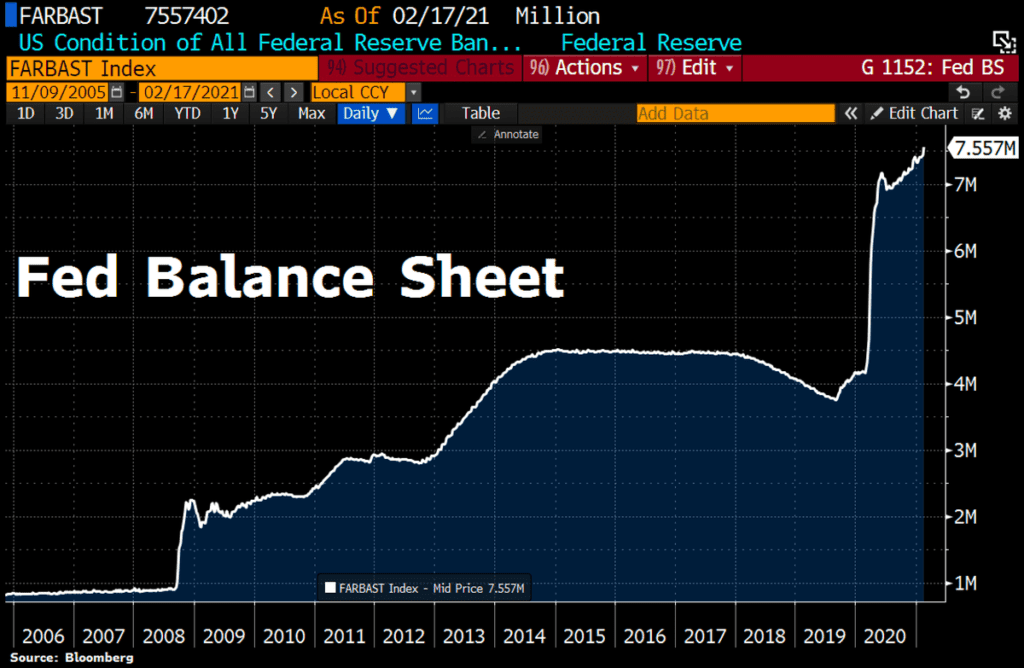

Fed Doubles Down on Securities Purchases as Balance Sheet Hits $7.5 Trillion

As the ongoing Covid-19 pandemic continues to wreak havoc on the global economy, the Fed’s efforts to stabilize the U.S. economy have pushed its balance sheet to an all-time high. According to recently released data, the Fed’s balance sheet rose by […]

Source: Shutterstock

- The Fed’s balance sheet is now equivalent to 35 percent of the US GDP

- Central banks around the world are inflating their balance sheets to help navigate the choppy waters of a recovering global economy

As the ongoing Covid-19 pandemic continues to wreak havoc on the global economy, the Fed’s efforts to stabilize the U.S. economy have pushed its balance sheet to an all-time high.

According to recently released data, the Fed’s balance sheet rose by $115.2 billion in the recent weeks to hit an all-time high of $7.557 trillion. These purchases were almost uniformly securities, with Mortgage Backed Securities making up the lion’s share of the assets. With this new all-time high, the value of the Fed’s balance sheet is now equivalent to 35 percent of the U.S. GDP.

Purchasing securities is a way for the Fed to control the money supply. When the Fed believes it needs to increase the nation’s money supply it will purchase bonds from banks, thus injecting cash into the economy. Likewise, when it feels the need to reduce the money supply it sells securities.

Source: Bloomberg via Holger Zschaepitz (@Schuldensuehner)

Source: Bloomberg via Holger Zschaepitz (@Schuldensuehner)

“These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses,” the Fed’s Open Market Committee said in a published statement. The Fed has also gone on the record to say that it’s intervention in the economy won’t stop until there is a “broad and inclusive” labor market recovery as well as inflation of 2 percent. In its statement the Fed also said that so far Quantitative Easing “had materially eased financial conditions and was providing substantial support to the economy.”

Initially the Fed started buying Mortgage Backed Securities as an asset after the 2007-2008 housing crisis. According to data from FRED, mortgage holdings hit a low of $1.36 trillion in November 2019. During the worst of the Covid-19-induced economic crisis in 2020, the Fed snapped up over $1 billion in MBS to the tune of about $100 billion a month. As a result, the average 30-year mortgage rate went down significantly allowing cash to be diverted away from mortgage payments and back into the economy.

The pattern of the Fed enlarging its balance sheet with government securities purchases is a trend followed by most developed economies. Reports show that the Bank of Japan increased its balance sheet by $6.8 trillion in 2020 while the European Union’s balance sheet increased by $8.5 trillion. China took a more conservative approach and injected only $5.94 trillion.

China state broadcaster CGTN cited the People’s Bank of China official Chen Yulu who explained that policymakers in Beijing preferred to cut bank’s reserve requirement ratio to inject money into the economy. The report also cited an economist at one of the nation’s major banks who said that unlimited quantitative easing can create bubbles and lead to future instability.

The Fed’s announcement doesn’t appear to have dramatically impacted the price of bitcoin, which had broken through an all-time high of $50,000 earlier this week on news that Tesla had added bitcoin to its balance sheet and MicroStrategy had doubled down on its holdings.