SoftBank’s Vision Fund Fell $10B From Q1 to Q2 2021

SoftBank has continuously made headlines for its big investments in the crypto space through its Vision Fund.

- The company said it will spend up to $9 billion to buy back about 15% of its shares

- “We are in the middle of a blizzard,” SoftBank CEO Masayoshi Son said during a news conference

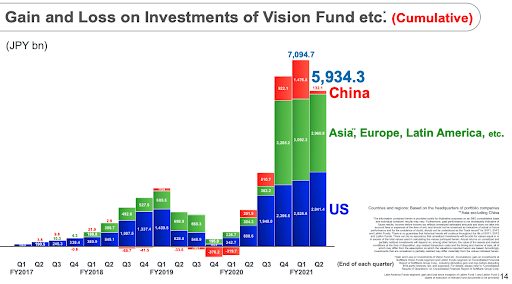

SoftBank Group Corp. showed its Vision Fund dropped about $10 billion during its first quarter to the second quarter of the fiscal year 2021, according to the company’s financial report during a six-month period ending on September 30, 2021.

The decline comes at a time when share prices in some of its portfolio companies also dropped and China’s increase in regulation on tech-based companies impacted its investments’ performance.

The company said it will spend up to $9 billion to buy back about 15% of its shares. The report is a signal that China’s corporate crackdown is affecting companies and investors alike.

Although the Japanese-based technology investor has business ties to China, SoftBank CEO Masayoshi Son said its China risk is “not so huge,” Wall Street Journal reported.

The SoftBank Vision Fund 1 focuses on medium- to long-term perspectives and large-scale investments for companies leveraging artificial intelligence (AI) while having a “unicorn” status, which is when the valuation is greater than $1 billion, it said in the report. Separately, Vision Fund 2 launched in October 2019 and aims to “facilitate the continued acceleration of the AI revolution through investment in market-leading, tech-enabled growth companies across vintage years,” it said.

Vision Fund changes quarterly measured in Japanese Yen (billions) Source: SoftBank

Vision Fund changes quarterly measured in Japanese Yen (billions) Source: SoftBank“We are in the middle of a blizzard,” Son said during a news conference. He mentioned he was “not proud” of this quarter’s reports on its Vision Fund and said the company would make future steps to double its “golden eggs,” or good investments, compared to last year.

SoftBank has continuously made headlines for its big investments in the crypto space through its Vision Funds. Most recently, the firm led a $93 million round for The Sandbox, an open NFT metaverse platform. In the past, it has led rounds ranging from $680 million for a NFT Soccer Platform Sorare to lower levels like $60 million for a blockchain analytics firm Elliptic.

Separately, earlier this month China state media reported that three of the country’s major technology giants signed a self-regulatory pledge to keep their growing NFT marketplaces away from cryptocurrencies. This news came at a time when Chinese regulators reinforced their position that bitcoin is without legal standing, but NFTs are allowed some room to operate, Blockworks previously reported.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.