Crypto Miner Core Scientific Downsizing After $840M Impairment Charge

The miner is cutting 10% of its workforce but expects to expand self-mining fleet by 36% in 2022

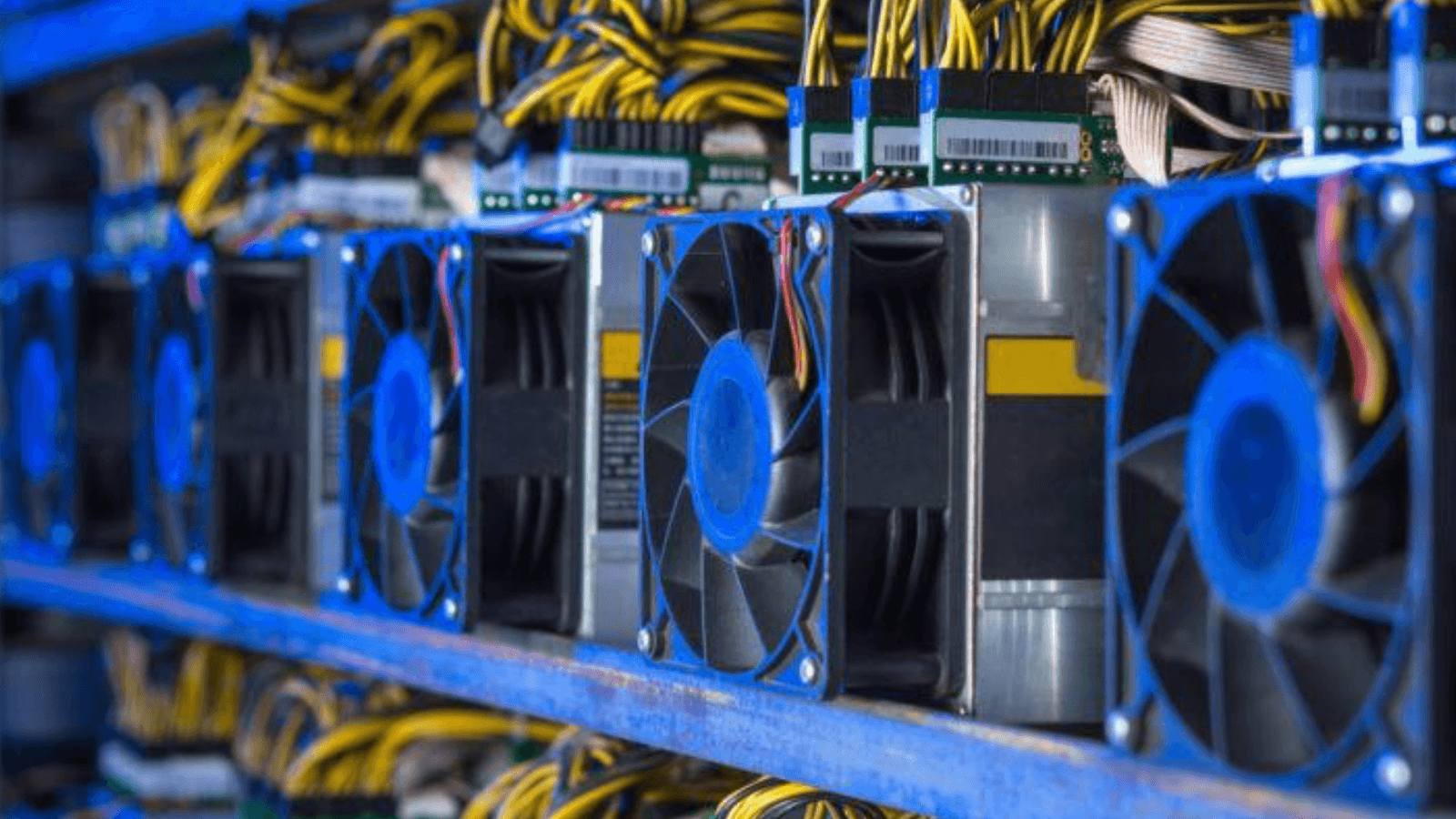

Bitcoin mining farm | Source: Shutterstock

- Produced 3,365 bitcoin in the quarter, a 4% drop from the prior quarter

- Shares of CORZ have clawed back some of the year’s losses over the past month

Core Scientific (CORZ) reduced its headcount by 10% in the second quarter as part of cost-cutting measures to deal with market turmoil, the cryptocurrency miner announced on Thursday.

The company posted a quarterly net loss of $861.7 million, including an $840 million charge driven by a revaluation of assets and a $150.2 million charge due to declines in digital asset prices.

“To date, we have eliminated approximately 10% of our workforce — none of whom are involved in our data center activities,” CEO Mike Levitt said during the quarterly earnings call.

The job cuts were not part of the miner’s core business, according to CFO Denise Sterling.

Aside from layoffs, the miner said it ceased its blockchain technology development business, renegotiated vendor contracts and resized its organization. The company expects operating expenses in the second half of the year to be 25% lower in comparison to the first half.

Revenue for the quarter rose to $164 million, from $75.3 million at the same time last year, beating average analyst estimates of $161.8 million, according to FactSet. That jump was “driven primarily by increases in digital asset mining revenue and hosting revenue,” the company said.

Core Scientific currently operates 125,000 self-mining servers — miners owned by third-parties but hosted by Core. By the end of the year, it expects 170,000 servers to be operative and eventually wants to expand its self-mining fleet beyond that number.

Bitcoin Miner Output and Outlook

The company produced 3,365 bitcoins in the quarter, representing a 4% drop from the previous quarter. It said current mining output averages 40 bitcoins per day, with a record 45.7 bitcoins in a single day this week.

Last month, Core sold more bitcoin than it produced to pay for capital investments and maintain liquidity. It also struck a $100 million equity financing deal with investment firm B. Riley Principal Capital amid the market downturn that weighed on miners’ balance sheets.

The miner holds 1,959 bitcoin and a cash balance of $128 million on its balance sheet at the end of June 30.

Crypto industry insiders expected to see a risk of miner defaults across both public and private miners as well as hosting facilities, although those risks have eased slightly with a modest recovery in bitcoin’s price. Bitcoin last traded at $23,937, up nearly 24% in the last month, data from Blockworks Research shows.

In the first quarter, Core lowered its total hashrate outlook to between 30 and 32 exahash per second, with a total power of about 1 gigawatt.

Hashrate, or the total computational power used to process transactions, is a key metric for bitcoin miners as it indicates how fast one miner’s machines work in competition with another. Core reiterated the same hashrate guidance for the remainder of the year.

Rival miner Marathon Digital posted a quarterly net loss of about $192 million, with its bitcoin production down 44% from the previous quarter.

Core’s shares are down 70.6% so far this year, but have recovered losses in the past month. They last traded at $3.24 per share in Friday’s pre-market session, data from TradingView shows.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.