Company formed from Celsius bankruptcy estate launches bitcoin mining operation

Some creditors to the erstwhile crypto lending platform are slated to become shareholders in the bitcoin mining company

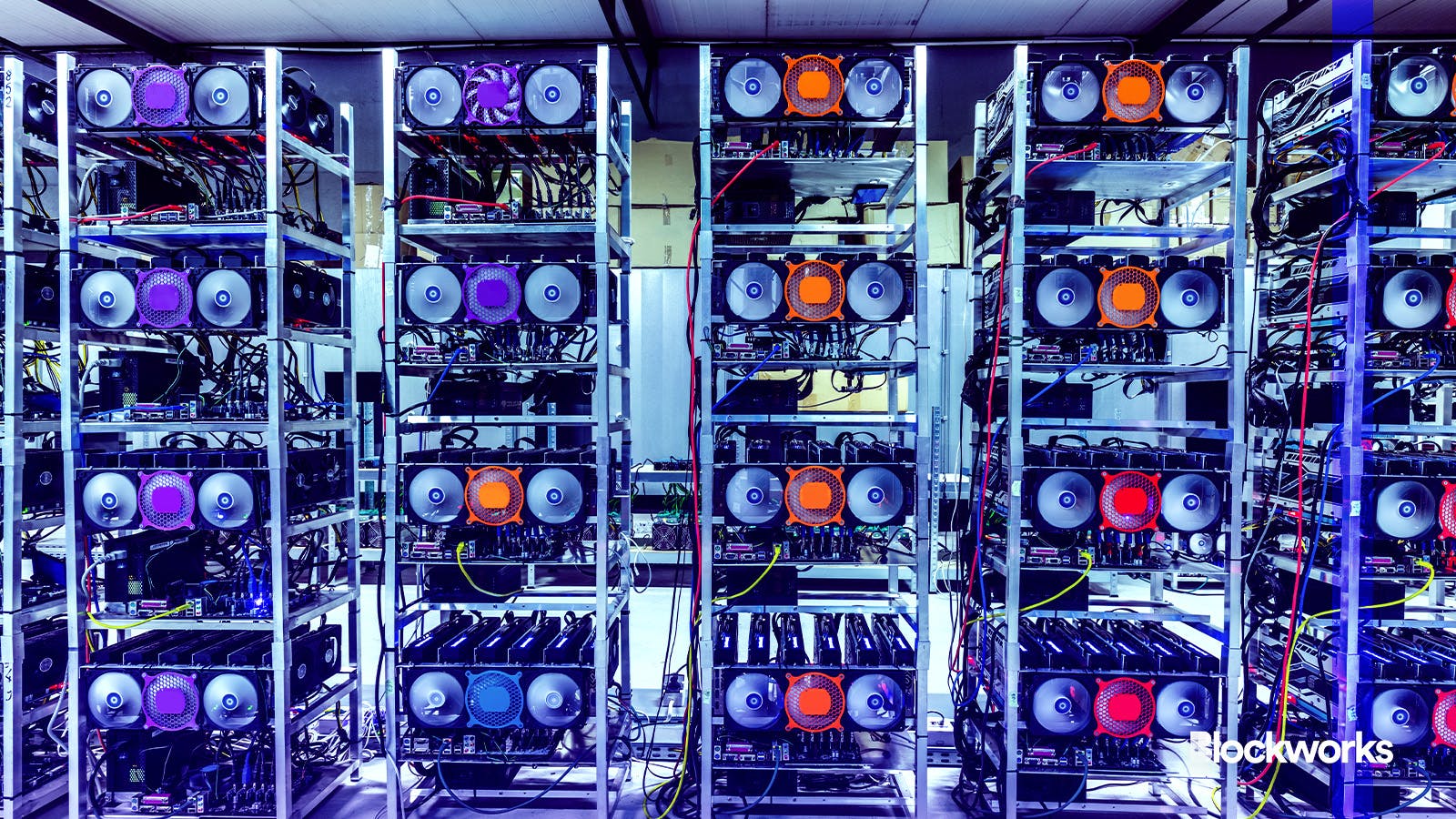

PHOTOCREO Michal Bednarek/Shutterstock modified by Blockworks

Ionic Digital, a bitcoin mining company spun up as a part of Celsius’ bankruptcy plan, is now operational.

Celsius emerged from bankruptcy Wednesday, distributing $3 billion in cryptoassets to creditors in the process, according to a press release.

Ionic will run 127,000 bitcoin mining machines across five sites in Texas. The mining rigs were purchased under former Celsius CEO Alex Mashinsky, who is currently awaiting trial for fraud. The new company will seek a public listing and issue shares to Celsius creditors hoping to recoup their lost funds.

Celsius filed for Chapter 11 bankruptcy protection in July 2022 after being caught in the liquidity crisis that followed the UST stablecoin’s sudden collapse. Since then, the Celsius estate has shuffled around its sizable crypto holdings and hammered out a plan to repay its more than 100,000 creditors.

Read more: SEC sues Celsius, former CEO for market manipulation, securities fraud

A bankruptcy judge in the Southern District of New York approved in November a plan allowing Celsius creditors to receive a combination of crypto and stock in the new bitcoin mining enterprise. The implementation was finalized in late December.

Ionic Digital received Celsius’ mining rigs and $225 million to ramp up operations. The company is helmed by Matt Prusak, a former US Bitcoin Corp executive who more recently worked at Hut 8 after a merger between the two mining firms.

Incoming CEO of Ionic Digital Matt Prusak

Incoming CEO of Ionic Digital Matt PrusakPer an agreement with the Celsius estate, Hut 8 will be paid equity plus a $20 million annual management fee over four years to assist with Ionic’s mining operations. In an interview with Blockworks, Prusak said he has no plans to leave Ionic after Hut 8’s contract runs out.

Read more: Crypto Hiring: Hut 8 exec set to take over Celsius mining company

Celsius creditors will become shareholders in Ionic Digital, which aims to become a publicly traded company in the near future. Prusak said the share distribution is in process but declined to give a specific timeline.

It’s an unconventional way to start a mining company, but running a company owned by Celsius creditors has its benefits. The new CEO steps into a role where his brand new company is well-capitalized, has no debt and could immediately have tens of thousands of shareholders.

“I think I’m embracing the uniqueness of the situation,” Prusak said, adding that he hopes to become a leader in the bitcoin mining space and help the industry mature. Prusak said some Celsius creditors had reached out with messages of support, and he hopes to engage more with his company’s shareholders in the future.

Prusak said the number of Ionic Digital employees was not yet finalized but it would be a small team. Several times throughout the interview, he emphasized that Ionic is independent from the Celsius Network.

Ionic Digital launches amid significant headwinds for the bitcoin mining industry. Mining stocks have seen a broad 2024 sell-off, particularly following the Securities and Exchange Commission’s approval of spot bitcoin ETFs. Hut 8 fell 44% in January. Things aren’t slated to get easier, with reduced mining rewards caused by the bitcoin halving looming in April.

Still, Ionic Digital furthers the hope that creditors to Celsius — some of whom lost significant sums — could be made whole.

“Crypto has had a lot of challenging stories and folks who have lost money in various ways,” Prusak said. “We had a wave of challenged companies in the sector and our efforts are part of that rebirth.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.