Crypto Conference in India Highlights Building for Next Bull Market

Blockworks joined crypto developers, Web3 venture capitalists and aspiring entrepreneurs caught up in Bengaluru at an event hosted by CoinDCX

Source: Shalini Nagarajan

- Local Web3 developers are raring to go, and are keen to expand the country’s innovations

- 64% of Buidlers Tribe Demo Day applicants were building on Polygon, 35% on Ethereum and 17% on Solana

More than 500 people came together to attend a crypto conference in tech hub Bengaluru, India, on Friday.

Unfold 2022, billed as India’s premier Web3 event, saw industry leaders, budding entrepreneurs, venture capitalists and developers meet at one of the city’s upscale hotels, Sheraton Grand in Whitefield.

The event was primarily aimed at inspiring and encouraging crypto developers, the key focus area of the conference’s hosting company CoinDCX.

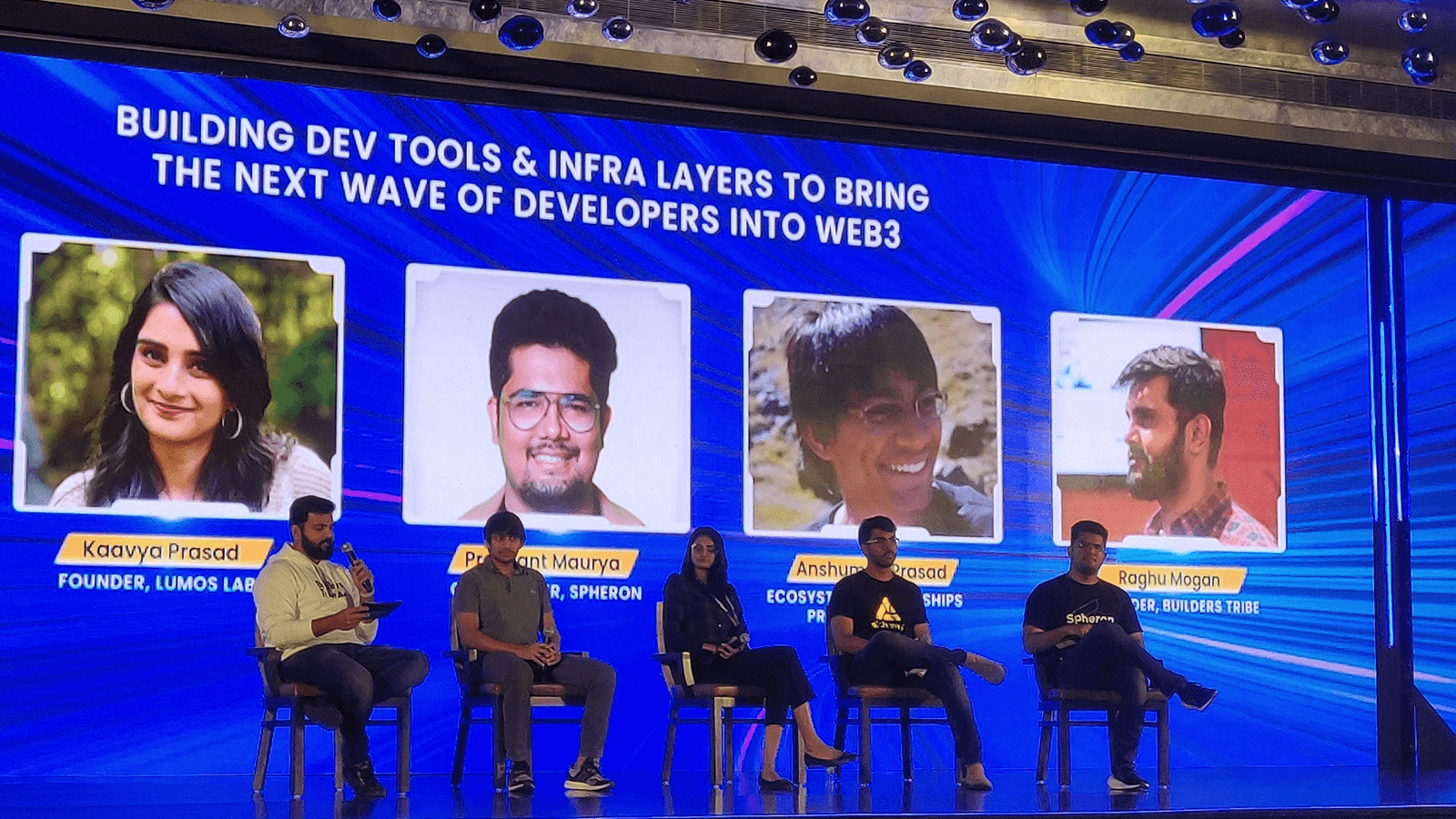

It included panel discussions focused on blockchain development tools, the current challenges Web2 developers face, the future of play-to-earn gaming, new ways of engagement for non-fungible tokens and a hackathon.

CoinDCX CEO Sumit Gupta expressed bullishness on India’s trajectory in the industry despite a tough regulatory environment. The country’s central bank still appears to be hostile toward the asset class, and local government authorities and tax sleuths have recently turned up the heat on crypto exchanges.

Yet, Gupta projected India is on track to count the largest number of Web3 developers, which could lead to a growth spurt in the industry’s startups.

“India hopefully will create more Web3 unicorns than in the last five to 10 years,” he said.

Angel investor Balaji Srinivasan, former chief technology officer at Coinbase, appeared virtually to discuss how a community of individuals connected online can establish formal statehood using on-chain consensus. “We can start new cities, even new countries,” he said, a reference to the thesis of his recently-published book “The Network State” which can be freely read online.

Other panels at the conference catered to developers looking for direction at a time when industry sentiment is low. The mostly-young crowd there remained largely unfazed by the recent slump in crypto prices, and it seemed everyone agreed now is the time to build.

The networking spaces were lively, with attendants from all over India flying down to the southern city to catch up on developments in the space.

Representatives of Web3 native incubator Buidlers Tribe, one of the event organizers, were present at the event to help aspiring crypto entrepreneurs with their ideas.

Buidlers Tribe’s CEO Pareen Lathia shared that 64% of the Demo Day applicants were building on Polygon, 35% on Ethereum and 17% on Solana. He said the incubator is on the lookout not specifically for ideas, but for persistently passionate go-getters.

“Web3 is so dynamic that people are shifting ideas even after Series A [fundraises]. People are not betting on ideas, but founders,” Lathia said, adding that the incubator program isn’t interested in short-term plays or cash grabs.

In a panel about the next wave of Web3 developers, Lumos Labs founder Kaavya Prasad said India generates over a million engineers annually, but most don’t produce quality products.

“The West is ahead in terms of innovation,” she said, adding that India is just scratching the surface. “But we’re not far from the West in terms of innovation in the next five years.”

Overall, the scene demonstrated immense confidence in India’s crypto startup community and a drive to keep the Web3 revolution going.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.