Crypto Markets Steady; US Dollar and Gold Slump: Markets Wrap

Investors risk appetite rebounds as cryptos make small gains and Wall Street indices advance.

shutterstock

- Gold fell to session lows, shedding 1.83% following PMI data

- Twitter confirmed rumors that users will be able to tip each other in bitcoin through the Lightning Network

Cryptocurrency markets are steady following early-week losses on Evergrande’s financial woes, Federal Reserve officials maintaining that inflation is “transitory” and PMI data which revealed sluggish growth.

Bitcoin and ethereum were both trading higher, making small gains of 3% and 4%, as of press time.

The biggest hike came from Terra ($LUNA) which jumped 14% on-day, according to CoinGecko.

DeFi

- Terra ($LUNA) is trading at $36.26, up 14.1% and trading volume at $1,656,869,018 in 24 hours.

- Uniswap ($UNI) is trading at $21.6, rising 1.7% with a total value locked at $4,479,348,489 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 32.4% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $44,660.3, up 2.91% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,134.86, advancing 3.49% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.072, declining -0.64% at 4:00 pm ET.

Insight

Bobby Zagotta, US CEO at Bitstamp, weighed in on crypto price action for this week.

“Crypto markets can be volatile — we know that. But critically, we also know that every ebb and flow creates more interest and adoption because over the long term, the entire industry continues to see massive growth,” Zagotta said. “But because of increased regulation, attention, and broad adoption we will continue to see everyday investors and financial institutions utilize cryptocurrencies and validate the underlying value proposition of digital assets over the long term.”

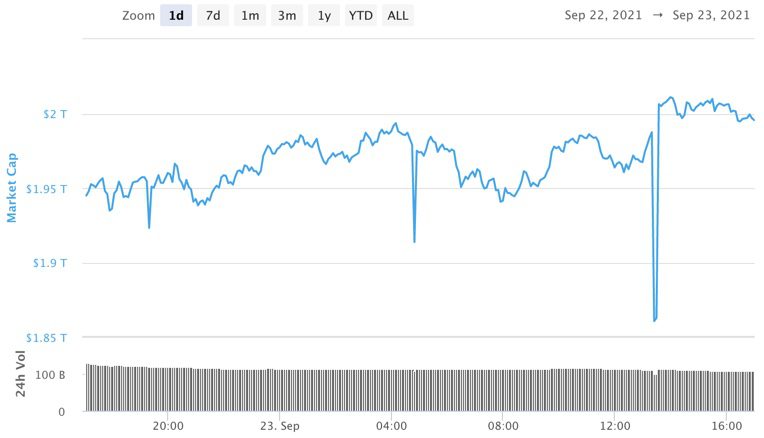

Total crypto market cap over the past day Source:CoinMarketCap

Total crypto market cap over the past day Source:CoinMarketCapAll major Wall Street indices closed ahead for a third day in a row amid volatile trading sessions earlier this month.

Equities

- The Dow rose 1.48% to 34,764.

- S&P 500 was up 1.21% to 4,448.

- Nasdaq made gains of 1.04% to 15,052.

Currencies

- The US dollar fell -0.44%, according to the Bloomberg Dollar Spot Index.

Commodities

- Brent crude was up to $77.24 per barrel, rising 1.38%.

- Gold fell -1.83% to $1,746.3.

Fixed Income

- US 10-year treasury yields 1.435% as of 4:00 pm ET.

In other news…

Twitter confirmed rumors on Thursday that users will be able to tip each other in bitcoin through the Lightning Network, Blockworks reported. The program, referred to as Tips, is set to launch globally to Apple IOS users first then Android users in the coming weeks.

We are looking out for

- Federal Reserve Chairman Jerome Powell will discuss pandemic recovery on Friday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.