Luke Gromen: Today’s Debt-to-GDP Will Likely Weaken the Dollar

In this interview, Gromen discusses the debt to gross domestic product ratio and the ongoing threat of inflation.

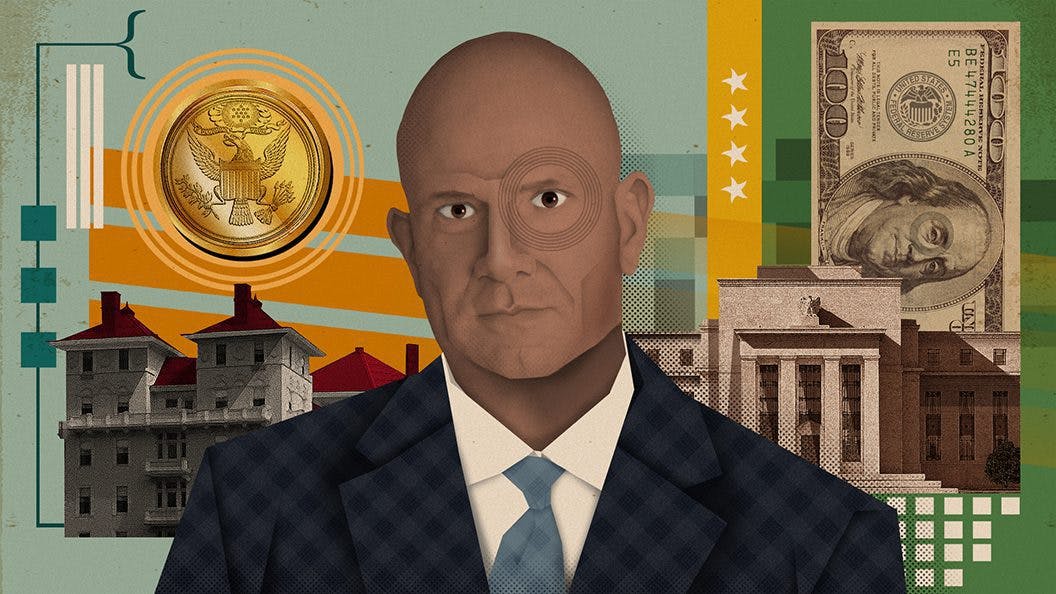

Luke Gromen, founder of Forest for the Trees LLC; blockworks exclusive art by axel rangel

- The economy is not growing quickly enough to keep up with inflation, said Gromen.

- Negative real rates, which occur when inflation outpaces interest rates, are likely to dip lower and continue for some time

Luke Gromen, founder of Forest for the Trees LLC, sat down with Blockworks at the Bretton Woods: The Realignment conference to discuss debt to gross domestic product ratio and the ongoing threat of inflation.

“We’re now getting into levels that historically, when you talk about the US in particular with debt to GDP at 130%, from which it is very difficult to recover without a weakening of the currency,” said Gromen.

The economy is not growing quickly enough to keep up with inflation, he explained. Negative real rates, which occur when inflation outpaces interest rates, are likely to dip lower and continue for some time.

Watch my full interview with Gromen below.