Binance Establishes Presence in Tax-Friendly Ireland

Binance appears to have registered a regional subsidiary in-country as well as a holding company for its Asia operations.

Blockworks exclusive art by Axel Rangel

key takeaways

- Binance is no closer to declaring a home but has opened up shop in Ireland, according to local media reports

- Given Ireland’s competitive tax rates it’s an often-used hub for international business, and its regulators have taken an easy-going approach to crypto

Binance has registered a number of companies in Ireland as the world’s largest digital assets continues to search for a place to call home.

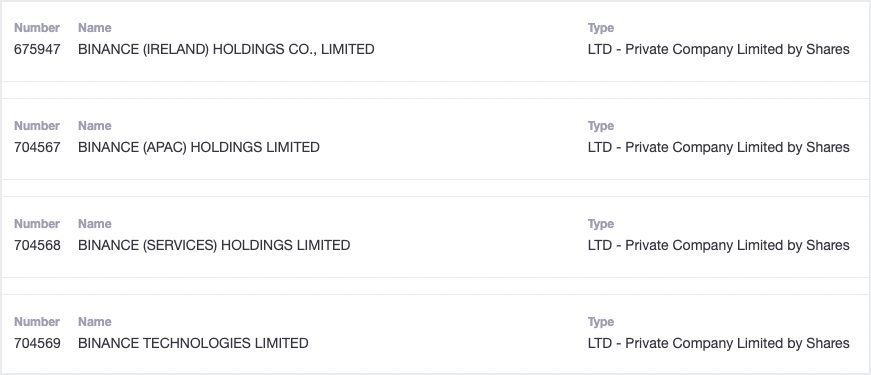

According to a report from The Independent, Binance has registered four companies in the country. One — Binance Ireland — appears to be established as a regional entity, while another, Binance APAC holdings, looks like a holding company for its Asia operations. Finally, Binance Technologies, is believed to be an entity to hold and license Binance’s IP as it’s in line with a similar structure in Singapore according to experts that have previously spoken to Blockworks.

Source: core.cro.ie

Source: core.cro.ie

As regulators take a sterner approach to dealing with digital assets, and laissez-faire loving Binance, its CEO Changpeng Zhao, has promised that Binance would find a permanent home as he said in a previous media interview that the company’s decentralized nature is something regulators often flag. In August, Zhao tweeted that the exchange was pivoting from “reactive compliance to proactive compliance.”

Many assumed this new home would be Singapore, given the city-state’s relatively crypto-friendly regulator and key hires the exchange has made in-country. However, that might not come to fruition as Binance has found itself in a tussle with the Monetary Authority of Singapore and has agreed to block access to its main platform and direct them to a slimmed down version that only lists a handful of tokens. Binance has a similar approach in other regions where it wants to stay on the good side of regulators.

Why Ireland?

While Ireland isn’t often thought of as a crypto hub, legal experts have written before that the country is a relatively crypto-friendly jurisdiction with its lack of specific crypto regulation and low tax rates.

“There is no specific virtual currency regulation in Ireland, and regulators have yet to indicate the extent to which existing securities regulation will apply to virtual currencies,” wrote Arthur Cox LLP, a Dublin-based law firm, in a September 2021 paper reviewing digital asset laws in Ireland. The country has chosen to take a hands-off approach to virtual tokens such as ICOs, which might be a sigh of relief for Binance when determining if its BNB token is a security.

Ireland’s competitive tax rate, and lack of taxation for non-Irish sourced income, likely also plays a role in Binance’s decision to set up a company on the island. Under Ireland’s “knowledge development box” scheme, IP held by an Irish company is only subject to a 6.25% tax rate.

Binance’s BNB token appears to be unaffected by the news, and is up 0.5% on-day, according to CoinGecko.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.