Grayscale Bitcoin Trust Premium Hits All Time Low

Blame Canada. That might be the tune Michael Sonnenshein and Barry Silbert are humming in the office this week as the Grayscale Bitcoin Trust premium dips well into the negative, hitting nearly -12%, as two Toronto-listed ETFs sap up capital inflow […]

Source: Shutterstock

key takeaways

- Plethora of investor-accessible vehicles for bitcoin exposure has created a drop in fund inflows for GBTC, pushing its premium deep into negative territory

- Bloomberg analyst believes this might create a fresh run, but it comes with implications for the broader market

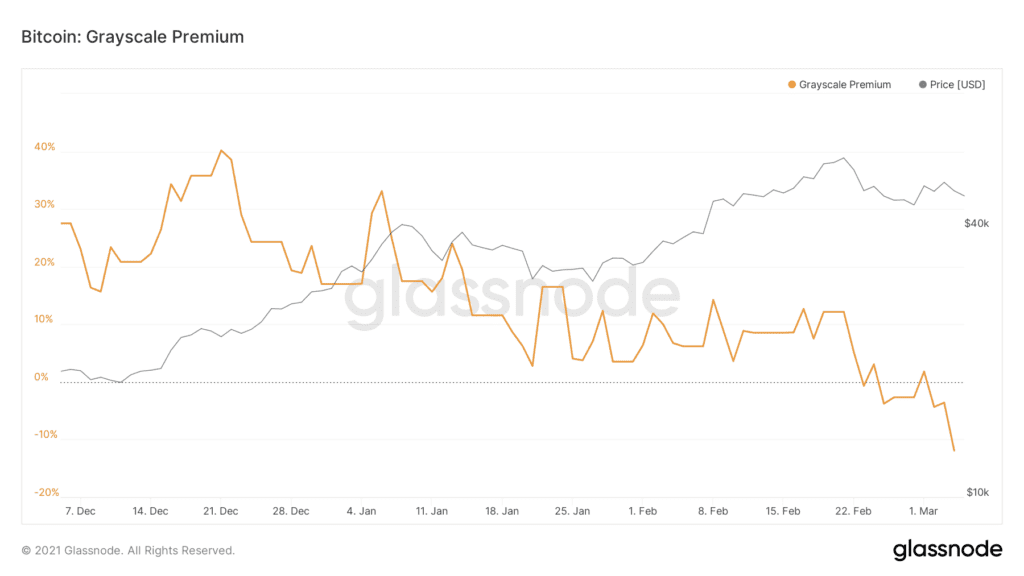

Blame Canada. That might be the tune Michael Sonnenshein and Barry Silbert are humming in the office this week as the Grayscale Bitcoin Trust premium dips well into the negative, hitting nearly -12%, as two Toronto-listed ETFs sap up capital inflow that would once be headed towards Grayscale.

According to data from Glassnode, fund inflows to GBTC were down by 85%. Glassnode shows that in February the fund took in 6,599.9 BTC compared to 41,568 BTC in January. All the while, Purpose Investment’s bitcoin ETF, the world’s first, added 10,215.9033 BTC to its digital treasury and Evolve Funds bitcoin ETF, which launched shortly after, hit $50 million in bitcoin AUM.

3iQ’s Bitcoin fund, while not an ETF, also saw a significant inflow.

The launch of these two ETFs, which are accessible to US investors through some brokerages, boosted the Canadian ETF sector to its second-highest month ever of capital inflows. Bloomberg reported that Canadian ETF managers attracted $5.2 billion in February with the two bitcoin funds responsible for nearly $500 million of that.

The implications of a compressed premium

So what does it mean if the GBTC premium stays in the negative territory?

It presents an interesting arbitrage opportunity if you’re able to purchase bitcoin via the trust well below the market price, with the belief that the discount will move closer to the spot price as other arb traders move in.

But for some funds which created exposure to bitcoin via a buying into GBTC with leveraged bitcoin, this could be incredibly problematic..

These accredited investors were buying GBTC at net-asset-value and hoping to sell in the open market six months later when shares became unlocked. But with Grayscale’s premium squarely in the red, trading on the trust’s premium simply isn’t as easy as it once was.

For Grayscale this will be a huge loss since premium trading with its churn created constant liquidity via the frequent share creation and redemption.

“They don’t care if bitcoin is super volatile and goes all over the map because they’re going to pay back the shares,” Tom Lombardi, managing director of 3iQ explained.

“These hedge funds are not investing in bitcoin, they’re harvesting the premium. So they buy it at par value, and then they sell it at a 10% above par value. And if they’re 10 times leveraged, they get 100% return instead of only a 10% return.”

However, does punting around the premium on funds add any actual value to the commodity at the core of it? Lombardi said, “The mechanism of how the sausage is made, it’s not transparent and it’s not always adding net value to the market. The retail investors like you and I, we’re paying 10% more and those hedge funds are taking that as profit. It’s a cycle.”

But with two bitcoin ETFs in operation, and more expected in the near future, GBTC simply no longer has a monopoly on bitcoin exposure for retail investors.

Added Lombardi, the 10% premium was justified at one time, “because it’s the only way for me to get bitcoin in my IRA.”