Markets on Alert as Evergrande Ordered to Demolish 39 Buildings on World’s Largest Artificial Island

Trading of Evergrande shares was halted on Monday, but both digital asset and stock markets are shrugging off the news

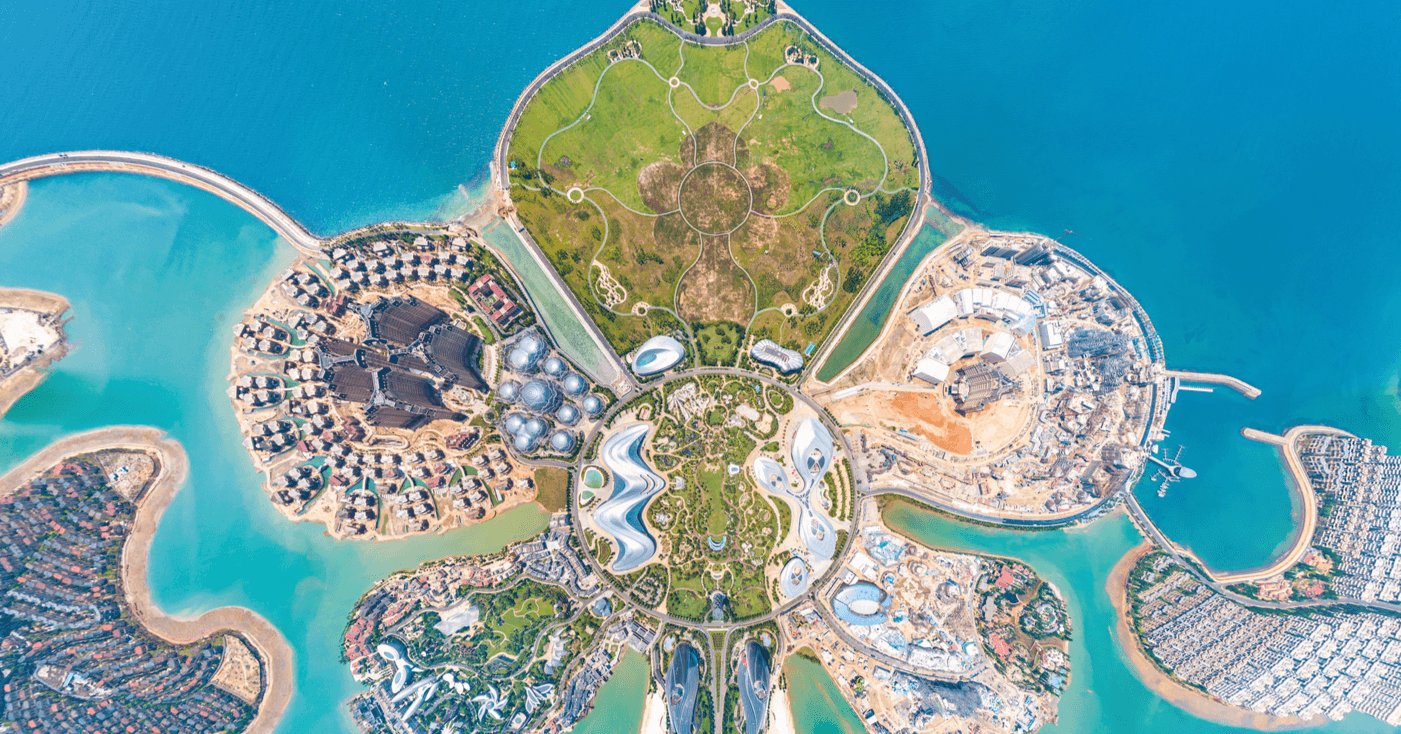

Ocean Flower Island; Source: Shutterstock

- An illegally obtained building permit was revoked and the company was ordered to demolish the 39 buildings within 10 days

- Evergrande missed bond payments equivalent to $255 million that came due on Dec. 28, but it has a 30 day grace period

In the latest setback for debt-ridden Chinese real estate giant Evergrande, an administrative ruling in Danzhou City, Hainan Province, will force the company to demolish 39 buildings under construction on Haihua Island — the world’s largest artificial island — according to local Chinese media.

Evergrande’s woes have frequently been correlated with drops in stocks and digital asset markets, particularly in September.

Last month, Fitch Ratings downgraded the Chinese real estate developer to ‘Restricted Default’ after the grace period on bond payments, previously due, expired. Evergrande missed a further $255 million in coupon payments last week, Reuters reported, starting the clock on a new 30-day window before triggering a further default.

Shares traded sharply lower on the news and closed out December in Hong Kong trading at $1.59, for a loss of roughly -89% on the year.

On Monday, the company requested shares to be halted pending the release of inside information, while an index of Chinese developer shares fell 1.7%, Bloomberg notes, although the company did not link the halt specifically to the demolition news.

Chinese Media reports that the Danzhou Comprehensive Administrative Law Enforcement Bureau issued the decision on Dec. 30, which was confirmed on Jan. 1, and requires Danzhou Xinheng Tourism Development Co., Ltd., an Evergrande subsidiary, to demolish the 39 buildings located in the bay area of Danzhou City.

The buildings occupy about 435,000 square meters on Haihua Island No. 2, but their planning permit was illegally obtained, according to the new order.

The development was a pet project of chairman Xu Jiayin, who told employees in a New Year’s speech that he was proud of their efforts in recent months despite the unprecedented financial challenges.

Unlike previous bouts of grim Evergrande news, markets in Europe, as well as S&P futures, show no adverse reaction in Monday trading as of 7:45 AM ET.

Major equities markets alongside the largest digital asset names started the day flat or modestly higher, but faded as US markets opened in New York, kicking off a seasonally strong month for stocks.

This story was updated on Jan. 3, 2022, at 9:15 AM ET.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.