Institutions Increasingly Seek Bitcoin Exposure Through Derivatives on Regulated Venues

Bitcoin has become an increasingly popular hedge amongst institutions worried about global currency debasement. The price of bitcoin rallied over 300 percent in 2020, outperforming more traditional inflation hedges like gold and silver by more than 250 percent. Blue-chip institutions—from BlackRock […]

Bitcoin has become an increasingly popular hedge amongst institutions worried about global currency debasement.

The price of bitcoin rallied over 300 percent in 2020, outperforming more traditional inflation hedges like gold and silver by more than 250 percent. Blue-chip institutions—from BlackRock to Tudor Investment Corporation—came out in support of bitcoin, confirming the narrative that the rally was institutionally driven.

Now that bitcoin has gained the acceptance of some professional money managers, the question remains: how will they choose to gain exposure?

Institutions are choosing derivatives over spot ownership

Derivatives offer investors the ability to manage risk and gain synthetic exposure to an underlying asset in a more capital efficient way when compared to buying spot. Trading on regulated marketplaces like CME Group also removes the need for costly infrastructure investments for managers.

“The main reasons derivatives are preferred by some institutional investors, especially through CME Group, are because these products eliminate custodial risks, reduces fees, and are compatible with existing workflows and systems,” said George Michalopoulos, portfolio manager at multi-strategy hedge fund Typhon Capital Management. “This also implies less onboarding and educational costs associated with ‘physical’ acquisition.”

The time and resources investors save by trading on regulated derivative venues are significant. Digital assets trade on an entirely separate capital markets infrastructure than other financial instruments. Funds wishing to replicate the types of strategies they run in other markets will need to invest the time to source and vet service providers, custody assets, interface with exchanges and safely transact.

In addition to the costs, the familiar infrastructure of derivatives provides reassurance and clarity for CTAs and fund managers wishing to trade.

“In an age when we hear about digital currency hacking on a consistent basis, centrally cleared cryptocurrency derivatives offer a compelling institutional path to getting exposure to a rapidly growing asset class, with better understood risks than the wild west of spot crypto,” said Michael Pomoda of LA-based Crabel Capital Management.

Institutions are more comfortable using regulated venues

Before the launch of CME Bitcoin futures in late 2017, the venues that were available to U.S. funds were offshore and loosely regulated. Although these venues succeeded in attracting liquidity, their lack of regulation and a centrally cleared infrastructure made them unusable for many professional investors.

“Offering crypto derivatives on a regulated, time-tested marketplace, like CME Group, provides institutional clients a way to get exposure to the value of the cryptocurrency without the added cost of holding the digital asset,” said Tim McCourt, Managing Director of Equity Index & Alternative Investment Products at CME Group. “Additionally, all futures and options contracts executed at the exchange are centrally cleared, which helps to mitigate counterparty risk between participants to a trade. Our clearinghouse serves as the counterparty to every cleared transaction, becoming the buyer to each seller and the seller to each buyer, guaranteeing the financial performance of both parties.”

Although investors are beginning to gain an appetite for the volatility of bitcoin, they will certainly want to avoid any sort of regulatory risk.

McCourt added, “It’s not only the benefit of transacting at a marketplace like CME Group which has a nearly 200-year history of building markets and offering risk management. We have a clearing house which guarantees the contract. That gives people a lot of comfort in dealing with the venue, because the rules of the road are clear.”

The market for digital assets is maturing. Many of the active participants today are managing money for other individuals and institutions, and they have a fiduciary duty to trade on a regulated venue.

The data tells us that institutions are embracing derivatives

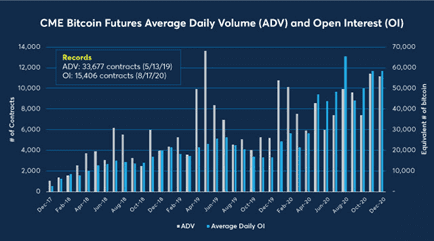

Though the market is still young, the early signs are very positive. Compared to last year, CME Group has seen significantly higher volumes on its futures contract, equivalent to 5 bitcoin, supporting the idea that it is indeed institutions driving the rally.

Average daily open interest (ADOI), a measure of the total number of outstanding unsettled contracts, reached a record 9,953 contracts (49,675 equivalent bitcoin) in December 2020, a 106% year-over-year increase.

Average daily volume (ADV) reached 11,108 contracts (55,540 equivalent bitcoin) in Q4 2020, a whopping 233% increase over the same time period last year.

Data from CME Group

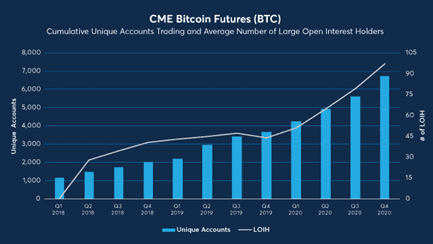

Data from CME GroupIn addition to a striking increase in trading activity, the relative percentage of large traders increased as well. One of the metrics CME Group tracks to gauge participation of funds and other institutional players is known as large open interest holders (LOIH), which is defined as any entity holding more than 25+ Bitcoin futures contracts (equivalent to 125 bitcoin).

In Q4 2020, the number of LOIH contracts rocketed up to quarterly record of 97, a 121% increase from the previous year.

Data from CME Group

Data from CME GroupAnd while the market for bitcoin futures is small compared to other markets CME operates in (over 2 million Micro E-mini futures traded in just one day in January), it is growing fast. In fact, CME Bitcoin futures set a record for average daily volume (ADV) in January 2021, with 17,500 contracts (87,500 equivalent bitcoin).

While volume has grown by an order of magnitude since launched in 2017, that’s not what excites McCourt the most.

“What I am proud of is that CME Group not only has trading growth — but also has significant open interest growth. That increasing open interest is really what signals a more institutional style of trading, because these are people who are holding contracts overnight, and holding contracts for a period of time. These are certainly larger positions that they are holding, which I think is a key sign of institutional adoption.”

While CME Group has been singularly focused on growing its Bitcoin futures and options market throughout the past few years, it recently launched Ether futures on February 8. Given the success CME has had with Bitcoin futures, the launch of an institutional product for Ethereum is an exciting opportunity for investors to gain exposure to the second largest crypto asset by both daily volume and market capitalization.