Cheatsheet: Ethereum on track to burn $10B ETH over next year

Crypto is certainly heating up on exchanges — but on-chain it’s already white hot

Satheesh Sankaran/Shutterstock modified by Blockworks

This is Cheatsheet, a primer on what’s happening in crypto today.

Crypto has hit that point of the bull market where anything and everything is rallying without any real link between star performers.

Today, toncoin (TON) is beating the top end of the table, up 25% as of 8 am ET. While TON is its own layer-1 blockchain, the token finds utility with a web of Telegram trading bots rapidly gaining popularity over the past year.

XRP is second for the day with 12.5%, followed by flow (FLOW), the native crypto for the NFT-focused chain built by Dapper Labs, which is up 9%.

Bitcoin (BTC) and ether (ETH) have ended up flat over the same period. Crypto’s total market capitalization is now only 7% shy of its $3 trillion record high, set in late 2021.

On-chain mail

After plateauing for six weeks, Ethereum is now burning supply faster than at any point in the past nine months.

- The ETH supply has shrunk by 74,603 ETH ($300 million) over the past month.

- Burns were totally stagnant between Christmas and the second week of February.

- Ethereum will burn $10 billion ETH over the next year at its current pace (and current prices), per ultrasound.money.

As of August 2021, the Ethereum network burns a small amount of ETH with every transaction — specifically the base fee paid by users.

The ETH supply has shrunk by 0.31% over the past year and is currently on track to reduce by 1.42% over the next if on-chain activity keeps up.

The network still issues fresh ETH with every block: without burns, the circulating ETH supply would increase by 0.5% every year.

- Top DEX Uniswap still burns more ETH than any other platform — more than 22,000 ETH ($87.9 million) over the past month.

- Telegram trading bot Banana Gun is burning more ETH than layer-2s Arbitrum and Optimism.

- ETH supply is tipped to dip below 120 million sometime in May, which would return it to Aug. 2022 levels.

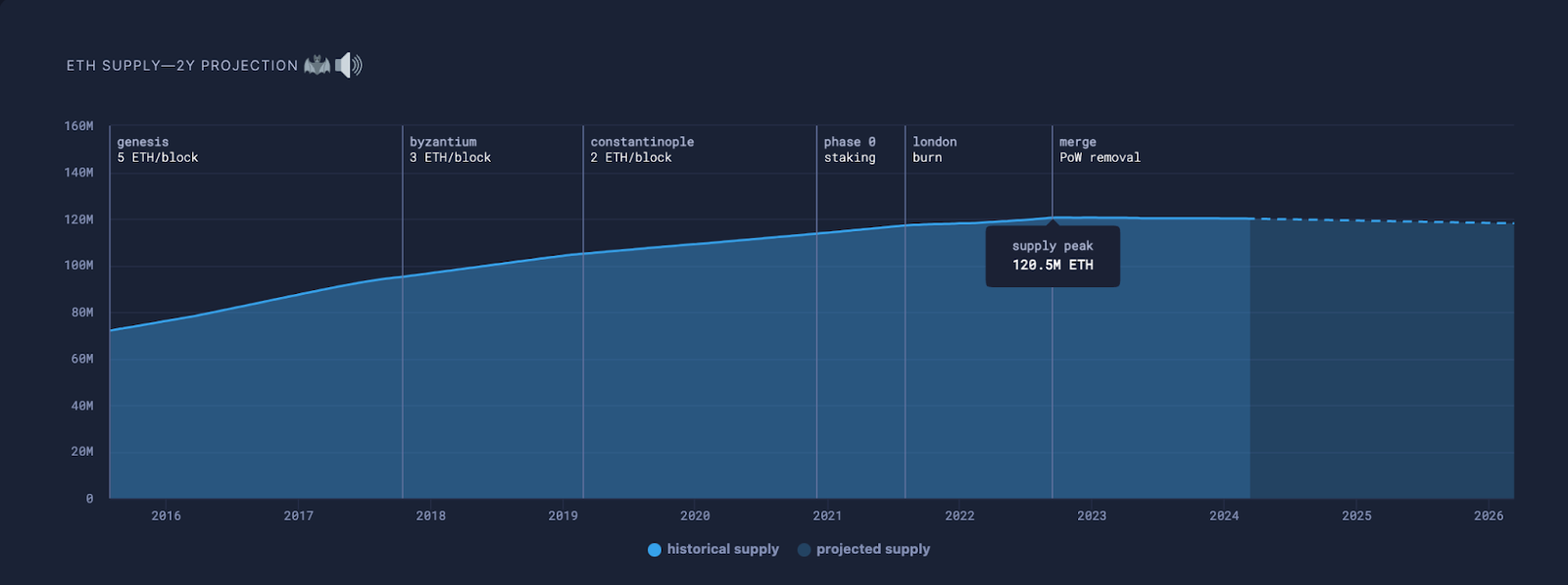

Ethereum supply may have peaked in September 2022 (source)

Ethereum supply may have peaked in September 2022 (source)

Crypto business

Bitcoin’s strength still hasn’t converted to gains for crypto stocks, with only two set to open Tuesday higher: MicroStrategy and Coinbase.

- MicroStrategy gained 4.11% on Monday and added another 5% after hours as of 7 am, ET.

- Coinbase slipped nearly 1% but regained 1.5% post-bell.

- CleanSpark and Marathon took a beating, down 17.24% and 13.2%, respectively.

Still, CleanSpark is the only miner to beat S&P 500 over the past month, now up 20% to the S&P’s 2%. The Las Vegas-headquartered firm announced plans to double its hashrate in February.

Over the year-to-date, CleanSpark’s 52% gains are second only to MicroStrategy, now up 147%. Coinbase trails slightly with 48.3%.

CleanSpark, now the second-largest mining stock by market value, flipped Colorado-headquartered Riot earlier this month, worth $3.34 billion to $2.98 billion.

- Former MicroStrategy CEO Michael Saylor has sold $167.4 million in MSTR shares this year, per OpenInsider.

- Saylor sold those shares for $688.29 on average, MSTR currently trades for more than double that price.

- He announced a plan to sell 315,000 shares in January — he’s more than three-quarters of the way through that stack.

On the ground

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.