Coinbase Plans to Launch NFT Marketplace

Coinbase NFT allows users to mint, purchase, showcase and discover non-fungible tokens on the soon-to-be marketplace, according to the company’s blog post.

- All NFTs will run on-chain via Ethereum-based ERC-721 and ERC-1155 standards but the company has plans for multi-chain support in the future

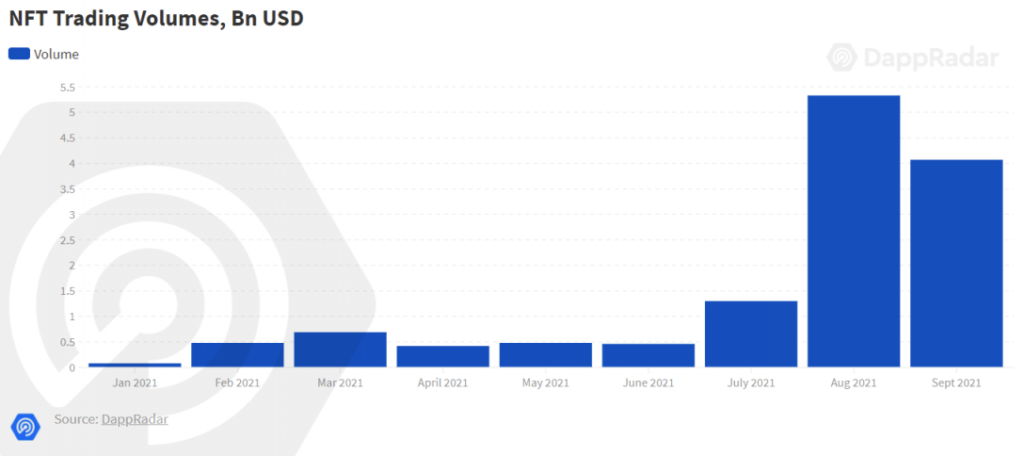

- The NFT space generated $10.67 billion in trading volume during Q3, an increase of 704% from the quarter prior

Coinbase announced the upcoming launch of a non-fungible token (NFT) marketplace on Tuesday.

Dubbed ‘Coinbase NFT’, the soon-to-be product offering allows users to purchase, mint, showcase and discover the crypto assets on a peer-to-peer marketplace, according to the company. Additionally, users can join a waitlist for early access to the offering.

Coinbase NFT will have “social features that open new avenues for conversation and discovery” and an “intuitive design built on top of a decentralized marketplace,” according to the company’s new marketplace web page.

“Coinbase NFT will help creators, collectors, and fans build community, which aligns with Coinbase’s mission of increasing economic freedom and bringing crypto to more people, in new, exciting and accessible ways,” a spokesperson for the publicly-traded company told Blockworks.

A mock-up of the Coinbase NFT marketplace; Source: Coinbase

A mock-up of the Coinbase NFT marketplace; Source: CoinbaseAll NFTs will run on-chain via Ethereum-based ERC-721 and ERC-1155 standards. However, the company has plans for multi-chain support in the future.

“In the same way we helped people access Bitcoin for the first time in a trusted, easy way — we need to do the same for the decentralized cryptoeconomy,” the spokesperson added. “There is so much cool innovation happening in crypto — and we want to bring that to our customers.”

The exchange’s announcement comes following a slew of regulatory news around Coinbase, including previous threats of legal actions from the US Securities and Exchange Commission (SEC), putting its lending program on hold, and most recently word of a forthcoming regulatory proposal.

Elsewhere and on his own accord, Coinbase CEO Brian Armstrong previously released a collection of electronic music NFTs with DJ DAVI in April. Later, the collection was put up for bid on Zora.

“There’s a lot of NFT praise happening right now,” Armstrong said in a previous interview with CNBC. “Generally, I am a fan of NFTs. It’s really cool that it’s making it possible for artists to get paid. It’s making it possible for artists to have a direct relationship with their fans (as well).”

As Coinbase adjusts to potential regulatory scrutiny, NFTs continue to rake in gargantuan amounts of cash across the board, according to a Dapp Industry Report in early-October. The NFT space generated roughly $10.67 billion in trading volume during Q3, an increase of 704% from the quarter before.

“NFTs will become a trillion dollar asset class by the end of the year,” Jenny DAO’s Jae Chung recently said at the Messari Mainnet event in September.

Coinbase (COIN) is trading at $247.33 per share down -3.57% at time of publication.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.