Dapper Labs Backer Animoca Scores $65M to Further Invest in the Metaverse

Hong Kong-based Animoca Brands, was an early investor in blue chip NFT projects such as Dapper Labs, OpenSea and Axie Infinity developer Sky Mavis.

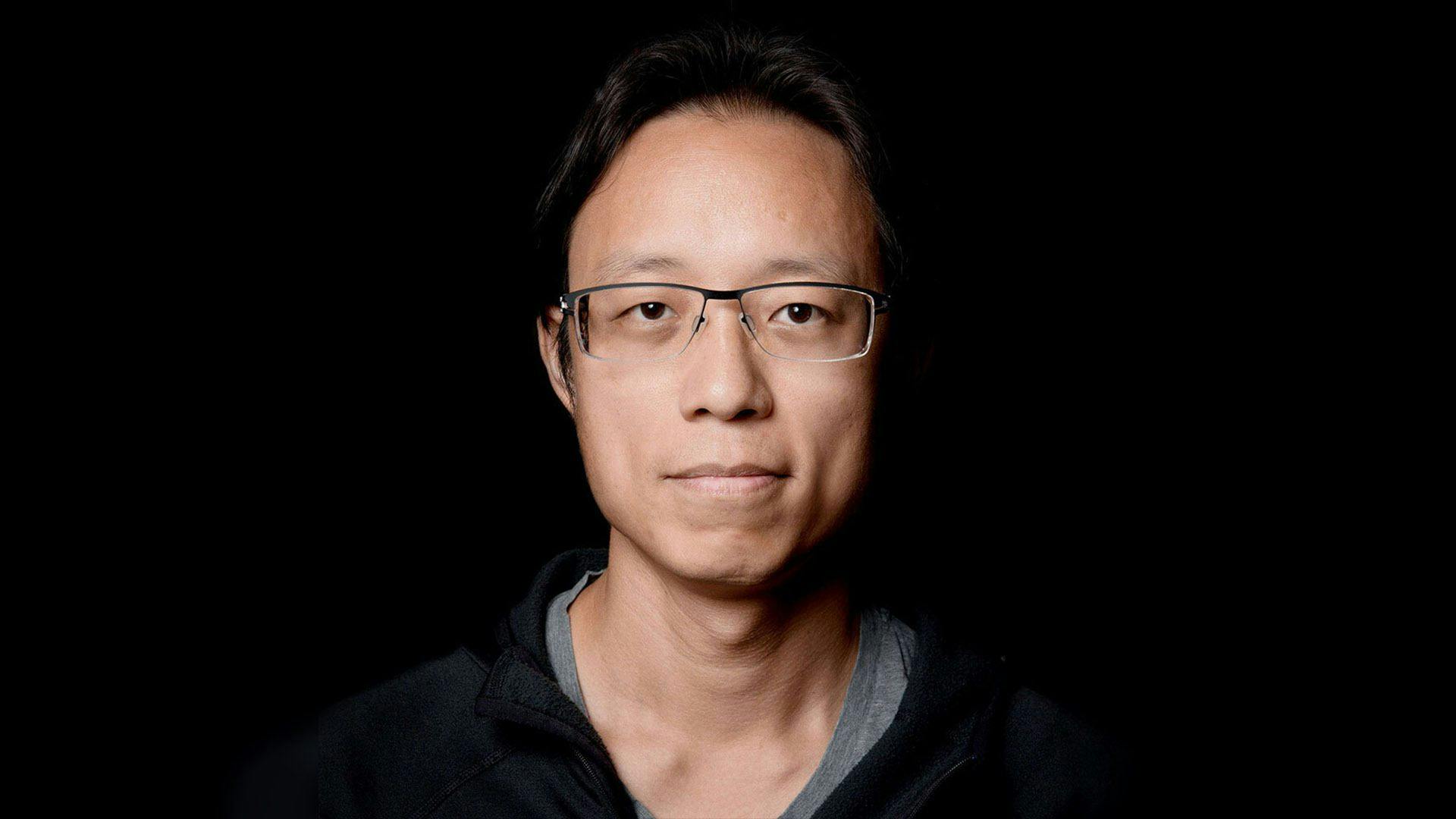

Yat Siu

Co-founder, executive chairman, and managing director of Animoca Brands; Source: Animoca

- Animoca previously raised roughly $139 million back in July, doubling its valuation in less than six months

- Investors in the most recent capital raise include 10T Holdings, Dragonfly Capital and Ubisoft Entertainment

Animoca Brands, a metaverse proponent and early investor of decentralized gaming, raised a whopping $65 million in funding, the company announced on Wednesday. The Hong Kong-based firm said in a press release that the capital will go toward “strategic investments, product development and licenses for popular intellectual properties.”

The company was an early investor in blue chip NFT projects such as OpenSea, Dapper Labs and Axie Infinity developer Sky Mavis.

“In 2018 we laid out a strategy based on our assessment that in the future digital property rights would revolutionize industries by expanding financial inclusion, and that this significant change would start with NFT adoption in games,” Yat Siu, Co-founder of Animoca Brands, said. “That future is already here.”

The Animoca Brands team in Hong Kong

The Animoca Brands team in Hong Kong

Investors in the round include 10T Holdings, Dragonfly Capital, Liberty City Ventures, Ubisoft Entertainment, Sequoia China, Com2uS, Kingsway Capital, MSA Capital and others. Previously, Animoca pulled in a $139 million funding round in July, doubling its valuation to $2.2 billion since.

“Animoca Brands will continue to advance blockchain in gaming — and beyond — to introduce billions of gamers and internet users to true digital ownership,” Siu added.

The funding news comes as money continues to pour into NFT-investing platforms.

Galaxy Interactive, an affiliate of Galaxy Digital, raised $325 million for its venture capital fund dedicated to interactive gaming and NFTs on Tuesday. Dapper Labs and Axie Infinity developer Sky Mavis landed a combined $402 million in capital since September as well.

MSA Capital, a participant in Animoca’s funding round, said that “crypto not only provides novel in-game monetization but also precipitates new systems for digital rights, begetting NFTs and metaverses,” a spokesperson added.

This story was updated on October 21, 2021, at 9:43 am ET. A previous version of the article misreported the funding amount at $85 million.