Running a blockchain foundation is actually really tough

Transparency is nice, but expensive

scoutori/Shutterstock modified by Blockworks

This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

It is frankly really hard to be the Ethereum Foundation.

Your job is to fund public goods R&D and ship complex network upgrades. But that means you’re also constantly choosing between selling ETH and being yelled at for selling ETH.

The EF has a staff of about 200 employees and an annual operating budget of ~$145 million. That money comes from a treasury of largely ETH. That ETH needs to be sold to pay your staff, but ETH holders dislike when you sell the thing they own. This is crypto’s most uniquely recurring theme: “Please make number go up, while also paying for things with the number.”

So the Crypto Twitter peanut gallery wants the EF to know they can simply “use DeFi.” Put the ETH in a lending vault, collect yield and stop wrecking the ETH chart, please.

The EF has historically been reluctant to do that for obvious reasons: It is not the job of a neutral ecosystem steward to be making complex risk management decisions.

Yet, yesterday the Ethereum Foundation doubled down on its use of DeFi (a continuation since February). The EF deposited 2400 ETH ($9.1 million) and $6 million of stablecoins into Morpho’s vaults.

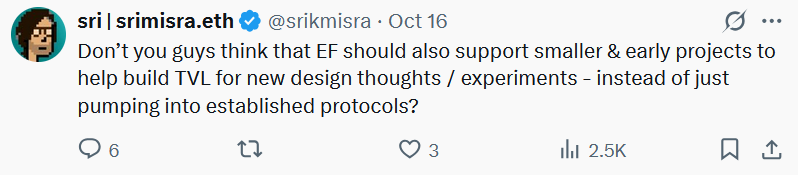

This should be good news for bagholders, but not everyone is happy:

Where previously the Ethereum Foundation wasn’t supporting its own ecosystem, now it’s not supporting the right players, i.e. the smaller guys and underdogs.

I don’t know, man. You can’t seem to please everyone, so maybe these decisions simply shouldn’t be public.

You could imagine a world where the EF tries to be “fair.” It allocates capital to smaller projects, but that exposes the foundation to a wider range of smart contract/security risks.

Best case scenario: Nothing breaks but the foundation’s operating expenses are inflated to pay for security researchers and an investment team. Fairness is expensive. Worst case: Protocols get exploited and the EF’s treasury runway is shortened.

Solana doesn’t seem to have the same problems, namely because its foundation isn’t committed to the same levels of radical transparency as Ethereum is. Solana is selling SOL too, presumably, but no one’s upset because it’s not on the Twitter timeline.

For starters, the foundation has actively backed the Solmate DAT, and has an active partnership with the “Solana Company” DAT (previously Helius Medical). The EF has sold ETH in OTC sales to DATs, but has not participated in any formal investments or partnerships with DATs.

Solana DATs, too, have been unabashedly proud about using DeFi. Forward Industries’ Kyle Samani wants Forward to be the most “natively onchain publicly traded company in the world,” he said on an Empire podcast, teasing the use of SOL in select Solana protocols.

Ethereum’s commitment to neutrality is admirable (remember when Justin Drake had to step down as an advisor to Eigenlayer for violating that tenet?).

But no one in Solana world seems to have a problem with that, so maybe the foundation’s optimal strategy is to do the low-profile, risk-minimized thing and announce as little of it as possible.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.