Arrests and Sanctions Drove Lower Crypto Hacks in Q1

Mango Markets exploiter Avraham Eisenberg’s prosecution sends a warning to attackers, while US sanctions against Tornado Cash raise risks for laundering stolen funds, according to TRM Labs

JLStock/Shutterstock, modified by Blockworks

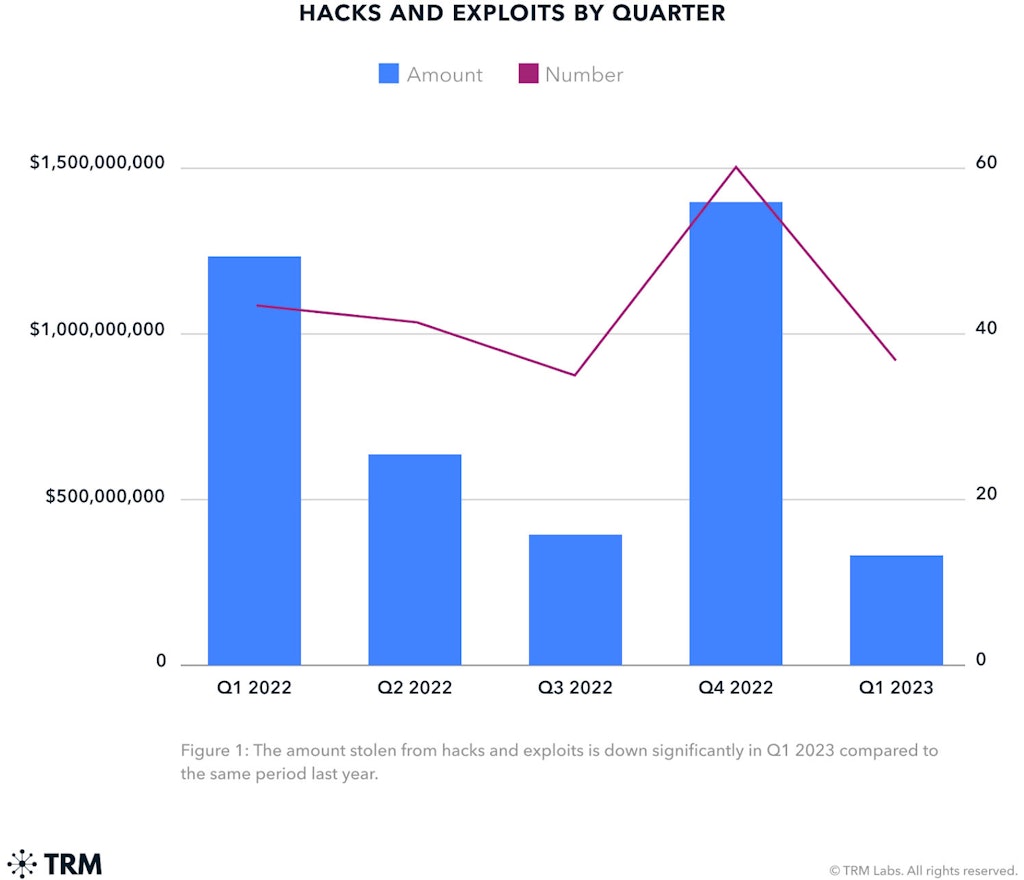

Crypto-related hacks took a nosedive in the first quarter this year, new data from TRM Labs showed.

In a striking decline, about $400 million was pilfered in nearly 40 incidents, marking a 70% drop compared to the corresponding period in 2022.

A report published on May 22 revealed that the average size of hacks dropped to $10.5 million from nearly $30 million in the same quarter a year ago. Meanwhile, hacking victims successfully recouped over half of the stolen funds during this period.

For instance, in March, a hacker discovered a bug in DeFi protocol Tender.fi’s code and managed to snatch $1.5 million. But instead of running away with the loot, the hacker actually reached out to Tender.fi and struck a deal to return the money. The catch was a bug bounty worth 62.15 ether ($850,000)

TRM Labs said there is no single straightforward explanation for the decline in hacks, but two events may have dampened the enthusiasm of potential attackers.

In 2022, the top ten hacks reportedly accounted for about 75% of the total stolen funds. It’s important to note that quarterly numbers don’t accurately predict yearly losses.

Source: TRM Labs

Source: TRM Labs

Eisenberg’s arrest in Mango Markets exploit

Crypto investor Avraham Eisenberg, who employed a “highly profitable trading strategy” to siphon off over $110 million worth of crypto from DeFi trading platform Mango Markets, was arrested in Puerto Rico in Dec. 2022.

Shortly after the incident occurred in mid-October, the self-proclaimed game theorist openly admitted to his role in depleting Mango Markets’ funds.

Despite Eisenberg returning a portion of the funds, apparently in exchange for avoiding legal repercussions, the SEC didn’t let him off the hook. The agency charged him with breaking anti-fraud and market manipulation rules in securities laws.

On top of that, Mango Markets didn’t hold back either and slapped Eisenberg with a lawsuit, demanding $47 million in damages plus interest.

“Avraham’s prosecution may have signaled to would-be attackers that even an agreement from the victim not to pursue legal action may not confer protection,” TRM Labs said.

US Treasury’s sanctions against crypto mixer Tornado Cash

Decentralized crypto mixer Tornado Cash was added to the US Treasury’s blocked list last year. It was accused of facilitating the laundering of billions of dollars in virtual currency, including $455 million reportedly stolen by North Korean hackers.

As a consequence, the Treasury froze Tornado Cash’s US assets and prohibited American companies and individuals from conducting any business with them.

“The use of sanctions by the US government against crypto targets may have raised the potential costs of carrying out such attacks and made it more difficult to launder the proceeds,” TRM said.

However, the blockchain intelligence company said while crypto hacks have slowed down, the trend may only be temporary.

“The amount stolen and number of incidents in the first quarter of 2023 mirrors that of the third quarter of 2022. That was followed by a record-setting number of hacks that turned 2022 into a record year,” TRM added.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.