Prop AMMs, the aggregator wars and Solana’s REV

How are all these seemingly separate things related?

CryptoFX/Shutterstock modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

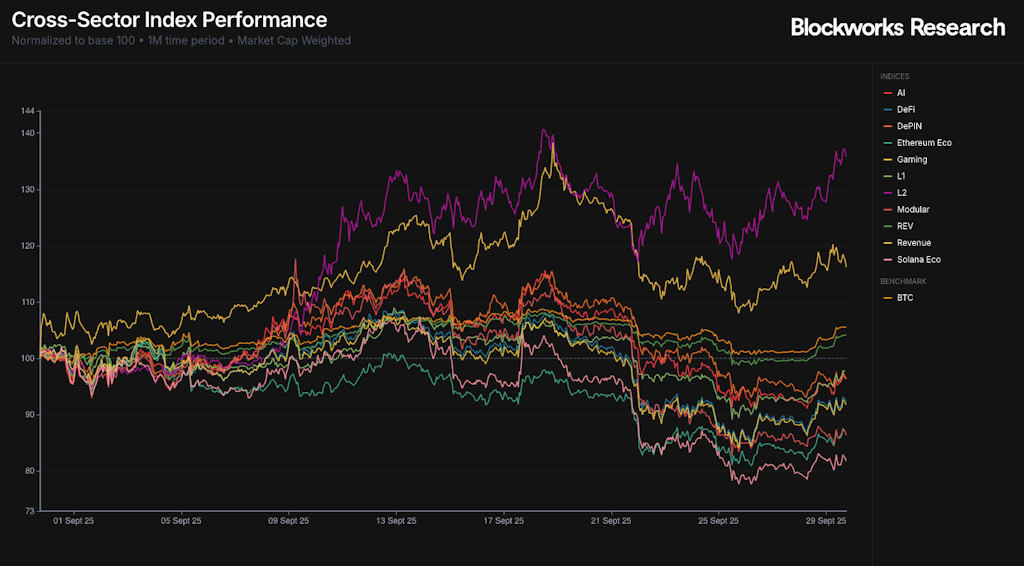

A rangebound market has found strength off the lows. The week opened green across the board, with both equity indices and crypto majors trading higher. BTC has moved up 5% from its recent low, and this strength is mirrored in ETH and SOL, each up 9% and 11% from their recent lows, respectively. L2s were the biggest winner on Monday’s session, while Modular and Gaming were the biggest losers on the day.

Zooming out to the monthly timeframe, L2s remain the notable winner. While most indices are down for September, L2s have notched a gain of 32%.

Under the surface, every L2 tracked in the index is down for September, except MNT and IMX, up 62% and 43%, respectively. While markets remain choppy and rangebound, pockets of alpha will continue to persist.

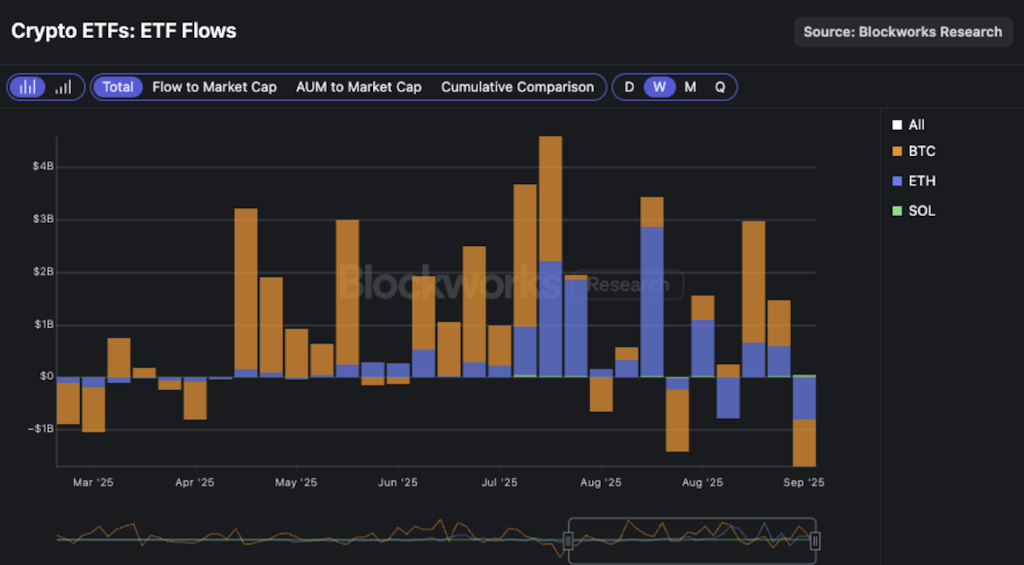

Regarding ETF flows, last week was the most negative week in aggregate since the March selloff. BTC ETFs exhibited ~$900 million in net outflows, while ETH ETFs saw -$800 million. The direction of ETF flows continue to mirror the price action on the majors, further evidencing the “flows-driven market” thesis.

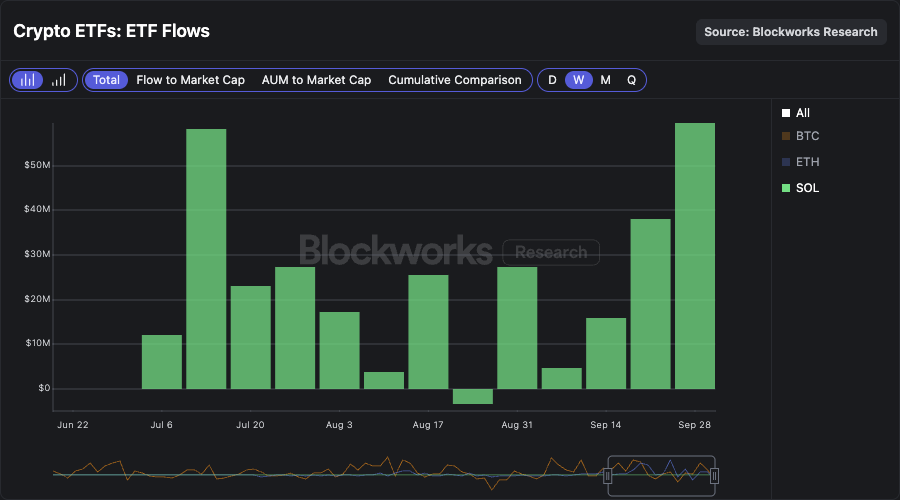

In contrast, and despite last week’s selloff, SOL ETFs posted their most positive week in net inflows since inception, registering +$59 million. This marks five consecutive weeks of net inflows for SOL ETFs. The pending approval of SOL ETFs under the ‘33 Act, likely to occur within the next few weeks, could likely accelerate this momentum. To reiterate, we view it as likely that SOL ETFs approved under the ‘33 Act can attract multiples more in AUM than what is already exhibited in the REX-Osprey SSK.

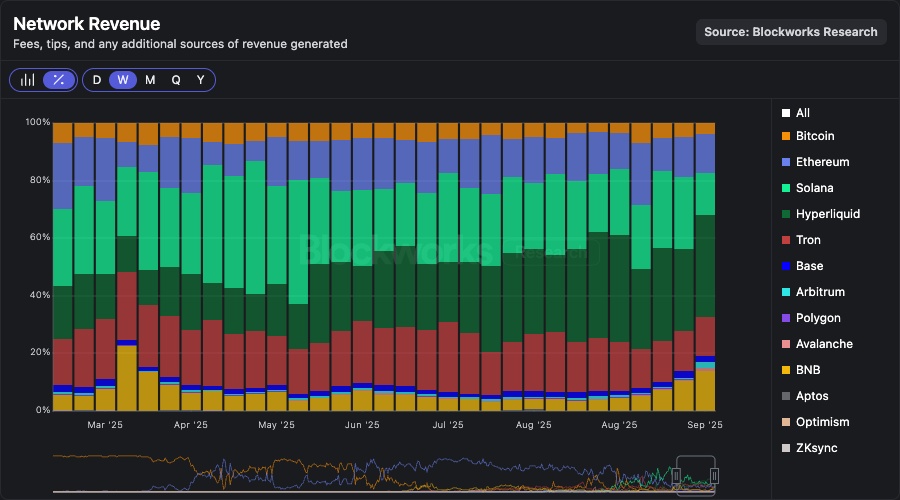

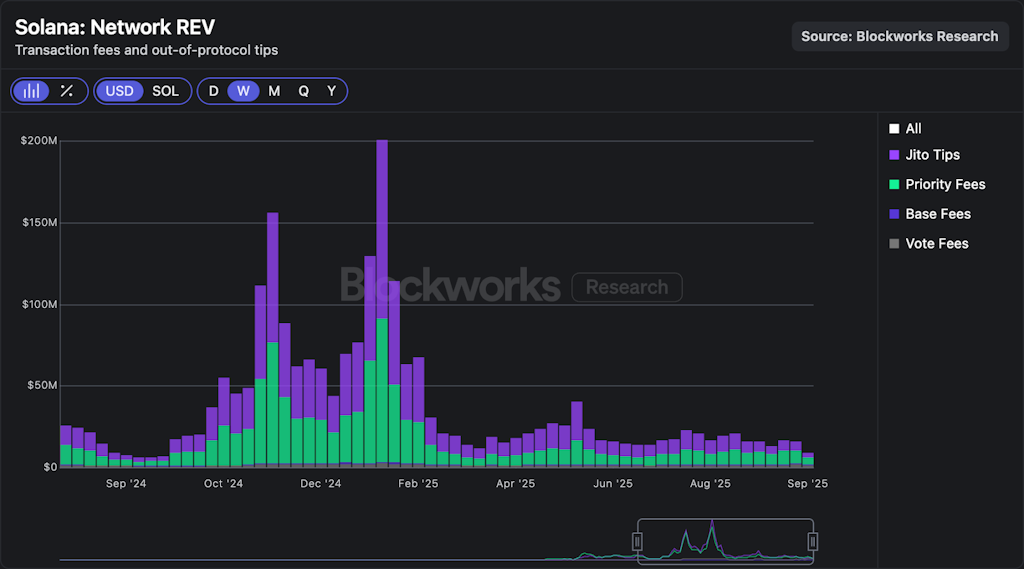

While we are constructive on inflows into these new SOL ETFs upon approval, the trend in several of Solana’s network fundamentals remains unfavorable. DEX volumes, REV and application revenue remain subdued. Additionally, Solana has been steadily losing market share in Network Revenue to both Hyperliquid and BNB. New inflows from these ETFs could continue to support SOL’s price action, but the onchain data says the activity is increasingly happening elsewhere.

Prop AMMs, the aggregator wars and Solana’s REV: Are they all related?

Last month, I wrote about prop AMMs, explaining how they were changing Solana’s market structure. Today, I want to talk about their continued dominance and two intimately related dynamics that remain under-discussed: the aggregator wars and the sharp decrease in Solana’s REV.

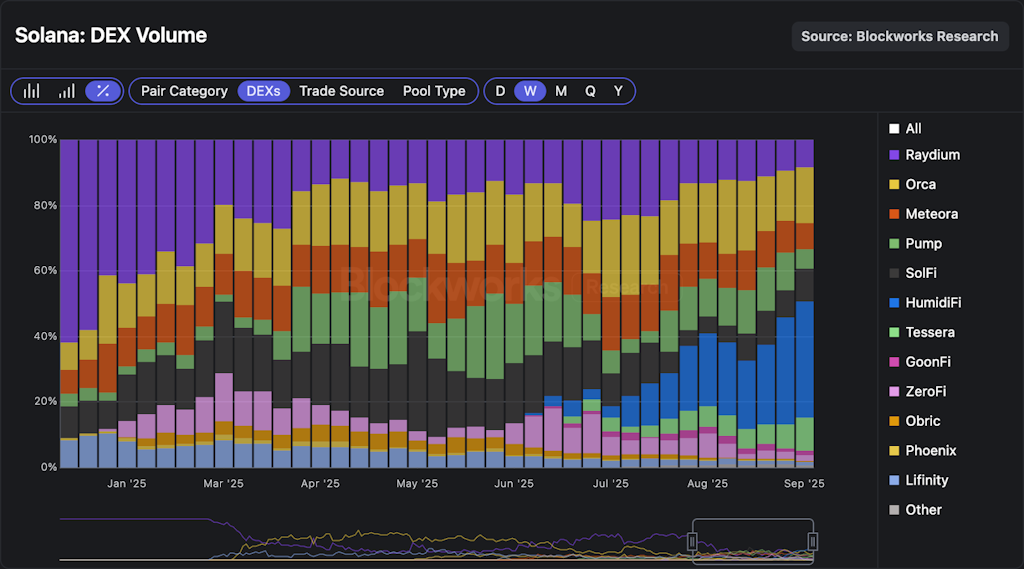

Let’s start with continued dominance. HumidiFi has consolidated as the top prop AMM by trading volume over the past few weeks. It now accounts for almost 50% of SOL-stablecoin volumes on the chain, and last week it accounted for 35% of total Solana DEX volumes, surpassing all other DEXs, including “traditional AMMs” such as Orca, Raydium and Meteora.

September will mark the first month ever in which prop AMMs (HumidiFi, SolFi, etc.) surpass traditional AMMs (Orca, Raydium, etc.) in monthly Solana DEX volume. When SolFi launched in October 2024, all prop AMMs combined accounted for just 7% of total volumes on the chain. This month, HumidiFi alone has accounted for 28% of total DEX volumes.

Switching gears a bit, a few weeks ago, Thogard from FastLane published an article arguing that the SVM is a poorly suited execution environment for prop AMMs and that they would thrive on Monad instead. His two core arguments were:

- “In the SVM, the best prop AMM is selected by the aggregator after simulating all of the possibilities…but by the time the transaction is executed that prop AMM may no longer be the best.”

- “In the SVM, any prop AMM can force a transaction to revert, forcing aggregators to maintain white lists, which reduces competition and increases integration time.”

I attempted to debunk his thesis by pointing out that he was missing a crucial piece of the story: The proliferation of prop AMMs on Solana has also led to increased competition in the aggregation front. Why does this matter?

It’s important to recall that prop AMMs don’t have a public frontend. This means that the vast majority of their volume comes from DEX aggregators. Thogard’s second argument relies on the false premise that Jupiter has a monopolistic position: “I’ve been told by friends that getting their prop AMM listed on Jupiter takes >three months and that the game has become political.” While Jupiter dominates aggregator volumes today, by no means are they free of competition. If Jupiter takes too long to integrate new prop AMMs, other aggregators like DFlow or Titan will gladly hit their contracts and have an edge to provide better price execution for the end user. Since aggregator loyalty is purely price-driven, Jupiter risks losing order flow by “being political.”

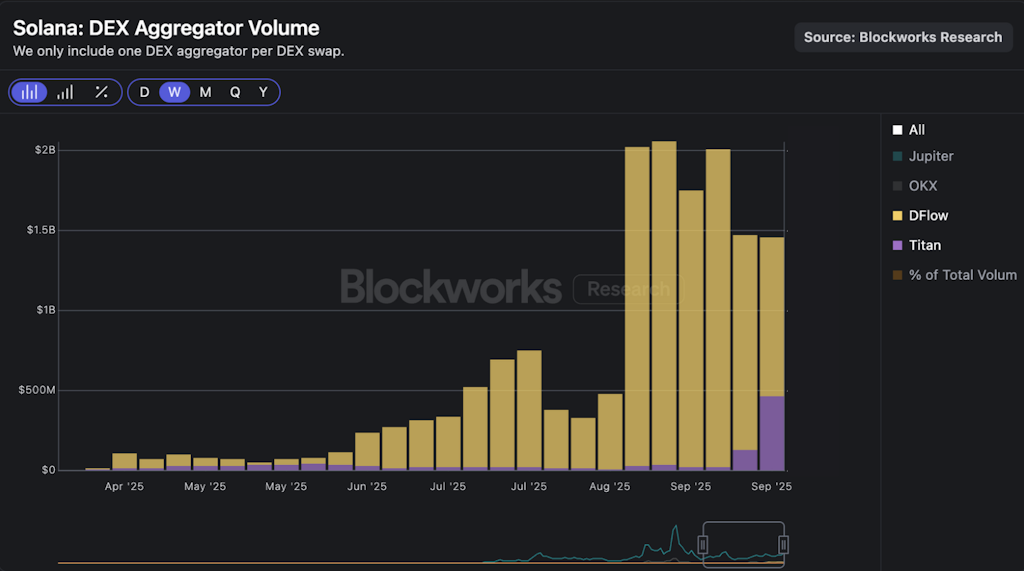

The chart below shows that DFlow and Titan’s volumes have increased dramatically since late August, averaging approximately $1.5 billion in combined volume over the past two weeks. Note that Titan’s recent surge is due to its public launch on Sept. 18, with the team reporting that their proprietary algorithm is outperforming competitors’ pricing 87% of the time. For the reduced competition argument to be valid, all aggregators would have to collude to maintain the same prop AMM integrations when, in reality, the opposite occurs. Aggregators are actually incentivized to integrate new routes as fast as possible to maintain or increase their routing win rate.

That leaves us with only one argument to address, which is the theoretical delay between simulation and execution. In this regard, DFlow unveiled JIT Routing (Just-in-Time Routing) last Thursday, a solution that enables the aggregator to dynamically re-optimize swaps onchain during execution. Whenever a swap route includes a prop AMM leg, DFlow’s onchain program will check the prop AMM’s price just before executing that leg. If the price has moved significantly from the initial quote (indicating the originally planned path is no longer optimal), the DFlow router will automatically reroute the trade to the current best venue, all within the same transaction. This will lead to lower realized slippage for users and higher transaction success rates. Notably, it showcases that Solana-native teams will work around any SVM’s theoretical limitations to deliver the best experience and price execution to their users.

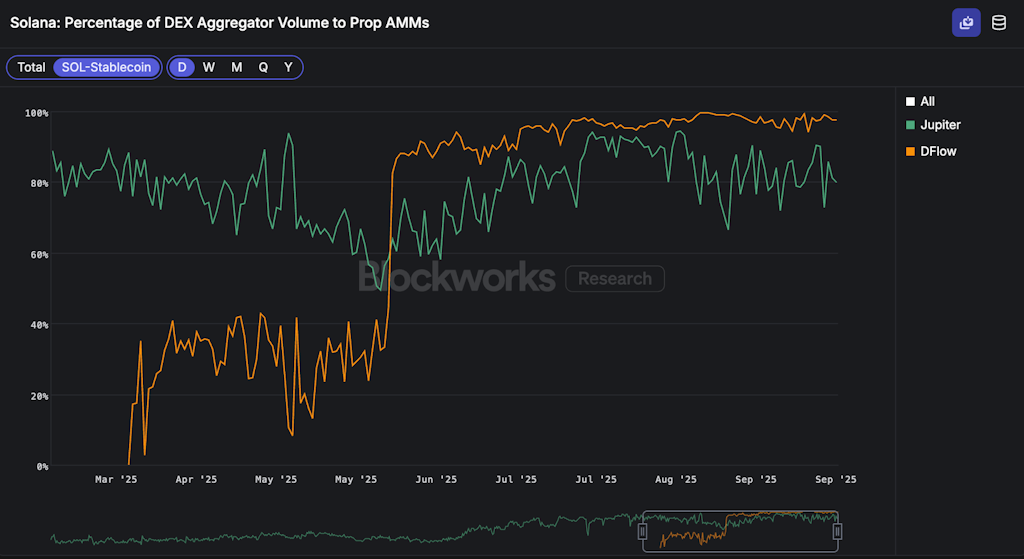

The chart below shows the percentage of DEX aggregator volume flowing to prop AMMs for the SOL-stablecoin pair. We observe that DFlow routes 98% of SOL-stablecoin volumes to prop AMMs vs. 80% for Jupiter. This discrepancy may partly explain why DFlow beats Jupiter in execution quality for the SOL-USD pair, especially for larger sizes.

The rise of prop AMMs is one of the most interesting things happening on Solana today, and I think we are still grasping their full implications. For instance, last week SOL-stablecoin volumes accounted for 74% of total DEX volumes on the chain, a figure we haven’t seen in over four years! Concurrently, memecoin volumes have fallen down a cliff, with a 10% market share last week, the lowest share since December 2023.

This shift in market structure has downstream implications for Solana’s REV. Last week, Solana generated $9.1 million in REV, the lowest weekly print since September last year, before the US election. While not all of these trends can be attributed solely to prop AMMs, they have certainly played a significant role. It will be interesting to monitor if prop AMMs continue to evolve in the coming months and the second-order effects in Solana’s ecosystem (aggregators, volume composition, REV, etc.).

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.