What makes Pump livestreaming different from Twitch or OnlyFans?

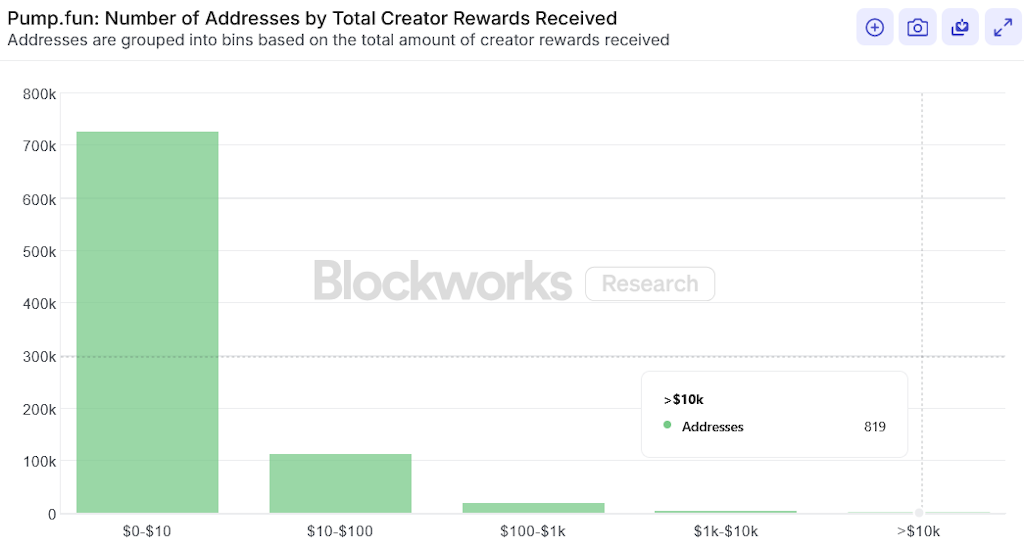

The BAGWORK memecoin creators made $169K on a 4-day-old memecoin, making it the 0.01% of creators that have earned more than $10K with Pump

Pump.fun and Adobe stock modified by Blockworks

This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

In early 2021, the video game streaming platform Twitch faced a major PR problem.

Female streamers scantily clad in bikinis started streaming themselves hanging out with cocktails in jacuzzis — what viewers dubbed the “hot tub meta.”

Unsurprisingly, Twitch’s advertisers pushed back. Twitch responded by quickly tightening its policies, and top streamers saw ad monetization get deactivated overnight.

That category of streaming continues to exist today, but in a quarantined corner operating under highly permissioned rules most advertisers opt out of.

From a business standpoint, it was the right move for Twitch.

A significant chunk of Twitch’s revenue comes from advertisers, and brands aren’t interested in associating their names with risky content. The economics of Twitch don’t align with shock value.

That’s the market space Pump is leaning into.

Take, for instance, the 4-day-old BAGWORK memecoin.

Over the weekend, a creator duo ran the classic “do anything for attention” playbook: streaking across a live baseball game, getting slapped by famous fitness influencers, threatening to jump off the Santa Monica pier, shaving their heads…you get the idea.

The strategy worked. BAGWORK is trading at a $27 million market cap now and the duo behind the token has pocketed a tidy $169K within four days of the token being live.

That’s thanks to Pump’s revamped fee model in early September that lets token creators earn a cut every time their token is traded.

(Creators earn a 0.95% take-rate fee at a 420 SOL market cap, which scales down to 0.05% at a 98240 SOL market cap.)

This presents unusual incentives for Pump’s streamer creators.

Creators get paid on volume, not loyalty. If traders don’t see upside, volume dies, so creators are incentivized to keep the spectacle rolling to drive more trades. That’s very different from Twitch streamers or OnlyFans models who monetize from one-time gifts, tips or subscriptions from a dedicated fanbase.

It’s easy to see how Pump’s fee model incentivizes creators to supply not only shockbait content, but a constant stream of it.

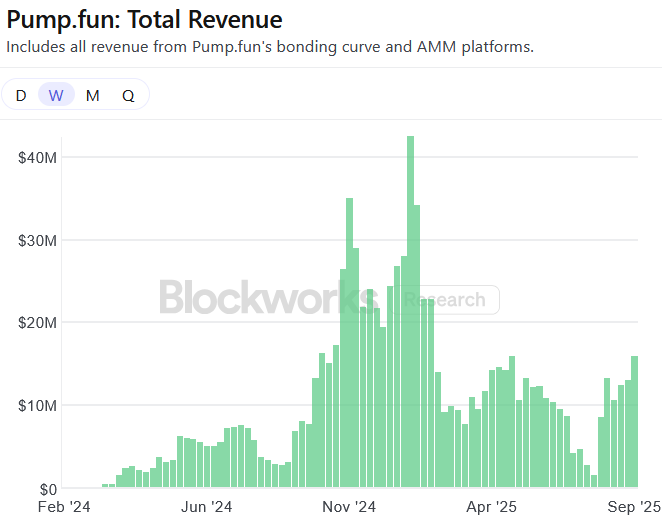

Pump’s business model also only works because it isn’t beholden to advertisers (unlike Twitch). The platform takes a 0.05% protocol fee for every token traded on its platform.

What makes Pump so unique compared to traditional streaming platforms is that the addressable “stunts for attention” surface area is basically infinite.

There are only so many video game streamers or OnlyFans models willing to strip for the camera, but there are endless ways to manufacture buzz that moves a memecoin and, by extension, creator fees.

Before you get any ideas, Pump creators don’t have it that easy. Only 819 addresses — ~0.094% of all wallet addresses that have created a Pump token — have earned more than $10K in creator rewards, according to Blockworks Research data.

Creators literally have to “work for their bags” (hence BAGWORK, get it?), and only a small sliver of them see a lucrative payday.

The only question is what else creators would be willing to do for their bags.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.