Digital Dollar Project Readies Five Pilots

The Fed is one of several central banks around the world considering creating a CBDC, or central bank digital currency. The central banks of China, Europe and England already have plans in place to move forward with theirs.

Chris Giancarlo, former CFTC chairman, and Digital Dollar Project head; Source: ANDY DAVIS FOR THE WSJ

key takeaways

- Five pilot programs will create data to aid in the design of a Fed-issued digital currency

- Projects are a private sector effort by the Digital Dollar Foundation

The Digital Dollar Project is launching five pilot programs this year in order to collect data that can aid in the design of a US Federal Reserve-issued digital dollar.

These five projects are a private sector effort from the Digital Dollar Foundation, which is led by former US Commodity Futures Trading Commission chairman Chris Giancarlo, in collaboration with Accenture, which is providing the initial funding for the pilots. The Digital Dollar Project is meant to be a neutral platform through which to explore the future of US currency.

A global movement

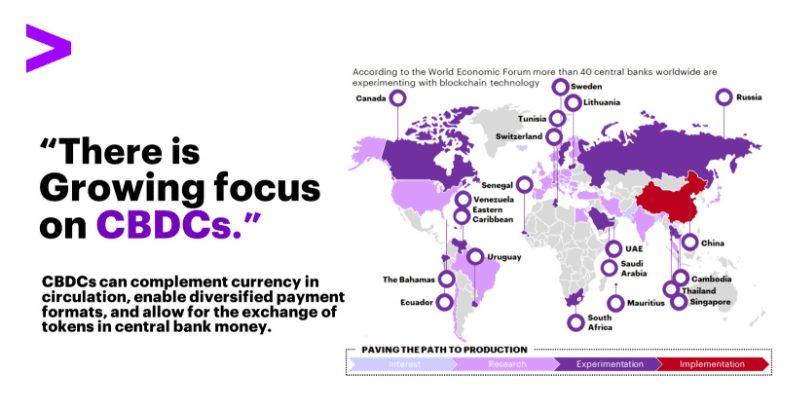

The Fed is one of several central banks around the world considering a central bank digital currency (CBDC). The central banks of China, Europe and England are already moving forward with theirs. Currently, China is working to create and deploy its digital yuan, which signaled the beginning of a potential global digital money war against the dollar.

Source: Accenture

Source: Accenture

Fed chair Jerome Powell has repeatedly said that while the central bank is doing research on a potential digital dollar, it’s more important that the US do it right rather than hurry to do it first.

Still, the US, “does need to be a leader in setting standards for the digital future of money,” Giancarlo said in a Monday press release. “We need to better understand how to balance the complex issues of a CBDC and how to incorporate key societal values, like privacy rights, financial inclusion and rule of law.”

Digital dollar developments

CBDCs are digital representations of a fiat currency that are centralized (unlike bitcoin, which is decentralized) and regulated by a country’s monetary authority.

CBDCs have been a hot topic among central banks since the introduction of the Facebook-proposed stablecoin project Diem three years ago. Many lawmakers viewed Diem as a threat to the US dollar and sovereign currencies globally. The Diem project plans to launch its digital currency pilot later this year.

The Digital Dollar Project will announce its first three pilots within the next two months. The five pilots are meant to complement other research on digital dollars already being conducted by the Federal Reserve Bank of Boston and the Massachusetts Institute of Technology. The Project plans to make its test ground transparent and accessible to all public and private stakeholders.