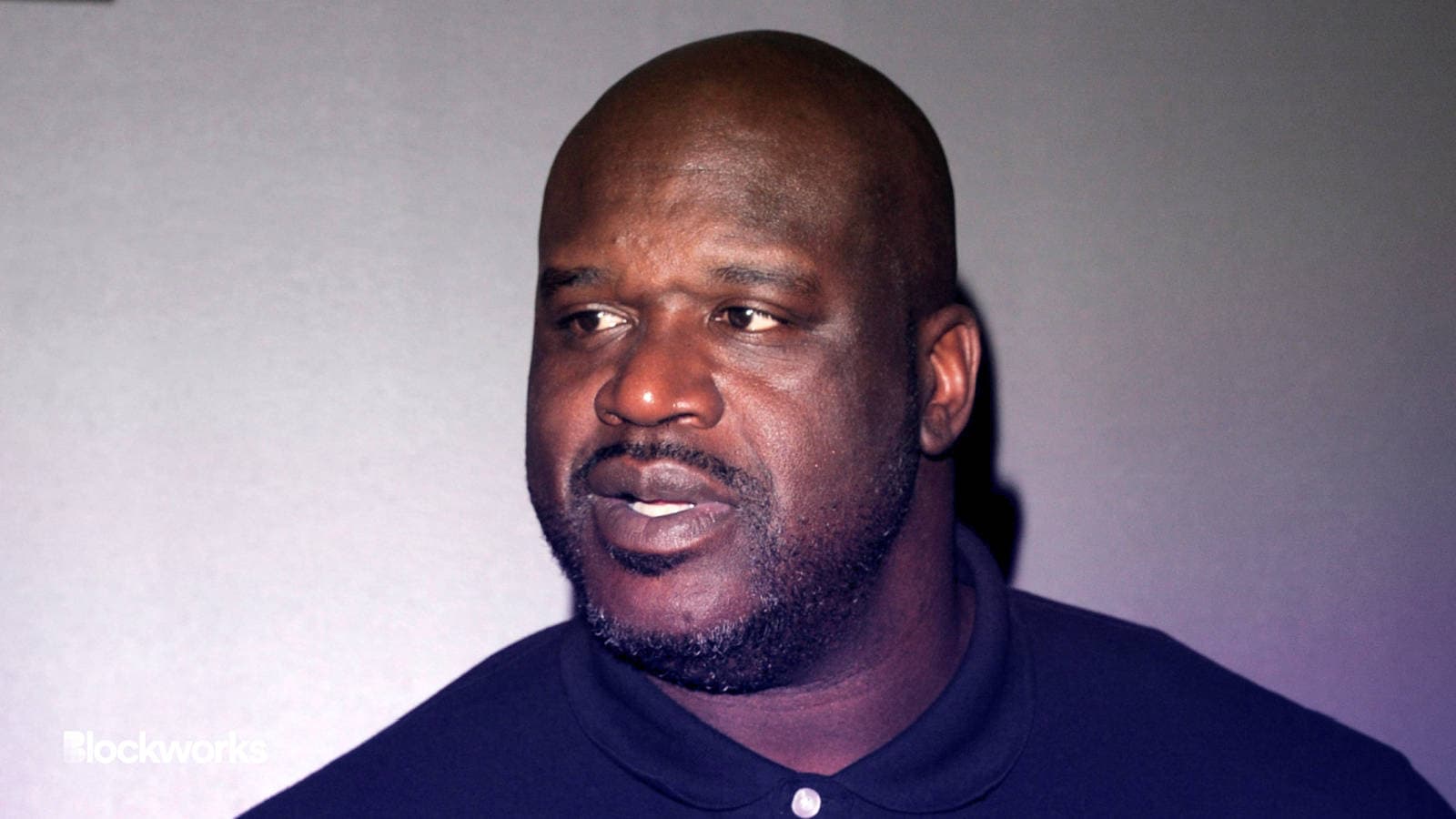

Shaquille O’Neal Served in FTX Case, Ending 3-Month ‘Sideshow’

NBA legend Shaquille O’Neal is said to be the only celebrity who avoided servers of the FTX endorsement lawsuit

Ron Adar/Shutterstock, modified by Blockworks

NBA Hall of Famer Shaquille O’Neal has finally been served by lawyers representing investors in a class-action lawsuit against FTX celebrity endorsers.

O’Neal was handed official legal documents outside his Texas residence at 4pm local time on Sunday. Adam Moskowitz, managing partner and class-action co-counsel at The Moskowitz Law Firm, confirmed the serving to Blockworks in an email.

“The good news is his home video cameras recorded our service and we made it very clear that he is not to destroy and/or erase any of these security tapes because they must be preserved for our lawsuit,” he said.

As of last week, O’Neal was the last remaining defendant named in the suit to be served. O’Neal joins Tom Brady, Larry David, Gisele Bündchen, Stephen Curry and Kevin O’Leary, among others.

The development ends a three-month hunt to serve the former basketball superstar over his role in endorsing the now-defunct crypto exchange FTX.

FTX pushed sweeping marketing campaigns, including Super Bowl ads, celebrity endorsements and naming rights to the Miami Heat’s arena. Some promotions reportedly promised investors greater returns than a typical deposit account.

The lawsuit was filed by a retail investor on behalf of other FTX users who’d been influenced to use the platform by celebrities. O’Neal’s “FTX: I Am All In” commercial, cited by Garrison, was created by New York advertising agency Dentsu McGarrybowen and global partnership firm Wasserman.

FTX filed for bankruptcy last November following an $8-billion wave of withdrawals, which quickly led to allegations of severe mismanagement and fraud. Former CEO Sam Bankman-Fried has pleaded not guilty to federal charges and awaits trial later this year, while close associates have struck plea deals to cooperate with the US government.

Lawyers had until Monday to hand over official legal documents to O’Neal after Judge Michael Moore, presiding, issued a deadline after denying a request to serve the celebrity via Twitter.

“We took Judge Moore’s instructions very seriously and are glad to finally end this silly sideshow,” Moskowitz said. Blockworks attempted to contact O’Neal via his philanthropy website but did not immediately receive a response.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.