Joe Biden To Sign Executive Order on Crypto This Week: Report

The US president will reportedly sign a long-anticipated executive order directed toward furthering crypto regulation in the country

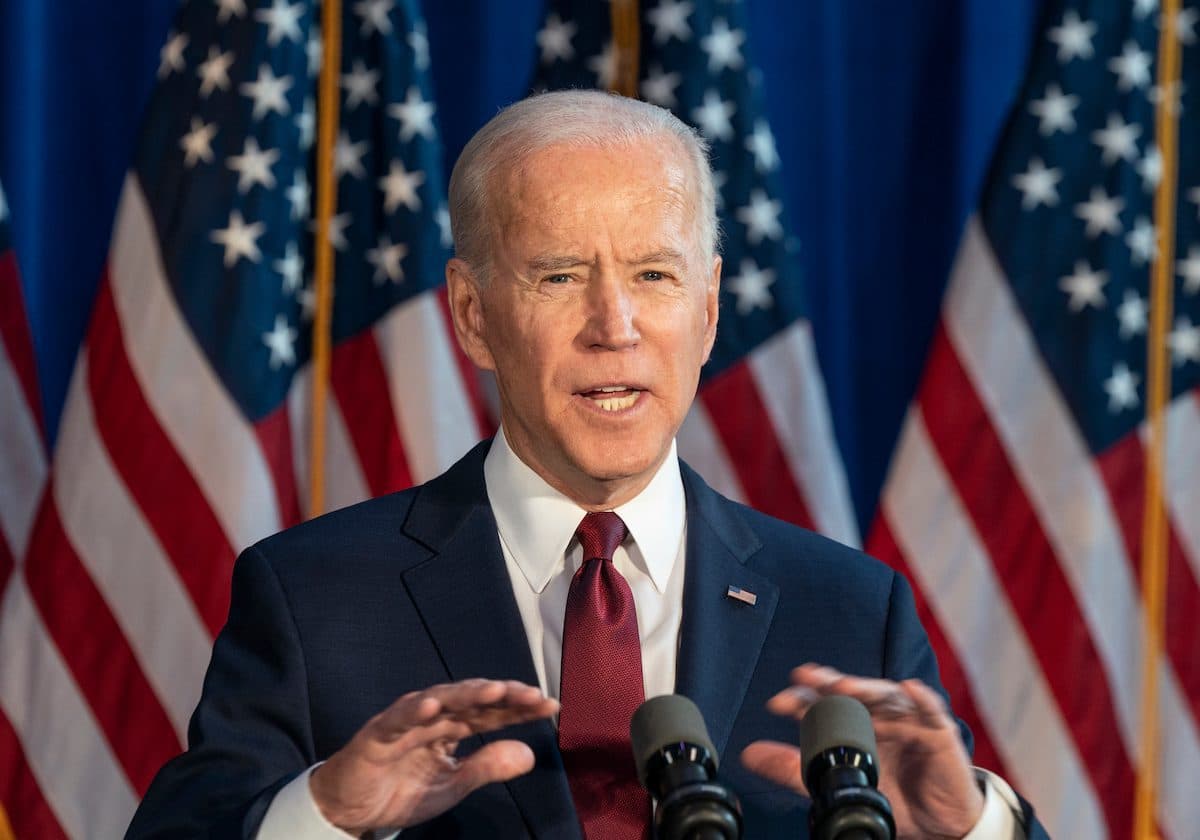

President Joe Biden | Source: Shutterstock

- While the order is not yet fully understood, it has been speculated that an individual authority will be given new regulatory oversight powers

- Crypto regulation in the US has slowly ratcheted up in recent years, with greater reporting requirements placed on exchanges

President Joe Biden is reportedly preparing to sign an executive order on cryptocurrency policy this week, according to a report by Reuters on Monday, which cited a person familiar with the matter.

The order, which may seek to appoint an individual with regulatory authority to oversee the crypto market, could come as early as Wednesday, per the report.

Jurisdiction of digital asset market oversight continues to burn in the minds of regulators eager to close the gap on what they perceive as trading activity occurring outside their remit.

Last month, Commodity Futures Trading Commission (CFTC) chair Rostin Behnam told a Senate committee hearing his agency wanted to be charged with regulating the crypto spot market.

During that hearing, Benham was asked whether a lead agency for regulating crypto should be established and said that his agency, along with the Securities and Exchange Commission, should share the responsibility.

It’s been speculated — particularly by Michael Fasanello, director of training and regulatory affairs at Blockchain Intelligence Group in January — that a new individual would be given oversight powers over multiple partner agencies.

Those agencies include the CFTC, the SEC, the Financial Crimes Enforcement Network and the Office of the Comptroller, according to Fasanello.

Some, though, including SEC Commissioner Hester Pierce, have said adding a new regulator to the mix in an already “fragmented regulatory system” for financial products should not be a top priority.

Crypto regulation in the US has slowly ratcheted up in recent years, with greater reporting requirements placed on exchanges as well as scrutiny of stablecoins, whose value is generally pegged to fiat currency or commodities.

Last year, the Treasury Department pushed out a requirement for individuals to report transactions in crypto exceeding $10,000 or more to the Internal Revenue Service.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.