The Investor’s Guide to Bitcoin

Bitcoin’s product-market fit has continued to evolve, making it a more attractive vehicle for investment than ever before

What is bitcoin, and how can one invest in it?

Want more like the Guide to Bitcoin? Scroll to the bottom for further reading and a list of other Blockworks Investor’s Guides.

A quick primer on Bitcoin

Bitcoin is like Carl Sagan, David Attenborough or Nelson Mandela. Few people can name its peers, but most have almost certainly heard of it, and it’s notably changing things for the better.

Investors don’t need another answer to the question, “What is Bitcoin?” You probably recognize bitcoin as one of the first examples of cryptocurrency. You know it was created to solve the problem of centralized currency control, and it provides a peer-to-peer system for electronic cash transactions.

You also likely already know that the best way to understand Bitcoin’s intentions is to read the Bitcoin whitepaper.

So instead, this guide will answer questions like:

- What should I do with Bitcoin, if anything?

- Is Bitcoin being used as it was originally intended by its creator(s)?

- Is Bitcoin a good investment?

- Are there any environmental issues with Bitcoin?

- Is it an ethically-sound investment?

The case for Bitcoin

Bitcoin is both a payment network and a currency. While the network was intended to be a trustless system for payments, Bitcoin is one of the least efficient transaction models in the modern crypto space.

But that doesn’t make Bitcoin useless — the opposite is true, in fact. As the industry has progressed and created blockchains and currencies with more specific applications, Bitcoin’s product-market fit has evolved far beyond what its pseudonymous creators outlined in the whitepaper, making it a more attractive vehicle for investment than ever before.

Bitcoin’s strengths

Immutability — A key feature of Bitcoin is the immutability of its transactions. A transaction cannot be changed or reversed, which proves the authority of conflicting transactions by honoring the first one that’s validated, and protects against disputes and mediation costs.

Supply hard cap — The total supply of bitcoins is capped at 21 million BTC — a strong selling point for those who view it as a store of value. No matter how much demand for BTC grows, a fixed supply ensures scarcity, which can lead to increased value.

Trustlessness — Validating transactions on the network with community consensus and trustless organization removes the need for centralization (leading to the next point). It also creates a way for transactions between parties to be secured by a coalition of independent validators, so users neither need to trust the other party nor the transaction facilitator.

Decentralization — Removing a central third party that controls and confirms all transactions (like banks and governments) puts the control of a user’s money back in that user’s hands. It’s ideologically a major perk, and it practically defends against abuses of power by central authorities around the globe.

Proof-of-work — Using CPU power to validate transactions ensures a committed validator and protects majority decision-making against someone able to allocate many IP addresses or bots to take over a voting system.

Privacy — The lack of personal information in a transaction, in theory, protects users’ right to privacy from all manner of fraud, surveillance and coercion. (See weaknesses for practical problems.)

Simplicity — A simple, singularly-focused system ensures that one system can more efficiently be devoted to its purposes and less vulnerable to the improper interactions/breaks that can happen in more complex protocols.

Bitcoin’s weaknesses

Bitcoin maximalists (fundamentalists) may tell you Bitcoin has no weaknesses. And in truth, its simplicity serves it very well in an industry that is constantly changing. But by acknowledging where Bitcoin doesn’t fit, we can honor it and our balance sheets by using it where it does.

Immutability — For use in transacting, immutability can become inefficient when reversing a transaction is necessary. Refunds and incorrect transactions take a second transaction to rectify, and theft of bitcoins is irreversible, requiring Layer-2 insurance protocols to protect against it (which are not readily available).

Decentralization — From the user side, there isn’t a clear downside to decentralization, other than some network inefficiency, which will be addressed in the next point. Governments, however, often view unregulated Bitcoin as a threat to their control, which can either be a strength or weakness of Bitcoin depending on whom you ask.

Proof-of-work — After the invention of proof-of-stake and other consensus models, Bitcoin’s proof-of-work model appears inefficient. Its strengths remain, but can be wasteful if the energy to power the network is not sourced sustainably. Proof-of-work also creates opportunities for network centralization, as the people with the best chance of mining bitcoin and powering the network are those with the money and connections to be able to do so at scale, and cheaply.

Privacy — Despite intent for privacy, bitcoin is not a very private currency. It is easily traceable, and once a transaction is linked to a user, that user’s wallet is now correlated with their identity, and transactions are no longer private. A variety of privacy-preserving networks have emerged to fill this hole.

Simplicity — While the singular focus of bitcoin on peer-to-peer transacting has inspired countless technological and social progresses, the failure of bitcoin to remain the most efficient method of transacting opens it up to obsolescence. Additionally, it largely leaves Bitcoin out of market developments like DeFi and GameFi. Luckily for Bitcoin, it has found a different fit in global markets, which will be addressed further below.

Supply hard cap — The supply of bitcoins being capped at 21 million results in an inflexible monetary supply (which some economists suggest is necessary for use in transacting and for a healthy, adaptable economy). Additionally, early holders able to amass more bitcoin at lower prices create a centralization of wealth and supply control, in opposition to the core principle of decentralization. Additionally, as users lose access to their bitcoins due to the level of technical familiarity needed to safely store one’s bitcoins, the total supply of accessible bitcoins slowly shrinks.

You’ll notice that many of Bitcoin’s strengths are also its weaknesses when incorrectly applied. This is where the maximalist view breaks down, and it’s important to consider how Bitcoin is used when speaking of its value:

Bitcoin as a store of value

The concept of Bitcoin as a store of value is necessary for bitcoins to preserve purchasing power over time, and has thus always been intended for the currency. However, as its utility as a medium of exchange faded, its use as a store of value has grown in importance.

An inflexible currency not subject to inflation and with immutable transactions is proving to be very useful as a way to protect one’s wealth. Individuals, corporations, banks, and governments alike are turning to bitcoin as a way to preserve purchasing power with something more convenient and usable than gold, but less volatile (at least, when factoring in inflation and politics) than government-issued currencies.

On the subject of volatility, framing is key.

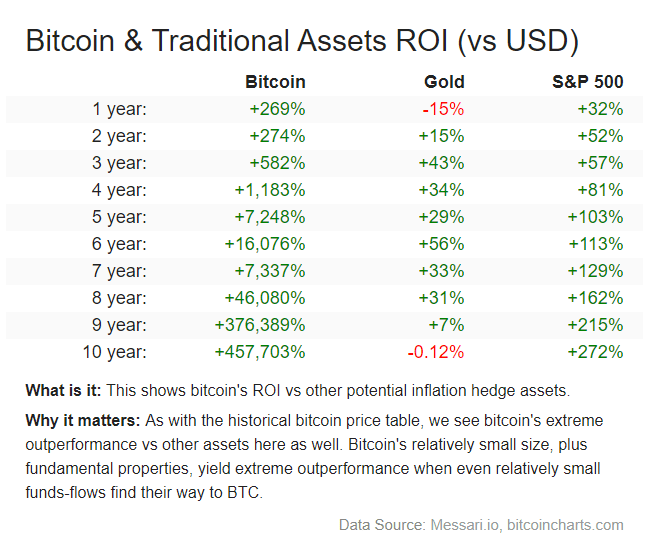

Bitcoin for day traders may be considered a volatile asset, but year-over-year bitcoin has offered a massively-profitable ROI, albeit one which shrinks with every cycle, thus making it increasingly stable over time.

So, is bitcoin useful as a means of transacting daily? Not really. But, is it an asset perfectly suited to storing, protecting and occasionally transacting one’s wealth? Yes, and likely to a degree far beyond what its creator(s) intended.

How to invest in bitcoin

Hold on for dear life

“Hodling” is by far the most reliable “tried-and-true” method of investing in bitcoin for profit. A misspelling of “hold” that was retroactively given the meaning “hold on for dear life,” to hodl bitcoin is to buy bitcoin and never let go.

Given the consistently positive and often outsized returns, the safest play appears to be to let bitcoin save your net worth from inflation and other investments (not financial advice):

If hodling is your method of choice, simply set up a Bitcoin wallet and purchase some from a DEX or private party, or skip the setup and buy from a centralized exchange like Coinbase (though, you may still want to explore cold storage wallets for security).

As with buying and selling any asset, day trading is a viable investment option, and should be done with careful analysis and thorough risk assessment.

TradFi integrations

Using bitcoin like you were a trader before 2008 (if you were, I would like to set aside this parenthetical to congratulate you on your resilience) is also an enticing option, thanks to ever-increasing interest from Wall Street and products that integrate the currency.

Bitcoin ETFs are fighting to gain approval in the US (specifically spot ETFs), but you’ll also find bitcoin exposure through index funds, backing collateralized loans and sitting on corporate balance sheets. A variety of bitcoin-exposed traditional financial suites are offered by both blockchain-based and traditional companies.

Mining

Rather than purchasing bitcoin or bitcoin-exposed products, investors may choose to earn bitcoin by mining it (participating in validating transactions on the proof-of-work network and earning bitcoin in return for spent processing power).

Due to the popularity of bitcoin, bitcoin mining is a competitive ecosystem. Miners with the ability to source cheap power and build warehouses full of mining rigs have the best chance at profitability. That said, anyone with a powerful enough computer can participate and has a chance to earn bitcoin.

As proof-of-work consensus protocols like Bitcoin consume electricity, using them at scale risks being unsustainable. However, because excess renewable energy is cheap and would otherwise go to waste, some mining operations are using bitcoin as a profitable way to push economies toward greater sustainability.

Final considerations

Investing isn’t just the transfer of money, or a risk/reward profit vehicle. Its effects are social, environmental, emotional and political, and one’s convictions matter as much as one’s risk tolerance. Consider both carefully before committing to an investment strategy, and remember, you can never be too informed.

Further reading

More on bitcoin

Bitcoin Developers Do Not Have a Fiduciary Duty to Bitcoin Owners, Judge Rules

Exxon Mobil Powering Bitcoin Mining Pilot Using Excess Natural Gas: Report

Is a Change to ‘Exchange’ Definition Key to Bitcoin ETF Approval?

Bitcoin ATMs Illegal in the UK, Regulator Says

Biden’s Crypto Executive Order May Be ‘Watershed Moment’ Despite Lack of Specifics

Get educated. Check out The Investor’s Guide to AVAX, The Investor’s Guide to Music NFTs, The Investor’s Guide to DeFi 2.0 and The Investor’s Guide to Avalanche.

The content of this webpage is not investment advice and does not constitute any offer or solicitation to offer or recommendation of any company, product or idea. It is for general educational purposes only and does not take into account your individual needs, investment objectives or specific financial circumstances.