Equities Topple and Cryptos Changed Little Following Jarring Inflation Data: Markets Wrap

Some correlate a rise in inflation and bitcoin’s limited supply as a signal to buy, but investors seemed unbothered by the hike.

Source: Shutterstock

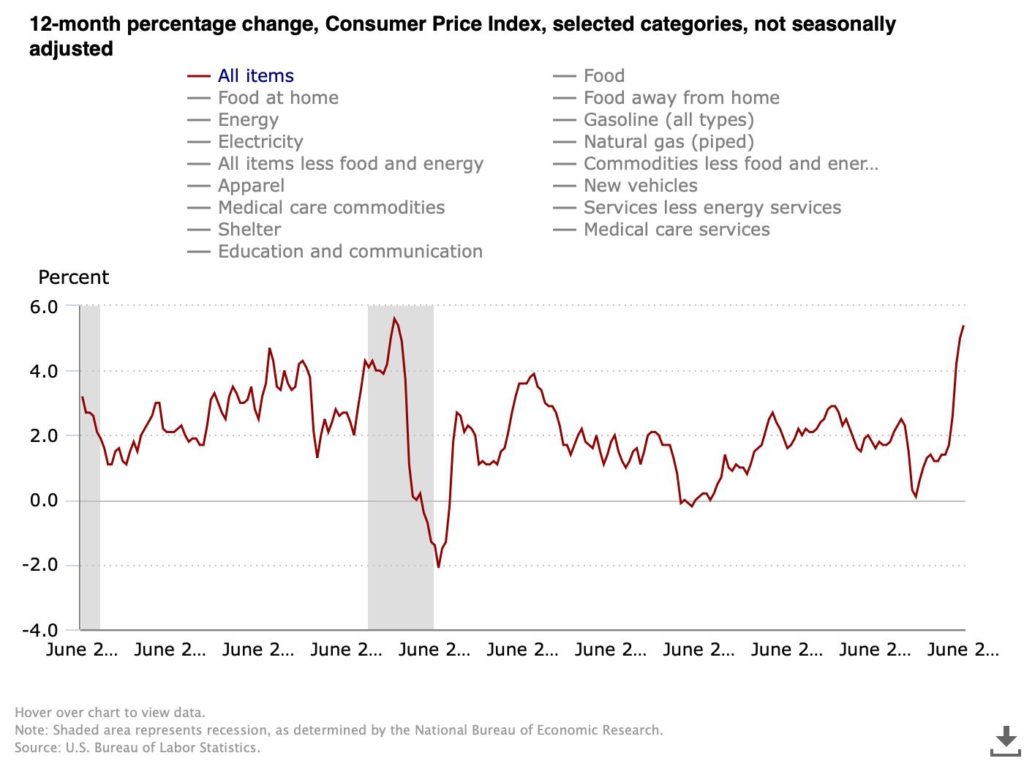

- U.S. Consumer Price Index shot up 5.4% over the last year, its highest hike in over a decade

- Bond yields rose after $24 billion in 30-years were sold by the Treasury Department.

Bank earnings season kicked off as key inflation data hit unexpected highs on Tuesday, leading to an intraday day decline in U.S. stocks and leaving investors to assess the future for economic growth.

U.S. June Consumer Price Index data (CPI) jumped 5.4% year over year, its highest hike since 2008, according to The Labor Department on Tuesday. Excluding food and fuel, inflation rose 4.5%, the largest increase since 1991. The data showed a surge in demand for services most dramatically hit by the pandemic, indicating how demand could be outpacing the sector’s ability to provide. These include hotels and air travel as Covid-19 restrictions are gradually lifted. Inflationary pressures may continue as markets are presented with supply constraints.

Earlier in the day, the tech-heavy Nasdaq Composite rebounded, making significant gains for another trading session. However, the index lost its momentum in the afternoon.

Finance shares fell despite an increase in second-quarter earnings. JPMorgan Chase and Goldman Sachs both beat analysts’ estimates. JPMorgan reported an $11.9 billion profit, soaring over $7 billion past last year’s figures. Similar to the S&P 500, both bank stocks were in the red by market close, falling 2.01% and 0.94%, respectively.

Equities

- The Dow was down to 34,925, shedding -0.20%

- S&P 500 declined -0.23% to 4,374

- Nasdaq fell -0.20% to 14,703

Insight

“The economy and stock market are mostly held up by both fiscal and monetary stimulus. As either of those two legs starts to get withdrawn, the economy and stock market are both at risk of retraction and corrections,” Founder of Lyn Alden Investment Strategy, Lyn Alden said in a note to Blockworks. “Fiscal policymakers are looking for ongoing infrastructure stimulus, but that remains in limbo for the moment. And while the Fed hasn’t withdrawn monetary stimulus yet, they are looking to begin tapering perhaps late this year or sometime next year.”

Coined by some as a hedge against inflation, cryptos were mostly flat following the unusually high CPI data on Tuesday. Some crypto enthusiasts claim bitcoin’s limited supply makes it the perfect buy during times of high inflation. But investors seem unbothered by the higher prices, potentially agreeing with Federal Reserve Chair Jerome Powell’s prediction that inflation may be transitory.

Crypto

- Bitcoin is trading around $32,299.33, down -1.65% in 24 hours at 4:00 pm ET

- Ether is trading around $1,926.13, shedding -5.00% in 24 hours at 4:00 pm ET

- ETH:BTC is at 0.0596, down -2.86% at 4:00 pm ET

- VIX shot up 5.57% to 17.07 at 4:00 pm ET

Insight

CEO of Permission.io, Charlie Silver weighed in on fixed incomes and their correlation to potential reflation trading and cryptocurrency.

“Keep an eye on the 10-year treasury rate. If that continues to drop that can be a negative signal for the reflation trade which includes equities, commodities and crypto,” Silver said in a note on Monday.

But bond yields rose after $24 billion in 30-years were sold by the U.S. Treasury Department.

Fixed Income

- U.S. 30-year treasury yields 2.039% as of 4:00 pm ET

Commodities

- Brent crude is up to $76.52 a barrel, advancing 1.81%

- Gold is up 0.11% to $1,807.70

Currencies

- The US dollar strengthened 0.53%, according to the Bloomberg Dollar Spot Index

In other news…

Goldman Sachs said volatility in crypto markets may be a good thing for Coinbase, the largest publicly-traded exchange in the asset class. In a recent note to clients, the investment bank referred to COIN as a “top 25 tactical trade”, predicting it would beat Wall Street’s predictions for Q2 earnings. The company could profit from fees as trading volumes skyrocket amid bearish headlines and sliding value in cryptocurrencies, CoinDesk first reported.

We’re watching out for …

- Federal Reserve Chair Jerome Powell will deliver remarks on a Monetary Policy Report before the Senate Banking Committee to congress on Thursday

- Bank of Korea’s monetary decision will be on Thursday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.