Red day for crypto, green day for miners

Crypto markets were negative yesterday, but BTC miners rallied on blockbuster HPC deals

Elisabeth Coelfen/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

We saw a sea of red in crypto as markets went risk-off on weakening macro, with the Balancer exploit likely exacerbating the move. On a brighter note, BTC miners IREN and CIFR rallied after unveiling sizable HPC deals, posting strong gains on the day.

We dig deeper into why SOL is trading weakly, with various ecosystem tokens near all-time lows, and whether there are reasons to be optimistic.

Indices

Markets turned risk-off as crypto underperformed broader assets. Gold (+0.5%) was the day’s only gainer, while BTC (-0.9%) slipped alongside traditional benchmarks, with the S&P 500 (-0.3%) and Nasdaq 100 (-0.1%) both lower as investors rotated defensively.

The day’s weakness across crypto markets likely reflects tightening financial conditions, with traders waking up to a more hawkish Fed tone, a strengthening dollar (DXY approaching 100), and a rising US 10-year yield nearing 4.1%. The October ISM Manufacturing print came in at 48.7, highlighting weak underlying economic activity (<50 contraction) and likely contributing to the broader risk-off tone.

While the Balancer exploit further undermined sentiment toward crypto, losses were broad-based and steepest in high-beta sectors. L2s fell 14.0%, followed by Ethereum (-13.6%) and Solana ecosystems (-13.2%). DeFi (-11.1%) and L1s (-7.9%) also lagged, with REV down 4.2%.

All eyes now turn to upcoming ISM Services PMI, US unemployment and payrolls and CPI over the coming days and weeks, with these releases likely to set crypto’s next leg — whether a deeper pullback or a push higher.

Market Update

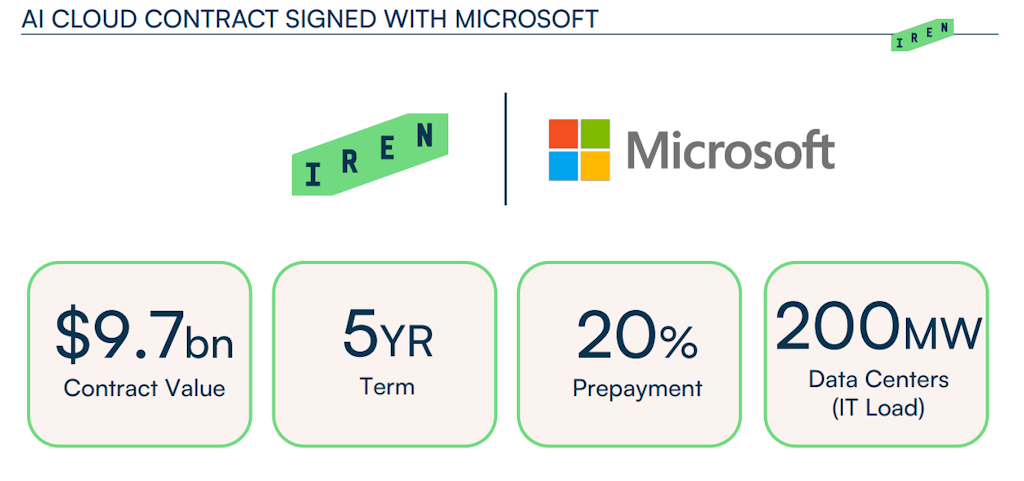

IREN shares jumped 11.5% yesterday on the Microsoft deal, underscoring how markets appreciate contracted AI revenue rather than hash price beta. Microsoft’s five-year, $9.7 billion agreement with IREN marks one of the clearest examples of hyperscalers tapping BTC miners’ power dense campuses for AI. The deal gives Microsoft access to Nvidia GB300 capacity, includes ~20% prepaid capital to IREN, and is tied to new liquid-cooled build-outs at IREN’s 750MW Childress campus that target ~200MW of critical IT load. Cash from Microsoft’s department will help finance GPU purchases. Note that IREN sets itself apart from other transitioning miners by focusing on operating its own GPUs, positioning as a cloud compute provider rather than colocation model.

Cipher’s AWS deal and new 1GW Texas campus drove a 22% jump in the stock, as investors welcomed the clear strategic direction and growing momentum behind its AI pivot. The company signed a 15-year agreement valued around $5.5 billion to provide roughly 300MW gross capacity for AWS’s AI workloads. Rent is set to begin in August 2026 as new facilities come online. Cipher also announced a joint venture to build a 1GW campus in West Texas, a well suited spot for HPC thanks to its scale, fiber diversity and dual grid connections.

Together, these deals illustrate how BTC miners are being drawn into the broader AI infrastructure buildout. Markets now recognize that miners are able to secure long-term hosting agreements with hyperscalers and can generate steadier, more predictable revenue than being subject to BTC hash prices. Core Scientific’s 12-year partnership with CoreWeave and TeraWulf’s recent 25-year deal with Google-backed Fluidstack highlight the same dynamic, each prompting strong market reactions when announced. Miners will likely continue evolving into key players in the HPC ecosystem, as the economics of AI hosting remain far more attractive than those of traditional bitcoin mining.

Solana’s tension: Network performance vs. value capture

Of the major crypto assets, SOL is the only one that is trading below its Oct. 10 liquidation wick low, with various Solana ecosystem tokens sitting at or near all-time lows. What can explain this relative weakness, and are there reasons to be optimistic?

Let’s start with institutional flows. The pace of purchases from Solana DATCOs has slowed considerably, with 1.92 million SOL purchased in October vs. 9.84 million SOL in September. The chart below shows that the five largest SOL DATCOs are all trading at a discount to outstanding mNAV as of Nov. 3, significantly tightening their financing conditions. FORD, the largest SOL DATCO with 6.28 million in token holdings (~$1 billion), is trading at a slight discount to mNAV (0.91x). However, peers are trading at mNAV ratios between 0.3x and 0.7x, introducing the risk that some of these DATCOs pursue a similar strategy to the one employed by ETHZilla, which sold approximately $40 million of its ETH treasury holdings to repurchase shares until its discount to mNAV is normalized.

Despite DATCO headwinds, ETF flows have surprised to the upside. The Bitwise SOL staking ETF (BSOL) began trading last Tuesday, seeing immediate success. BSOL led all crypto ETPs in weekly flows last week, with $417 million. As of Nov. 3, BSOL had $420 million in AUM, surpassing SSK’s $388 million less than a week after launching. In addition, the Grayscale Solana Trust ETF (GSOL) launched on Oct. 29, with $88 million in AUM as of Nov. 3.

Below, we see SOL ETF flows by issuer. Note that the chart excludes BSOL’s seed amount of $220 million and GSOL’s seed of ~$100 million.

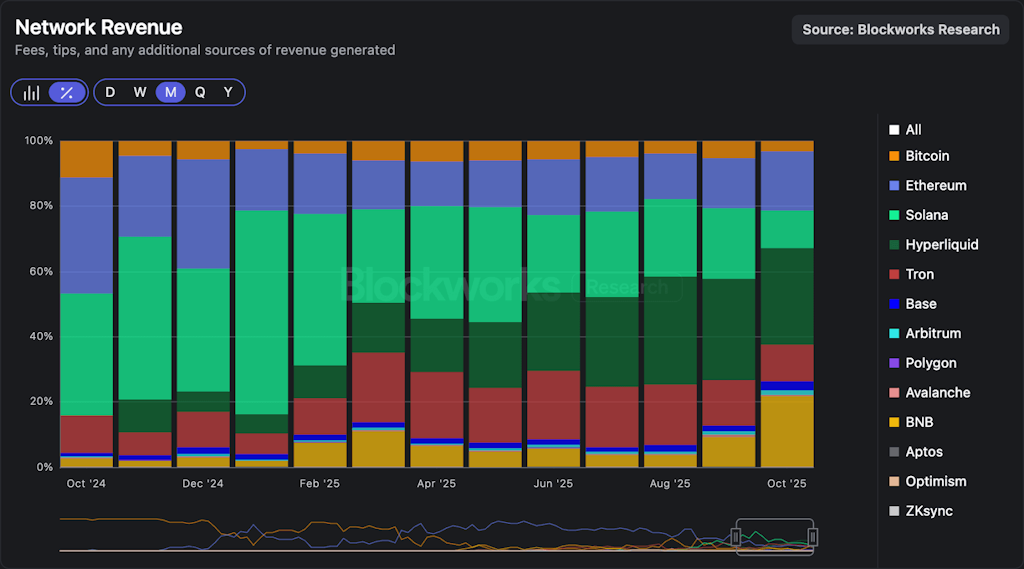

While institutional appetite is high, Solana’s underlying fundamentals are showing mixed signals. Starting with the negative, Solana’s Real Economic Value (REV) amounted to $41 million in October, the lowest figure since February 2024. Solana was the fourth-highest chain by revenue market share in October, ending a streak of twelve consecutive months as either first or second. The chart below shows that Hyperliquid was the leading chain by revenue ($105 million) last month, followed by BNB ($77 million) and Ethereum ($65 million).

Solana’s decreased value capture is especially evident when contrasted with application revenue on the chain, which has remained more resilient at $92 million, though still down significantly from the January highs. Notably, Pump accounted for 50% of total app revenue on the chain, with October marking the second consecutive month that Pump has surpassed Solana in monthly revenue, despite Pump being valued at under 2% of Solana’s market cap (5% if fully diluted). Of course, this is an apples-to-oranges comparison, but it does put into context the scale of Pump’s numbers as well as Solana’s sharp decline in value capture over the past year.

REV and token holder revenue falling to levels not seen since 2024 raises questions about the network’s ability to capture value. That said, decreased value capture is also a function of improved network performance, and users not overpaying for transaction inclusion. As an example, consider Solana’s performance during the Oct. 10 liquidation cascade.

While CEX performance was throttled on Oct. 10, particularly for perpetual futures, several onchain systems kept working as intended. Solana performed significantly better than Ethereum and the main L2s during this volatility event. The chart below compares Solana’s median fee to that of Ethereum, Arbitrum, and Base during Oct. 10 (UTC time). We observe that Solana’s median fees hovered around $0.0012, spiking to $0.0056 at peak volatility (5x), normalizing to pre-liquidation levels quickly.

On the other hand, Ethereum, Arbitrum, and Base saw exponentially larger spikes, with median fees remaining abnormally high for hours following the liquidation cascade:

- Base median fees spiked from $0.004 before the volatility event to $4.6 at peak (1,200x).

- Arbitrum median fees spiked from $0.01 before the volatility event to $117 at peak (12,000x).

- Ethereum median fees spiked from $0.34 before the volatility event to $220 at peak (650x).

TPS paints a similar picture. We see that Solana’s TPS was hovering around 1,000 before the volatility event, rising to a peak of 3,400 after and remaining elevated for the ensuing hours. On the other hand, we observe that both Arbitrum and Base had a significant spike (Arbitrum peaking at ~400 and Base at ~640), but TPS dropped to pre-liquidation levels in the span of one hour. Ethereum’s case is interesting, in that TPS actually decreased during the volatility event, suggesting that the network was facing significantly degraded performance.

So, while Solana’s value capture has definitely decreased, its network performance has improved dramatically, which at the end of the day benefits users and applications. The work done by Anza, Firedancer, Helius and other infrastructure providers has turned Solana into the most resilient decentralized network in production, which is especially evident and important during this type of stress test.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.