Ethereum ETF momentum collapses after record August

ETH ETF inflows fell in a 92% drop that highlights the fragility of demand as flows mirror price action

oneshot1/Shutterstock and Blockworks Research modified by Blockworks

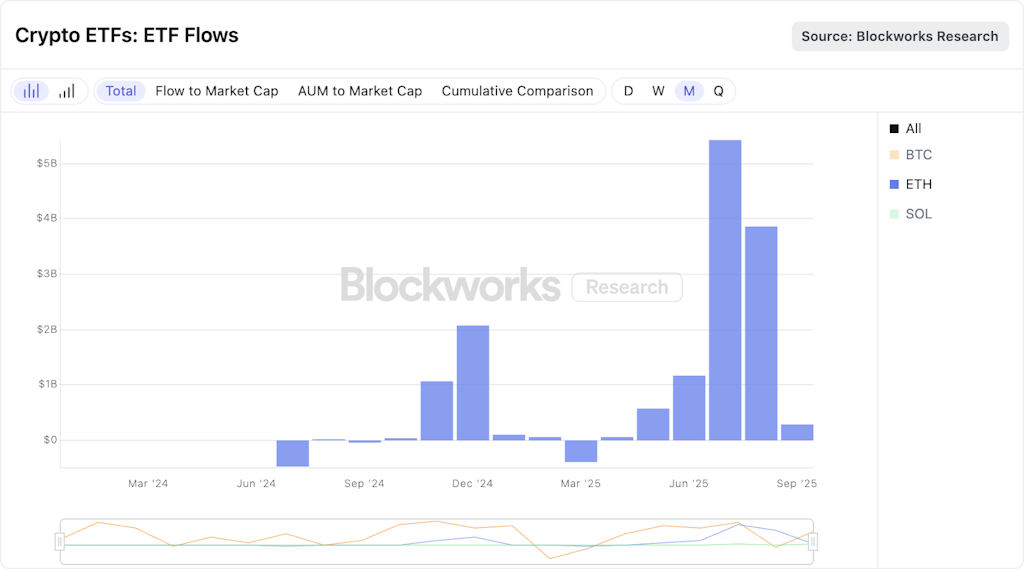

Ethereum ETFs recorded a dramatic slowdown in September, with monthly inflows collapsing from $3.9 billion in August to just $285 million, according to Blockworks Research data.

The sharp drawdown marks one of the steepest reversals since ETH ETFs launched earlier this year.

The month-over-month change reflects what Blockworks Research analysts call a “flows-driven market.” Last week was the most negative week in aggregate since the March selloff, with bitcoin ETFs posting $900 million in outflows and Ethereum ETFs losing $800 million. Both asset classes have seen ETF flows mirror underlying spot prices, reinforcing the thesis that secondary market activity in the funds is dictating near-term price action.

Source: Blockworks Research

Source: Blockworks Research

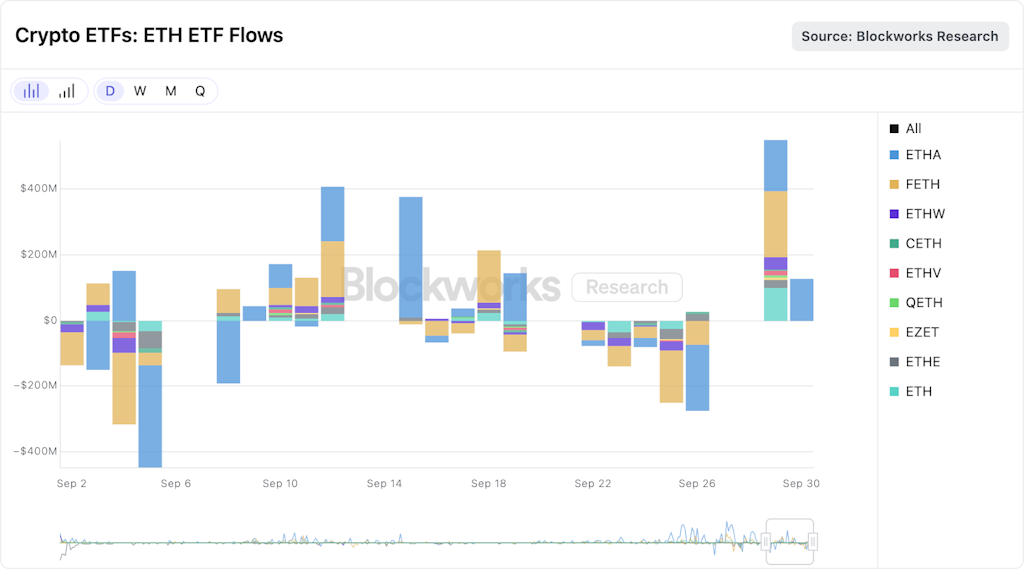

Part of the most recent outflows may be the result of the monthly trends, according to James Butterfill, CoinShares Head of Research, who notes that options expirations at the end of the month beget outflows while early month inflows typically follow.

“The evolving ETF landscape has supported the growth of a much more active options market,” Butterfill told Blockworks.

For ether, the reversal was particularly acute. ETH saw a peak-to-trough price drawdown of nearly −20% in September, before rallying into month-end with a 4% surge on September 30 that left the token down just −3.5% for the month overall. While ETFs are expected to dampen volatility by anchoring institutional demand, September’s flows notwithstanding.

“When [the ETFs] were launched at the beginning of 2024, Bitcoin’s 30-day average volatility was around 40%; today it has fallen to just 25%,” Butterfill said.

A closer look at issuer-level flows shows the divergence within ETH funds. ETHA posted $315 million of net inflows, while smaller products like FETH (−$51.6M), ETHW (−$38.8M), and ETHE (−$28.7M) dragged the category lower.

Source: Blockworks Research

Source: Blockworks Research

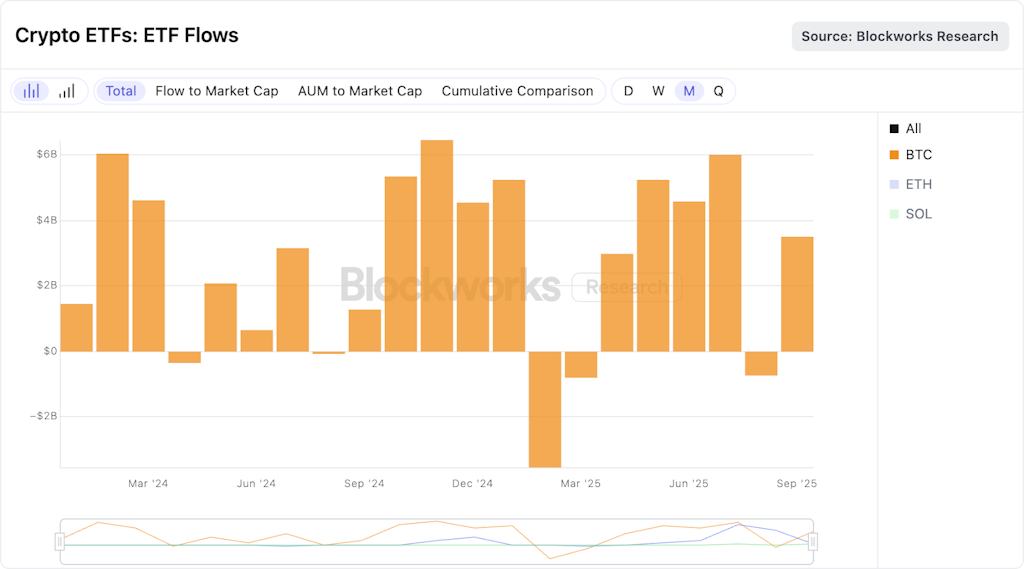

Bitcoin ETFs, meanwhile, continued to draw heavier absolute flows and with more resilience relative to ether. The BTC ETFs rebounded to $3.5 billion net inflows in September. Despite a weak final week, creations earlier in the month more than offset redemptions.

Source: Blockworks Research

Source: Blockworks Research

Butterfill cites fiscal uncertainty as a tailwind. “With recent macro data coming in weaker than expected, raising expectations for two rate cuts this year instead of one, the US$1.1bn of inflows into Bitcoin appear to be closely tied to this shift,” he said.

The split has widened the performance gap between the majors. Bitcoin ETFs remain the preferred institutional vehicle, while Ethereum ETFs have proven more vulnerable to swings in sentiment. Some investors are opting into alternative proxy plays — like corporate treasuries holding ETH directly — but for now, the ETF lens remains the cleanest gauge of where large pools of capital are rotating.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.