Investors Waiting to Deploy Vast Stablecoin Reserves, Analysts Say

Major stablecoin supplies point to an abundance of patient investors ready to scoop up cheaper cryptocurrency prices, according to analysts

"Satoshi Nakamoto" (but not the inventor of Bitcoin) l Blockworks exclusive art by Axel Rangel

- Crypto investors are patiently awaiting a turnaround in market sentiment, according to two asset managers

- Stablecoins continue to hold weight as efficient safe haven vehicles, despite negative perceptions of their treasuries

Sweeping layoffs and liquidity crises swirling some of cryptocurrency’s largest lenders and hedge fund firms have rocked the industry to its core.

Yet despite wavering confidence and a drop in overall market sentiment, opportunistic investors stand ready to allocate their capital, according to two digital asset investment management firms.

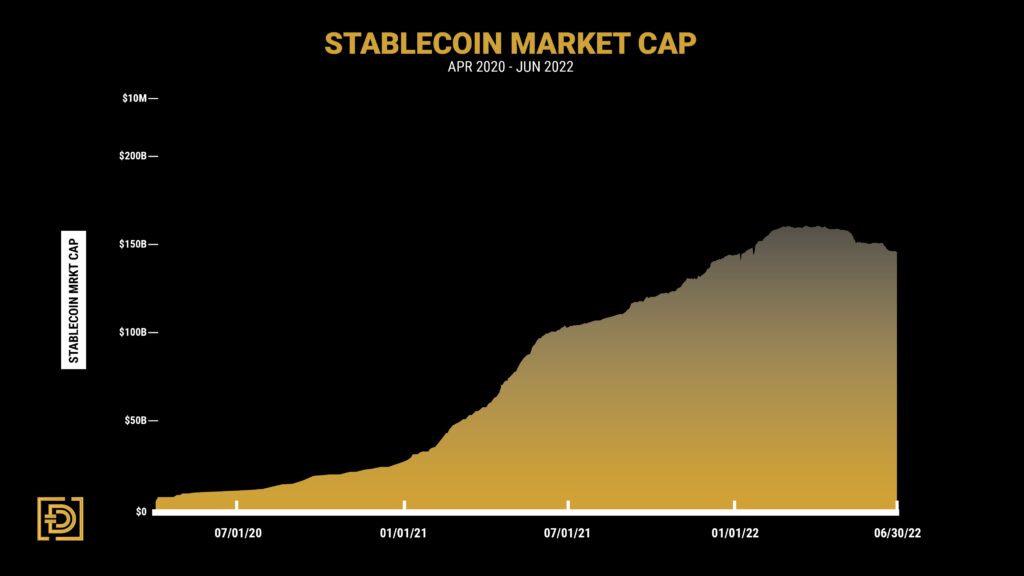

Research conducted by Digital Asset Investment Management (DAIM), revealed Friday, shows crypto’s four largest stablecoins by market capitalization have since grown considerably over a two-year period.

Tether’s USDT, Circle’s USDC, Binance’s BUSD, and MarkerDAO’s DAI rose more than 20 times – from $7 billion to $147 billion – beginning April 2020 to date, according to DAIM.

“That means the ecosystem has an additional $140 billion ready to be deployed into bitcoin and altcoins,” DAIM wrote in a newsletter, which also noted the stablecoins’ efficiency as shelter from crypto storms. “The amount of money sitting on the digital sideline has never been greater and points to an abundance of patient investors ready to pounce on discounted digital assets,” DAIM said in its report.

Stablecoin Market Cap. Source: DAIM

Stablecoin Market Cap. Source: DAIM

While the total market cap of all cryptocurrencies has dropped almost 70% since last November, from $3 trillion to $950 million, the circulating supply of the top four stablecoins increased by 12.6%, Australian-based digital asset manager and custodian Zerocap told Blockworks.

“The net growth in stablecoin supply is wholly indicative of users holding funds on-chain as opposed to retreating into dollars,” Zerocap said. “A portion of the stablecoins sitting on-chain are likely held there whilst investors dollar cost average into investments or are sitting idly, waiting for an opportune time to allocate.”

Stablecoins are typically pegged 1-to-1 to fiat (USD) and sometimes commodities (gold). The leading stablecoins are redeemable for cash, providing a reliable means of entering and exiting crypto during periods of high market volatility. They also offer those in developing nations a viable vehicle to sidestep inflation, according to some.

There are three types of stablecoins: algorithmic, fiat-collateralized and crypto-collateralized stablecoins.

Terra’s UST, which set off tremors back in May, failed the market in its algorithmic stablecoin design and ultimately crashed, leaving many of the industry’s top firms – including Celsius and Three Arrows Capital – swimming naked as the tide ran out.

Tether, originally known as “Realcoin,” by contrast, is the industry’s largest, both in market value and trade volumes. It’s also one of the oldest; Tether pioneered the concept of fiat-collateralization back in 2014. While questions still linger over the legitimacy of Tether’s reserves, proponents laud the coin’s ability to withstand sell-side pressure and process redemptions following periods of extreme volatility

Meanwhile, Circle’s USDC – the industry’s second-largest – is closing in on Tether’s stablecoin dominance, reflected in the asset’s circulating supply which swelled by 15% amid the downfall of UST, while USDT’s shrunk 20%.

“The immense growth of USDC relative to its peers is indicative of a surge in investors valuing clarity around stablecoin backing,” Zerocap said. “The Terra crash burnt a large percentage of users in the space and likely caused many to reevaluate the quality of backing behind the (intended) stable portion of their portfolio.”

The rise in popularity of USDC has bolstered stablecoin growth, increasing in supply by roughly 62% over the past eight months, the manager added.

Stablecoin hibernation for bulls

As the bear market reality gripped investors, exposure to crypto became intolerable for many. This led some to seek alternatives, including stablecoins, amid heightened risk of wayward pricing and declining company valuations.

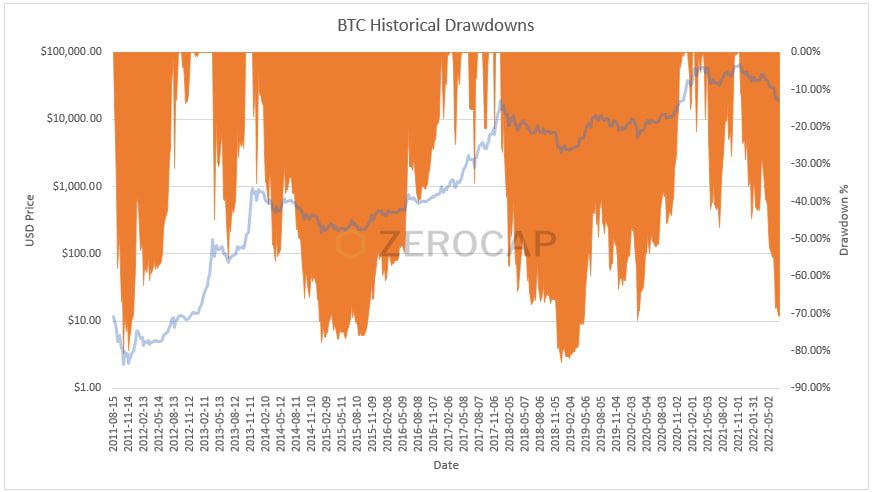

Crypto’s bellwether asset, bitcoin, shed 19% throughout April, from $45,550 to $37,630. Another steep drop – measured from May 5 through June 13 – shaved a further 44% off its price. Bitcoin is down more than 70% from its November all-time high of $69,000 to around $20,200 at press time.

Some observers and pundits have been quick to declare bitcoin a “dead” asset – adding to the incalculable number of times such declarations have been made since its inception in 2009 – yet DAIM points to the asset’s cyclical nature, beginning in 2013.

In the first cycle, which peaked in early December 2013 at $1,237, bitcoin plunged into bear market territory for a whopping 403 days before reaching a bottom of around $221 in January 2015. Bitcoin’s second cycle, which touched a new all-time high at $19,345 two and a half years later, witnessed a 363-day duration of lower lows until bottoming out at $3,247 in December 2018.

Bitcoin’s Historical Drawdowns. Source: Zerocap

Bitcoin’s Historical Drawdowns. Source: Zerocap

Applying those timelines to the most recent cycle peak, DAIM said it expects a bottom sometime in November or December of this year, though peering through the crystal ball has proved fallible in the past.

While defensive positioning is still key, for long-term investors the opportunity to accumulate blue-chip assets such as bitcoin and ether at current levels has been “historically profitable,” Zerocap said.

But as the old adage goes, past performance is not indicative of future results. Still, Zerocap reckons “with billions in forced selling, widespread accumulation and a 70% drawdown off the highs, the asymmetric risk to return profile of investments at these levels have not been seen in nearly two years.”

Those sitting on the sidelines in stablecoins, awaiting the resurgence of another bull market, could stand poised to take advantage of a time when the “negative news” eventually ends and sentiment shifts, both firms said. Just when exactly that might occur remains elusive.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.