Digital Assets Diverge from Stock Market

“Fragility is the quality of things that are vulnerable to volatility.” – Nassim Taleb One of my market mantras is that derivative traders are the smartest people in the room. If you’ve ever met anyone at Susquehanna (SIG), you know what […]

source: SHutterstock

“Fragility is the quality of things that are vulnerable to volatility.”

– Nassim Taleb

One of my market mantras is that derivative traders are the smartest people in the room. If you’ve ever met anyone at Susquehanna (SIG), you know what I’m talking about. Almost every person went to MIT or dropped out of school because they were already taking calculus in the 3rd grade.

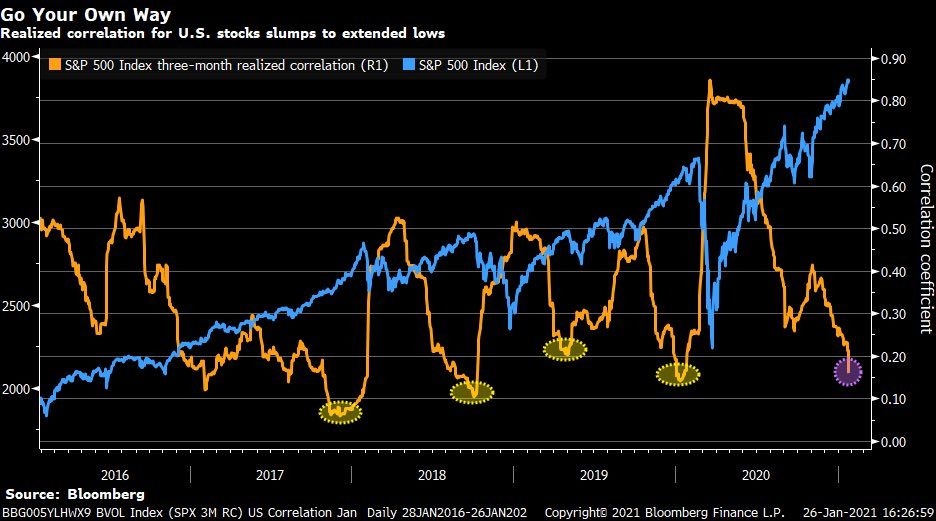

One of the things these derivatives traders keep front and center is realized correlations (or implied correlations). Today, I’m going to attempt to give a liberal arts explanation of realized correlation. [Pictured Below, Bloomberg, Liz Ann Sonders]

When realized correlations of stocks are low, there is a wide distribution of performance for each stock. Each stock is behaving in its own idiosyncratic manner.

In a correlated environment, every stock is moving up or down with each other in lockstep. In a non-correlated environment, every stock is moving up or down completely independently from one another.

This dispersion can be great for single stock pickers or retail traders. It is a sign there are many different incentives colliding in a marketplace with a wider holder base. Stocks tend to have their own sort of personality in this environment.

However, this is extremely frustrating when you run a large leveraged market neutral long/short hedge fund. These funds like dispersion in the performance of stocks, but only smaller ones that they can take advantage of.

They like to play chess with small strategic moves and then use leverage to juice their returns. When you throw a massive amount of retail trader flow and human emotion into the game, it messes up their entire business model. Their models can’t quantify emotion. On top of that, they can’t quantify emotion and leverage from retail.

For the past decade, retail traders were largely absent from the market. Now they are coming back, and their resurgence is hurting market neutral hedge fund performance.

I think we are likely going to see a deleveraging here in the public equity markets on account of these hedge funds getting killed. They need to wait out the retail investor madness at this point.

Get Back To Realized Correlations Already

As hedge funds de-lever, they cover their short book and sell their longs. This is part of the reason the WallStreetBets crowd thinks they are so smart. They’ve squeezed out a lot of the short books.

The problem now becomes, there will be no short cover bid when these stocks reverse. That is when the realized correlations start rising and the VIX starts moving higher.

As the VIX pops up, that causes more funds to de-lever and then comes the outflows from passive funds into a dearth of buyers. The only one left to hold the bag might be the Fed.

We are starting to see this today! Next, we’ll likely see an inversion in the front month VIX contract vs. 3 month contract to signal the near-term bottom. This happens when the near term fear is much larger than the fear of the future.

A Massive Divergence

What is particularly incredible is that digital assets are outperforming in the face of the SPX weakness today. Yes, this is the moment we’ve all been waiting for!

If this divergence keeps up, it is probably telling us that some sort of baton has been passed off in the asset management world.

What lies ahead could be one of the most powerful rotations into an asset class we’ve ever seen.

I am by no means confident in this, but my antennae are up… Crypto, you have my attention!

This take comes from our Daily Newsletter. Get premium market insights every evening at 7 PM EST. Sign up now.