Ex-State Street Digital Head To Lead RegTech Blockchain Startup

Former State Street Digital lead Nadine Chakar says financial services are at “a critical tipping point” when it comes to blockchain

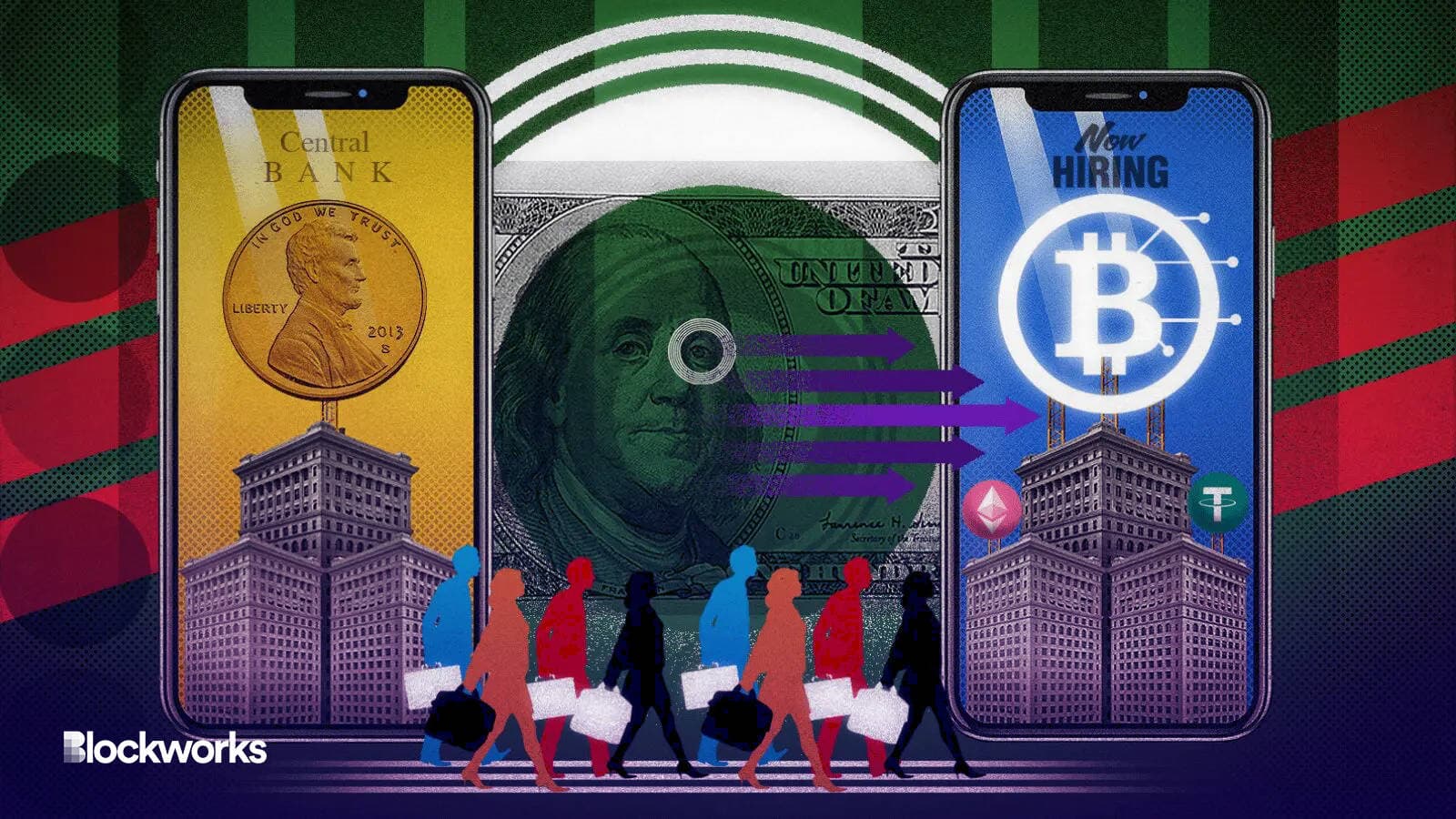

Exclusive art by Axel Rangel modified by Blockworks

Former State Street head of digital finance Nadine Chakar is now set to lead blockchain startup Securrency as its CEO.

Chakar is expected to assume the role on Jan. 9. The firm’s founder Dan Doney, who was previously working as the company’s CEO, will continue as chief technology officer.

Securrency is a blockchain-based financial and regulatory technology developer. The firm has worked with asset manager WisdomTree on its push to launch what it calls blockchain-enabled funds. Securrency says it serves as a transfer agent by maintaining a secondary record of share ownership on the Stellar or Ethereum blockchains.

WisdomTree Investments, alongside State Street, participated in Securrency’s $30 million Series B raise in Apr. 2021.

State Street Digital launched in Jun. 2021 as a way for the custody bank to expand its capabilities in the crypto, central bank digital currency, blockchain and tokenization segments.

Before leading its crypto-related efforts, Chakar became State Street’s head of global markets in 2019 after working for several years as global head of operations and data at Manulife Investment Management.

The Securrency move comes after a State Street spokesperson told Blockworks in October that Chakar was set to leave the company at the end of 2022.

The spokesperson added that Martine Bond — who led global markets for Europe, the Middle East and Africa, and was head of GlobalLink, had assumed Chakar’s role at State Street on an interim basis and is still in that role.

“The financial services industry is at a critical tipping point as it tokenizes regulated real-world assets and automates legacy financial processes using the power of blockchain technology,” Chakar said in a statement.

“As the new CEO, my priority is to accelerate the commercialization of what is in essence the digital asset intelligence and interoperability foundation for major financial institutions and the global ecosystem.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.