Ray Dalio Warms to Bitcoin, Calls it a ‘Long Duration Option on a Highly Uncertain Future’

The founder of Bridgewater Associates — once a staunch skeptic of bitcoin and crypto — is changing his tune. In a recent newsletter, Ray Dalio, the fund’s founder, says that bitcoin is “one hell of an invention” and cryptocurrency could be […]

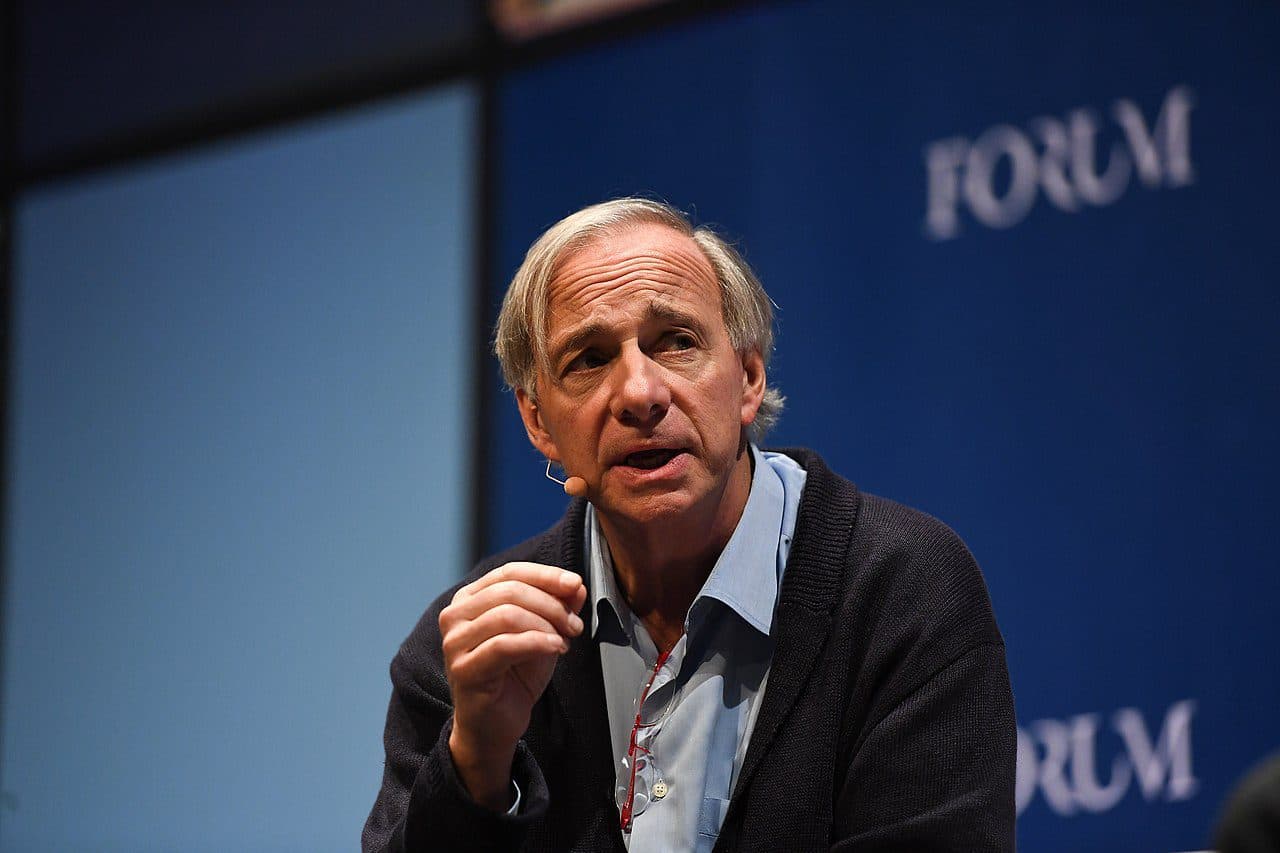

Bridgewater Associate’s Ray Dalio; Source: Wikipedia

- Bridgewater founder Ray Dalio considers including bitcoin in alt-cash and storehold of wealth funds

- Dalio expressed lingering concerns around cybersecurity and asset scarcity

The founder of Bridgewater Associates — once a staunch skeptic of bitcoin and crypto — is changing his tune.

In a recent newsletter, Ray Dalio, the fund’s founder, says that bitcoin is “one hell of an invention” and cryptocurrency could be a “gold-like asset” especially in a period of intense volatility.

“I tell you that I and my colleagues at Bridgewater are intently focusing on alternative storehold of wealth assets and expect Bridgewater to soon offer an alt-cash fund and a storehold of wealth fund in order to better deal with the devaluation of money and credit that we consider to be a major risk and opportunity and Bitcoin won’t escape our scrutiny,” Dalio wrote in a note to clients.

Bridgewater, the largest hedge fund in the world with AUM of over $138 billion, is known for its flagship Pure Alpha fund, but is also unique in its approach to preserving wealth over long periods of time. Bridgewater’s All Weather Fund, partially inspired by Nixon going off the gold standard in the 1970s, is an allocation based strategy dedicated to preserving wealth across century-long time periods.

Over the past few weeks Dalio has had a notable change in attitude regarding Bitcoin. Once an ardent skeptic of cryptocurrency, he tweeted in mid-November that he sees a handful of reasons why it can’t serve as an effective currency, but it came with the disclaimer that he “might be missing something.” As of early December, his attitude on the topic had warmed to the point of saying that bitcoin had a place in investor’s portfolios.

“Overall, it’s clear that Bitcoin has features that could make it an attractive storehold of wealth; it also has proven resilient so far. However, we have to acknowledge that this financial vehicle is only a decade old. In absolute terms and vis-a-vis established storeholds of wealth such as gold, how will this digital asset fare going forward?” Dalio noted in the report.

As single stock volatility runs rampant, the historical model for long/short funds becomes much harder. Dalio joins a club of other hedge fund titans accepting the digital assets’ role in the modern portfolio.

“Future challenges may still come from quantum computing, regulatory backlash, or issues we haven’t even determined yet. Even if none of these materialize, Bitcoin, for now, feels more to us like an option on a potential storehold of wealth,” he wrote.

Dalio’s perception of bitcoin as a long-term wealth preserving asset appears to differ from Paul Tudor Jones and Stan Druckenmiller, who many have warned may view bitcoin as a shorter term trade.

The hedge fund mogul did voice lingering doubts, however, including cybersecurity concerns and the proliferation of other “bitcoin-like” assets.