Core Scientific Stock Price Plummets 70% as It Considers Bankruptcy

The crypto miner’s board has decided to skip upcoming payments and hire advisers to evaluate the company’s options

Source: Shutterstock

key takeaways

- Core Scientific’s existing cash resources will be depleted by the end of 2022 or sooner, according to a company filing

- Research analysts expect the miner’s creditors could agree to restructure the debt, but noted the possibility of bankruptcy “should be taken seriously”

Core Scientific has decided to skip upcoming payments as it faces liquidity and operational issues, and has hired advisers as it considers restructuring its capital structure or seeking relief through bankruptcy.

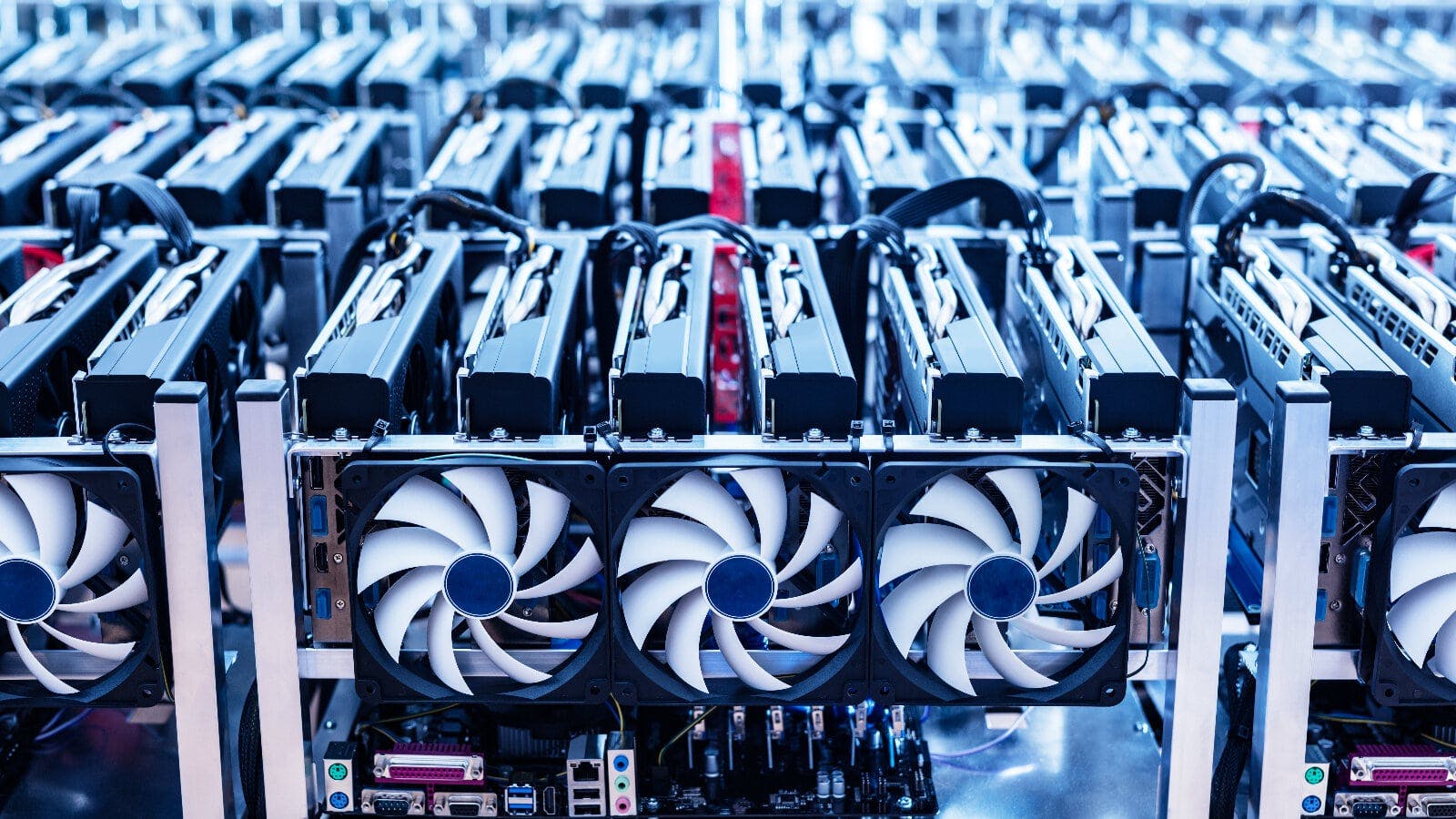

The crypto miner’s operating performance and liquidity has been “severely impacted” by the lower bitcoin price, litigation with bankrupt crypto lender Celsius Network and the increases in electricity costs and global bitcoin hash rate — and therefore mining difficulty — the company noted in a Wednesday filing.

“The board has decided that the company will not make payments coming due in late October and early November 2022 with respect to several of its equipment and other financings, including its two bridge promissory notes,” the filing states.

The creditors under these debt facilities could elect to accelerate the principal amount of such debt, sue the company for nonpayment or take action with respect to collateral, it adds. Such actions could lead to default of the company’s other debt agreements, including its two series of convertible notes due in 2025.

Core Scientific has hired Weil, Gotshal & Manges LLP and PJT Partners as advisers. In addition to seeking ways to raise additional capital or restructure its existing capital structure, Core Scientific “could seek relief under the applicable bankruptcy or insolvency laws,” the filing says.

The company’s stock price was down about 68% on the day, as of 10 am ET.

Compass Point Research & Trading Analysts Chase White and Joe Flynn said in a Thursday research note that it’s hard to predict at this point whether the company will need to file for bankruptcy.

“Given a large portion of its existing debt is equipment financing backed by mining rigs, we believe there’s a good chance [Core Scientific’s] creditors agree to restructure the debt in order to not have to take possession of the rigs, especially in the current market where rig prices have fallen 60%-plus from 2021 highs,” the analysts said.

Still, White and Flynn added, a scenario where the company has to file for bankruptcy should be taken seriously, especially if bitcoin prices decline further.

The price of bitcoin stood at roughly $20,600 Thursday morning, down roughly 70% from the asset’s all-time high reached last November, but up 13% from its Oct. 13 low of $18,160.

The filing comes after Core Scientific revealed earlier this month that it produced 1,213 bitcoins in September despite severe weather events and electrical equipment manufacturer defects. It expanded its fleet to roughly 232,000 servers, representing about 22.5 exahashes per second (EH/s).

Though Core Scientific held 1,051 bitcoins and roughly $29.5 million in cash, as of Sept. 30, the Wednesday filing notes that it had 24 bitcoins and about $26.6 million in cash, indicating it sold between about $18 million and $20 million worth of BTC in October.

The company said in the filing it anticipates that existing cash resources will be depleted by the end of 2022 or sooner, adding that it is difficult to predict when bitcoin prices could recover or energy costs could abate.

“Given the uncertainty regarding the Company’s financial condition, substantial doubt exists about the company’s ability to continue as a going concern for a reasonable period of time,” the filing states.

A Core Scientific spokesperson did not immediately return a request for comment.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.