — a 16% fall in just 30 minutes — before bouncing sharply.

Vetle Lunde, an analyst with Arcane Research, explained to Blockworks that there were several factors that contributed to such a massive market move. The relative strength of bitcoin throughout October and November, he explained, drew many retail traders into the derivatives market, opening up long positions on bitcoin.

“Then, overall fear in the broad financial markets contributed in stopping bitcoin’s strong momentum, with investors de-risking amid uncertainty regarding the new Covid mutation and Fed hinting towards accelerated tapering,” Lunde explained.

“Fast forward to early morning Saturday, many traders have open longs with leverage from higher price levels, fear in the market is high, and then some large sell orders are added to an already thin orderbook.”

Leverage likely played a large part in this, Lunde believes, as open interest was between 380,000 BTC to 400,000 BTC during the month of November.

“Following this flush, the BTC denominated OI has fallen to 325,000 BTC, a far healthier level in a historical context. As of now, at these levels, it seems unlikely that we’ll experience similar cascading liquidations in the near future,” he said.

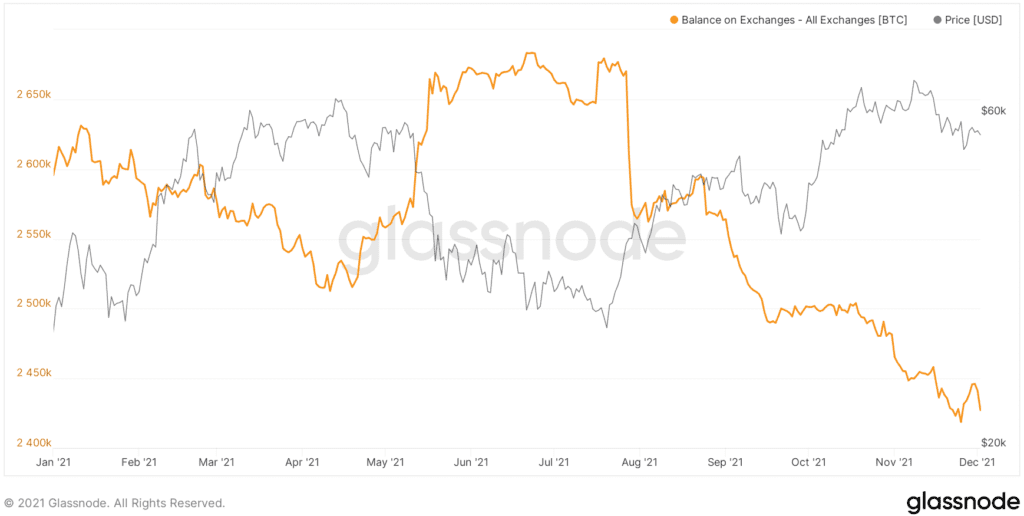

The number of bitcoin on exchanges, which had been trending down for weeks, has hit a historical low, signalling reduced liquidity in the market.

Bitcoin: Balance on All Exchanges

Bitcoin: Balance on All Exchanges

According to Glassnode, 2.4 million bitcoin are currently available on exchanges, down from 2.6 million in July.

“There’s barely any liquidity on weekends, so markets are slightly more vulnerable to shocks — that and a lot of demand coming from institutions, and they’re not trading over the weekend,” Joseph Edwards, head of research at crypto brokerage Enigma Securities, is quoted as saying in Reuters.

Market moves to start the week

The Chinese central bank cut its reserve requirement ratio (RRR) for banks on Monday, which Tranchess CEO Danny Chong calls, “a convincing move from PBOC to reduce possible headwind effects on the economy.”

“The far-reaching positives will benefit across industries and into small businesses as well. The timely release of 1.2 trillion yuan into the system serves as a strong stimulus, and we could see the effect spill over into rest of the world,” Chong added.

The CME Futures BTC market opened Sunday night with a $3,800 gap from Friday’s close, a fall of more than 7% and it has slip 2% lower as of 7:15 AM ET.

Major stock indexes are mixed: The Euro Stoxx 50 is up about 0.63%, and the S&P 500 futures are up 0.38% ahead of Monday’s open, while Nasdaq futures point down -0.28%, after a merciless second half of last week that saw the tech-heavy index shed about -4.4%.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.