Crypto Regulation 2021 & Wallet Privacy Rules

Proposed regulations aim to reduce privacy in crypto by forcing exchanges and any other virtual asset service providers to further identify users and even their private wallets.

Source: Shutterstock

- While public blockchains have always been transparent and provide immutable proof of all transactions, most users are at least pseudonymous today

- Proposed regulations aim to reduce privacy in crypto by forcing exchanges and any other virtual asset service providers to further identify users and even their private wallets

There has been a lot of talk about crypto regulations in 2021 and their impact on privacy and user wallets.

Some believe that onerous regulations that will “kill” crypto as an asset class are always just around the corner. While decentralization has a strong mitigating effect against that possibility, there’s one aspect of transacting with crypto that has come under serious threat lately – privacy.

While public blockchains have always been transparent and provide immutable proof of all transactions, most users are at least pseudonymous today. And those who choose to go the extra mile using methods like coin mixing and running their own full nodes can come close to total anonymity.

But proposed regulations aim to reduce privacy in crypto by forcing exchanges and any other virtual asset service providers to further identify users and even their private wallets.

Questions around these new proposed regulations abound. For example, does the amount of criminal activity occurring in cryptocurrency justify the need for these rules? Will the proposed changes serve the public good, or place unnecessary burdens on smaller financial companies and lower income individuals? What might the implications of such regulations be for virtual asset service providers?

We’ll dig into these questions in a moment. First, let’s briefly look over some of the history of related regulations and how we got here today.

Crypto’s FATF travel rule

The Financial Action Task Force (FATF) added it to its Recommendation 16 (sometimes referred to as the travel rule) in June 2019 and is scheduled to conduct a final 12-month review during June of this year.

The new regulation has its roots in the US Bank Secrecy Act (sometimes referred to as the BSA). The Financial Crimes Enforcement Network (FinCEN) originally created this rule in 1997. More recently, the agency added some clarifications for crypto assets.

After defining what it calls convertible virtual currencies (CVCs) in its May 2019 guidance, FinCEN then stated that the FATF travel rule does apply to CVCs. This implies that exchanges are required to disclose the identities of users involved in virtual asset transfers exceeding $3,000 or higher, in accordance with the BSA.

In February 2019, the FATF released guidance on Recommendation 15, where paragraph 7(b) R16 introduced a new version of the US Travel Rule for cryptocurrency regulations.

Formalized in June 2019, Recommendation 16 now states that countries should ensure that virtual asset service providers “obtain and hold required and accurate originator (sender) information and required beneficiary (recipient) information”

In other words, this could mean that any crypto user who wants to move cryptocurrency from their own wallet to an exchange might have to provide details about that private wallet.

This new recommendation leads to many questions, not the least of which include: enforcement practices and consequences, impact on innovation, user privacy and prevention of market monopolization.

The impact of privacy reduction

Christopher Kingsley, Chief Marketing Officer at Exodus, said that one way these new guidelines could impact bitcoin wallets would be a massive reduction in privacy. “We think it’s problematic that people have fewer and fewer private financial moments anymore, and that it’s corrosive to people’s fiduciary sovereignty.”

These rules could make the very concept of private financial transactions in crypto almost as obsolete as Netscape or Myspace. Public blockchains combined with all-encompassing know-your-customer (KYC) rules and what might effectively be called “know-your-wallet” rules could create a nightmare scenario where no one is able to achieve any level of crypto privacy.

Christopher Kingsley, CMO, Exodus

Christopher Kingsley, CMO, ExodusWhile bitcoin has its roots in the cypherpunk and anarcho-capitalist circles, not everyone involved today shares those views.

Many individuals and organizations in the crypto community are not opposed to regulatory frameworks for this new asset class. Still, it does seem as though the space’s maturation could be made more difficult when lawmakers rush to enact misguided rules.

If not done correctly, onerous regulations could stifle innovation and reduce access to new financial products for those who could most benefit,” according to Kingsley. “Ultimately, this will make the ability to enter the financial services product innovation field harder, and it’ll make it a lot easier for well-established, large-scale players to essentially offer fewer features for higher fees, knowing there are fewer options” available to users.

The consequences could also be “bad for innovation more generally.” This sentiment has been echoed by others in the space as well.

While the ostensive purpose of these types of crypto regulations in 2021 are to “combat terrorism and money laundering,” some have argued that despite such good intentions, the real impact hits hardest in terms of stifling innovation, hampering user innovation, and enabling monopolistic tendencies among industry leading service providers, noted Kingsley.

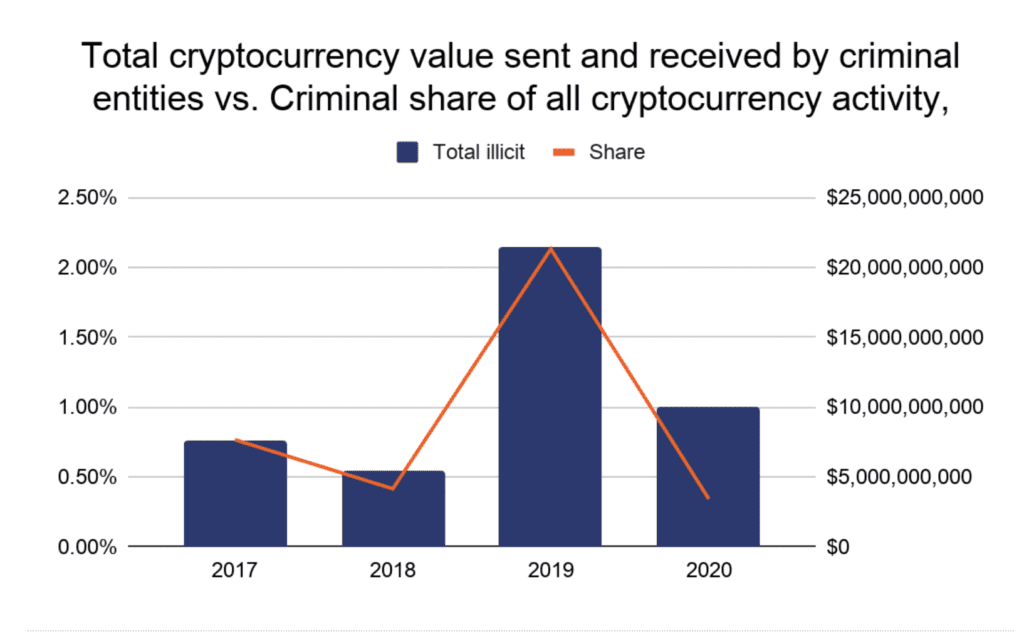

In fact, according to a January report published by blockchain analytics firm Chainalysis, only 0.34% of all crypto transactions in 2020 were involved in illicit activity.

Source: Chainalysis

Source: Chainalysis

Crypto regulations 2021

What might these regulations look like if they were to become enshrined in law?

Some things wouldn’t change much, including the average user’s experience when it comes to wallets and exchanges. The burden would mostly fall on financial institutions and their increased reporting requirements. Those requirements already apply to fiat transactions in some respects.

The key issue here is that large deposits of crypto could require an intrusive amount of customer data to be collected.

Using Exodus as an example, Kingsley said, Today “you can’t onboard more than $7K USD through Apple Pay or wire onto our service anyway because we want to make sure we’re compliant. But you can send any amount of crypto into an Exodus wallet without telling us who you are or where it’s from.”

Obviously, that last part would change if the current regulations being proposed were to take effect. He also implied that if regulations like this were to be made law, companies like Exodus could be forced to cease operations with US customers.

Not about consumer protection

The potential crypto regulations of 2021 don’t seem to have much to offer in terms of consumer protection. Nor can they do much for anti-terrorism or anti-money laundering efforts, as we now know these activities comprise only a tiny amount of crypto transactions.

Many moderate thinkers agree that some sort of regulatory framework can be seen as a net positive for the industry due to increased acceptance of crypto and ease of access for large players like institutions and corporations.

And yet, well-meaning rules like the FATF travel rule for crypto are the kind of thing that tend to lend support to many arguments made by crypto evangelists and anarcho-capitalist types.

Their objections to regulation in general are often centered around arguments in opposition to the very things that a travel rule could create: increased inequality and monopolization, reduced user privacy, and an unnecessary bureaucratic interjection into otherwise free markets that threatens to make them a little less free.

While the FATF travel rule for virtual assets has been open for comments from the public for months, regulatory agencies are under no obligation to take public opinion into consideration.