Digital Asset Funds Have Record Quarter with $4.2 Billion Inflows So Far

Q1 inflows into cryptocurrency funds now total $4.2 billion so far, breaking the record of $3.9 billion set in Q4 2020.

Source: Shutterstock

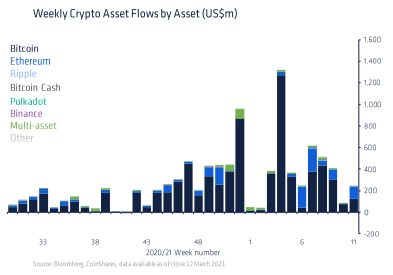

- Digital asset investment products saw a $242 million inflow last week

- Ethereum continues to grow in popularity, making up almost 50% of total flows

Amid bitcoin’s extended rally last week, digital asset investment products saw a $242 million inflow, up from $108 million the week prior, according to data compiled by asset manager CoinShares.

Q1 inflows into cryptocurrency funds now total $4.2 billion so far, breaking the record of $3.9 billion set in Q4 2020.

Bitcoin was the most popular asset with an inflow of $129.6 million. As bitcoin approached $60,000 last week, there were outflows of $39 million, likely due to profit taking.

Alternative coin ethereum followed with a $113.5 million inflow, up from $3.7 million the week prior. Ethereum is up more than 140% year-to-date.

Source: CoinShares

Source: CoinShares

Digital investment firm Grayscale, known for the Grayscale Bitcoin Trust (Ticker GBTC), continued to lead with a $12.8 million inflow into their products last week.

Passive funds, those that simply track digital asset prices, continue to be more popular with investors than active funds. Passive funds have $54.1 billion in assets under management as of last week, compared to active funds’ $786 million in assets under management. Pricing data shows that passive investment products continue to outperform active funds, according to CoinShares.