Galaxy Partners with Pyth to Push Better Bitcoin Pricing On-chain

The first major institutional exchange to join Pyth network in June 2021 was LMAX Group, a leading operator of execution venues for FX and cryptocurrency trading.

Source: Shutterstock

- Pyth Network, an oracle platform designed to provide trusted and verifiable market data to decentralized applications

- Oracle networks are essential pieces of blockchain infrastructure

Digital assets merchant bank Galaxy Digital announced today that it has signed a partnership with Pyth Network to serve as an oracle, providing data for its DeFi traders.

An oracle acts as the data gateway between real world information and the blockchain. It is the layer that queries and verifies external data sources for smart contracts, pricing, transactions and payment verification, among other things.

Given the explosive growth of DeFi during the last few years, oracles have attracted significant interest from many institutions that are normally in the data provision business, like telecom service providers such as Swisscom which recently joined Chainlink, one of the world’s largest oracles, as a node operator.

Pyth, which went live on the Solana blockchain in late August, and was backed by fundraising from Solana Labs, describes itself as an “oracle solution for latency-sensitive financial data that is typically kept behind the ‘walled gardens’ of centralized institutions.” Other stakeholders that are also contributing to the Pyth network include some of the biggest names in crypto and finance, such as FTX, Coinshares and DRW Cumberland.

Galaxy’s James Roth says this partnership will include Galaxy providing bitcoin prices in a sub-second timescale to the Pyth Network. Galaxy is the latest in a growing list currently numbering some 20 other firms that provide data to Pyth.

‘Better never than late’

The first major institutional exchange to join Pyth network in June 2021 was LMAX Group, a leading operator of execution venues for FX and cryptocurrency trading.

“Speed and reliability are the key to market data — there’s an old motto in market data that is, ‘better never than late’,” said Mercer. “The average block in Ethereum is 10 to 15 seconds whereas in Solana, you are talking about being able to update prices a few times a second. For solving market data problems the Solana blockchain is the obvious place for Pyth to be.”

Mercer added, “We’re in it because it’s the only way a centralized exchange like LMAX Digital can contribute to this fascinating world of decentralized finance. We think that Pyth can be the decentralized oracle solution for market data.”

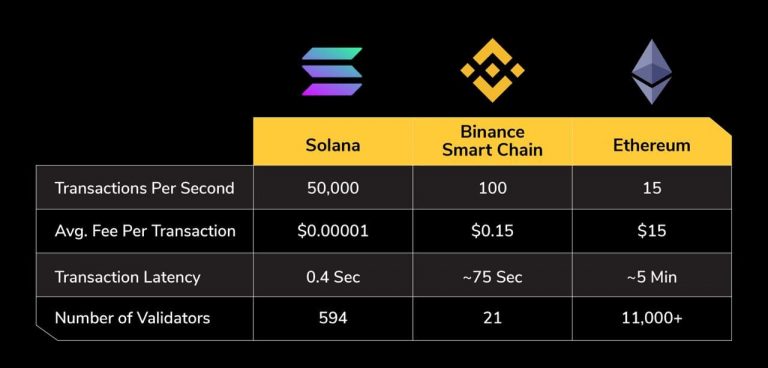

A main goal of the Pyth’s approach is to reduce dependencies on individual data sources, to provide data feeds that are both reliable and low-latency. This kind of speed is not a feature typically associated with decentralized ledger technology, which replicates state — records of transactions — across many nodes. Solana attempts to maximize speed at the expense of decentralization by processing transactions across a validator set that is an order of magnitude smaller than, for instance, Ethereum.

Scaling in layer-1 blockchains always entail tradeoffs; Source: Genesis Block

Scaling in layer-1 blockchains always entail tradeoffs; Source: Genesis Block

Expanding the market

It’s early days for this kind of blockchain-based financial application, but Galaxy’s Roth doesn’t view the project as experimental.

“We’re happy to experiment with lots of things, but that’s not what I would call this. I would call this something that we see as part of the core infrastructure of DeFi more broadly,” Roth told Blockworks during the Mainnet conference. “Anything that requires the input of a highly trustworthy price…it’s not just crypto, it’s also traditional equity.”

Roth explained that for Galaxy, they believe that there’s a massive value creation opportunity in being able to create “high fidelity, high quality, and trustworthy data” that sits on the blockchain and powers decentralized applications. After all, there are a world of data providers out there, but even some well-known names admitted to data integrity issues in the past. For institutional investors looking to deploy billions into the market, this is going to be unacceptable.

“We’ve been looking to participate in it for some time,” Roth said.

Pyth is an outgrowth of the Solana ecosystem, but future plans include support for Ethereum, Binance Smart Chain, and Terra, all of which rely on their own oracle solutions today. As other experts in the field, such as Chainlink’s Sergey Nazarov, have underscored, the reliability of data from these oracles is essential for the long-term health and growth of DeFi.

Noted Mercer, “Seeing as we are one of the founder/early contributors [of Pyth], we think that it’s going to be hugely influential and transitional, but look, the business that we’re in is foreign exchange and cryptocurrencies — we trade $30 billion a day — market data and efficient price data is key. That’s the value all of our participants are looking for.”

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.