Ethereum could be the ultimate app store for AI agents

Engineers from MetaMask, Coinbase, Google, and the Ethereum Foundation make the case for onchain AI agents via ERC-8004

VTT Studio/Shutterstock and Adobe modified by Blockworks

This is a segment from The Drop newsletter. To read full editions, subscribe.

How will we find new AI agents to use in the near future? What could a decentralized, more open AI ecosystem look like? And how will AI agents make payments for us?

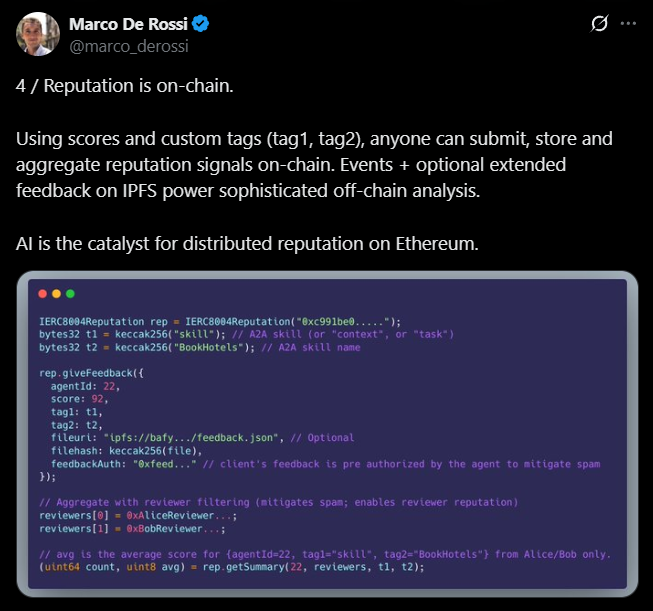

ERC-8004, a new Ethereum technical standard first unveiled this summer, aims to be an answer to all that. The standard is being peer-reviewed, and its smart contracts were launched on the Ethereum testnet this month. MetaMask AI Lead Marco de Rossi, Ethereum Foundation AI lead Davide Crapis, Google engineer Jordan Ellis, and Coinbase Developer Platform engineering lead Erik Reppel co-created the protocol, which also incorporates feedback and contributions from a slew of other crypto companies and projects.

ERC-8004 lets builders and users mint AI agents like they’re NFTs and delegate them using those ERC-721 rails. It makes AI agents discoverable, and can hold agent reputation scores onchain. The AI agents can use x402, a new open payment protocol developed by Coinbase.

Agent developers could ultimately charge for access to their tools and agents, who could be deployed for a range of use cases around user productivity, trading, payments or even reshape consumers’ subscription diets. At some point, perhaps AI agents could even hire each other to complete different tasks, like a more open version of what Google has developed with A2A.

“Maybe it’s early to think about the business model fully, even if x402 is clearly the best monetization source for AI agents, but we should focus a lot on use cases and not just on the infra,” De Rossi told me in an interview.

The agents themselves aren’t being stored on Ethereum because, as De Rossi explained, running AI agents in such a way is very complicated and would require “a lot of overhead.”

So it’s not going to be that decentralized. But there’s definitely a middle path that 8004 unlocks for developers between a completely closed ecosystem and something completely open and decentralized.

In this vision, users or companies host their own AI agents on their own devices or servers. Then, they use the blockchain, via 8004, as an open app store of sorts to share their models with others and receive ratings and feedback.

For this to have broad consumer appeal, AI agent explorers of sorts — pretty frontends with checkout integrations — would have to be built for humans. De Rossi said that roughly half a dozen teams in crypto are already working on making something to this effect a reality.

“The current situation is that you see stuff on the [block] explorer which is totally unusable,” he said.

Building something that anyone can use can be a difficult line to walk, though, if various platforms decide to restrict the visibility of certain types of AI agents.

But maybe this will happen in a more organic way if the crypto community is able to, collectively, give agents feedback and therefore shape their reputations. Agents with better reputations could get more visibility, while questionable agents with lower scores fade into the background (but remain accessible).

“The bad outcome is we have many different silos, like app stores, [and] that’s it,” De Rossi said of the future of AI agent discoverability. “That’s just worse for consumers.”

“If we want to make this happen in an interoperable way, there are two possibilities, probably. The US government,” De Rossi said with a laugh, “or the infrastructure owned by nobody, which is the blockchain.”

Pushing some vague ideals of whatever “Web3” is supposed to be isn’t going to spur blockchain adoption in the AI industry, De Rossi argued.

“Who cares? The point is, how can we have an infra that is neutral, and this is understandable to everybody. It’s public infrastructure.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.