Let Michael Saylor cook

Bitcoin doesn’t have spokespeople like most of Web3 — why not let Michael Saylor shoot his shot

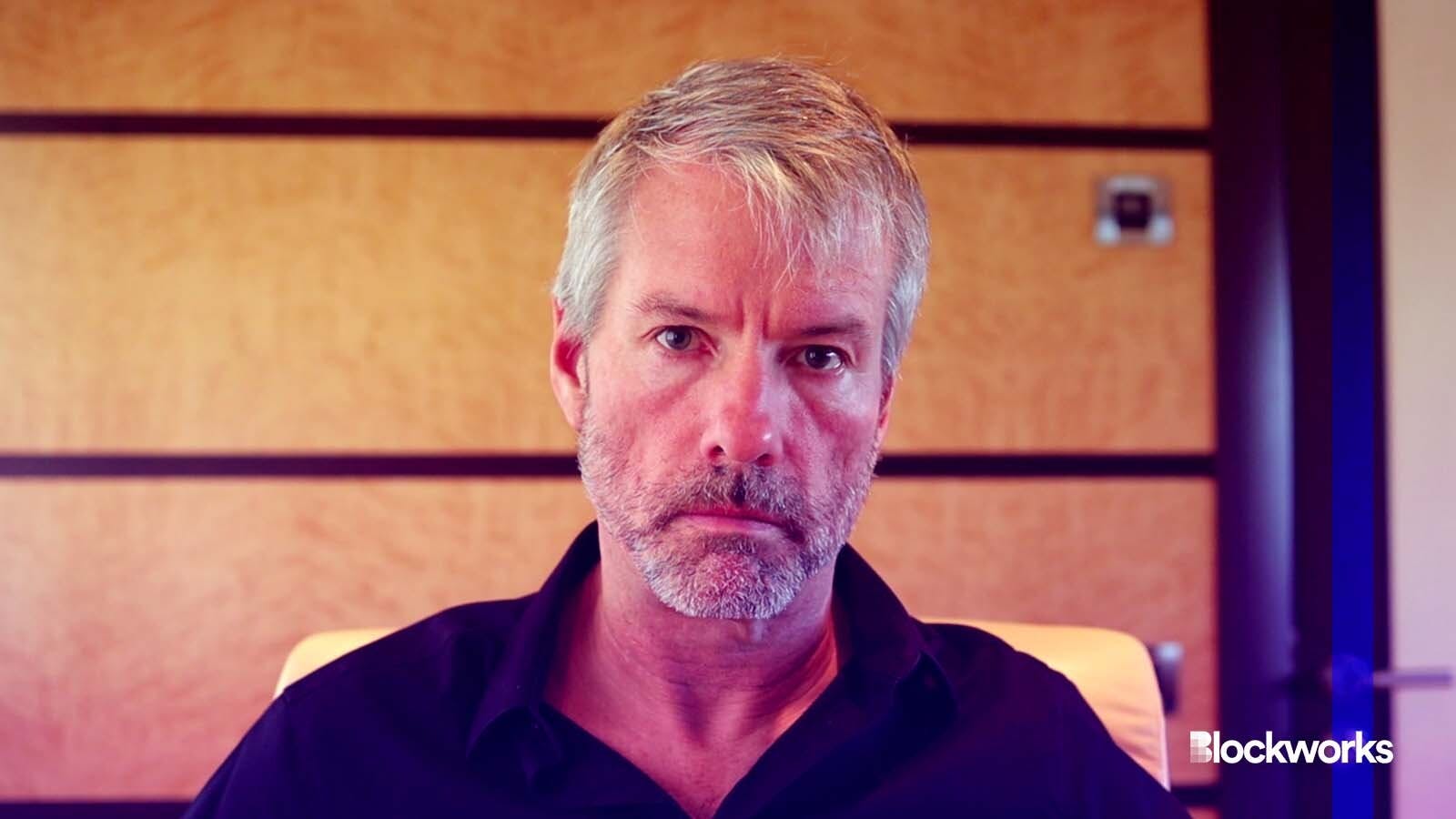

michael.com modified by Blockworks

Crush carbon under nearly three-quarters of a million pounds of Earth, heat it up to 2,000 degrees, and you make diamonds.

Subject a man to two decades of Wall Street shenanigans — from before the dot-com boom until now — and you get Michael Saylor.

The former MicroStrategy CEO and relentless Bitcoin bull is back in our feeds. In a recent podcast, Saylor huffed at the notion that buying almost $5 billion worth of bitcoin took “conviction.”

Saylor says: “How many chairs are you sitting on right now? Are you all-in on the chair? The point is you put on one pair of glasses, one pair of AirPods. You look at me through one screen, you’re using one microphone. That’s one microphone — you trust it? Is that conviction? That seems kind of scary, why don’t you diversify? Why don’t you use 10 microphones?”

The point is that we believe in lots of things in our everyday lives (like what knives we choose, says Saylor — we probably wouldn’t trust knives made of rubber bands, does that mean we have conviction in stainless steel?)

It sounds silly (because it is). It’s just that Michael Saylor wants you to know that Bitcoin is as obvious to him as anything other tool he uses in real life, from airplanes to roads (“If you get on an airplane, are you convicted? You put your entire family on one airplane, aren’t you afraid?”)

As goofy as all this is, Saylor has so far been right about Bitcoin — now up more than $1 billion on MicroStrategy’s purchases to date. In a world where money talks, Saylor is clearly translating it.

Saylor first got into Bitcoin when he milked $30 million from Block.one, the company co-founded by BitShares and EOS ‘mastermind’ Dan Larimer, for the Voice.com domain in 2019 — the most expensive domain of all time. The site has done practically nothing for Larimer and Block.one in the four years since.

That deal — which apparently cottoned Saylor onto the value-generating potential of Bitcoin — was an impressive feat that deserves praise. The fact that Saylor’s now up on $1 billion in Bitcoin is a bonus (although the actual profit is lower, as the firm must pay out its corporate bonds sold to buy BTC).

Granted, Saylor has at times peddled suspicious advice, even at the top of bull markets (sell everything you own and mortgage your house to buy bitcoin).

But all cryptocurrencies have their own brand of propaganda. Ethereum is a public good, Solana isn’t centralized, Cardano is peer-reviewed, banks will adopt XRP and Tether is fully backed. Depending on who you ask, those beliefs are shared fantasies, and at worst, folie à deux.

Bitcoin doesn’t have spokespeople like most of Web3. There’s no PR department, communications folk or marketing gurus. But there’s still magazines, conferences and global initiatives — and even a mascot in Saylor. We should at least be thankful he doesn’t rap or dance.

Let Saylor cook.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.