Bitcoin is inches away from cracking all-time high against gold

If gold remains steady today, a single move from bitcoin to $98,500 would do it

Iaroslav Neliubov/Shutterstock modified by Blockworks

Only one milestone left before bitcoin officially enters price discovery mode: gold.

No question that bitcoin is at an all-time high for US dollars. BTC hit $98,000 earlier this morning, awarding it a market cap close to $1.94 trillion (fully-diluted: $2.06 trillion).

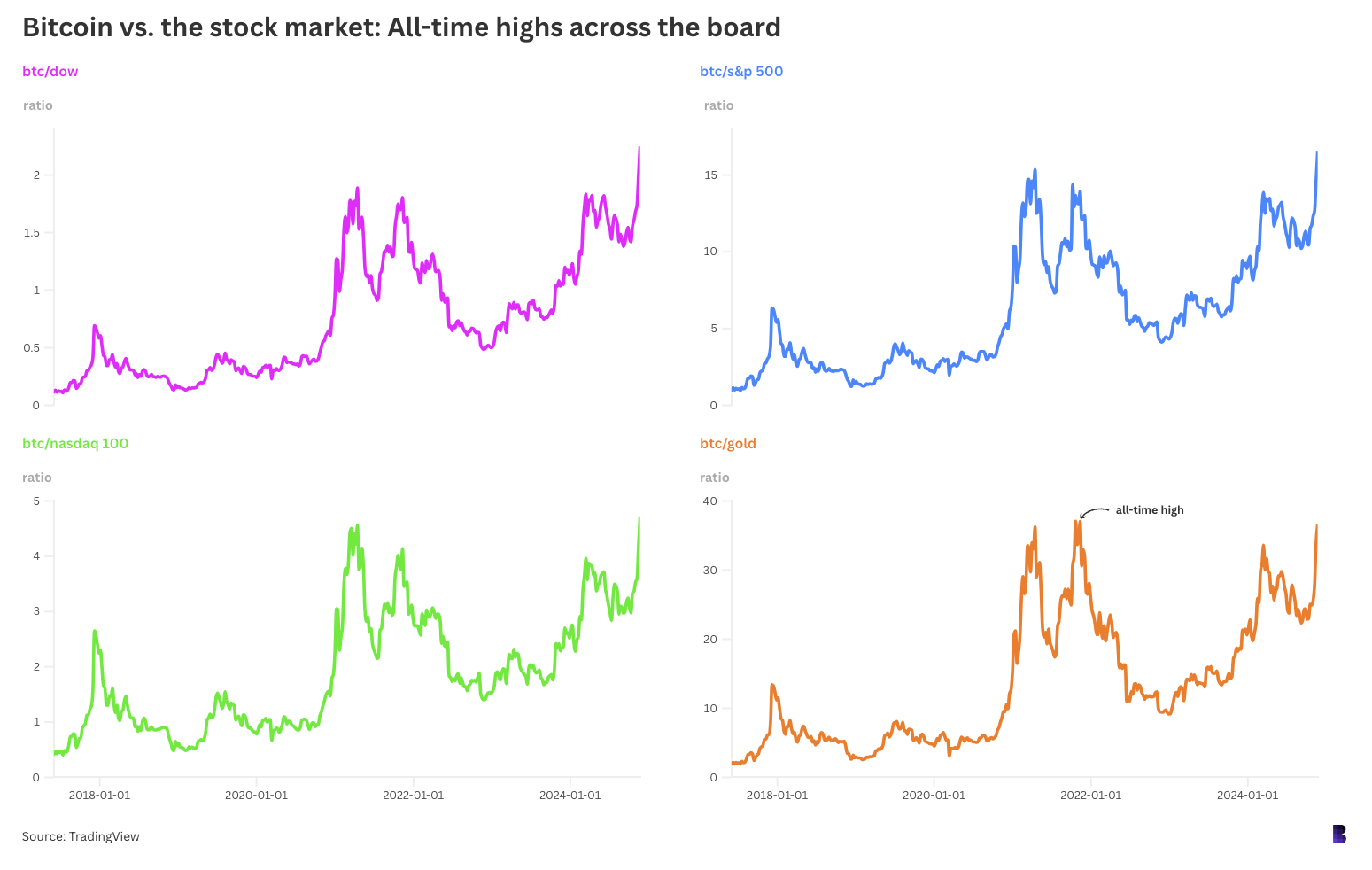

Bitcoin’s price has also formally broken 2021 records against all three major US benchmark stock indexes: the Dow Jones, S&P 500 and Nasdaq 100.

Gold, though, had outperformed bitcoin following crypto’s peak in November 2021 — until this past week. As of this morning, bitcoin was up 55% since then compared to gold’s 46%.

Bitcoin still needs to catch up to gold, which converts to lag between BTC’s gold all-time high, as well as its US dollar and stock market ratios.

On Thursday morning, the bitcoin-to-gold ratio was just under 36.83. When BTC set its November 2021 high, it was as much as 37.05, a tiny difference of less than half a percent.

If gold is steady today, a single move to $98,500 would do it from here, and even less if gold slips slightly. (Current bitcoin price: $97,845.)

At that point, there’s probably some other annoying technicality to pin on bitcoin. Perhaps it’s still below its all-time high against gold after adjusting for inflation, for instance. But whatever.

In any case, we’re all totally locked into the bitcoin price chart for the foreseeable future, including, probably, the Feds.

The US government crypto stash — seized in a variety of criminal cases — has now ballooned to almost $21 billion, over 98% of it bitcoin. The rest is mostly made up of ETH, BNB, TRX and stablecoins.

That’s up from just under $10 billion at the start of the year, per Arkham Intelligence data. Although it’s difficult to find the exact value of the crypto kept by the US government, as agencies regularly move it between unmarked wallets.

We can however zoom in on the 3,999 BTC sold by the Feds in June and July. Valued at the times of transfer to Coinbase Prime, those coins were worth on average $61,300 and likely generated more than $245 million for government coffers.

If sold today, they would’ve netted closer to $392 million, leaving $147 million on the table.

The German state of Saxony has it much worse. It altogether dumped almost 50,000 BTC on a string of exchanges around the same time as the US, raking in the euro equivalent of $2.78 billion.

Had Saxony held, it would’ve had almost $4.9 billion — converting to over $2.1 billion in lost potential revenue. That’s equal to 1.7% of Saxony’s total GDP in 2018.

All told, identified government treasuries are worth a combined $28.5 billion, belonging to the US, UK, Bhutan and El Salvador.

And with bitcoin properly in price discovery mode, now comes the true test of strength for their hands.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.