Bitcoin Market Shrugs Off Pandora Papers

Bitcoin is down 1% as latest docs from International Journalists Committee promises to shed light on the global elite’s hidden wealth — including Hong Kong’s many shell corporations.

A segment of Revolution Collage by Sal Strom whose work was exhibited in the Art gallery at Bitcoin 2021

- Bitcoin found some buying support during the US weekend as the first batch of the Pandora Papers were released

- A Hong Kong-based fund manager that Blockworks spoke to about the Pandora Papers said, “Crypto is a medium to move money from one place to another quickly,” he said. “In Asia it’s a medium to avoid the banking system. It’s like a transmission cable.”

Bitcoin opened the US trading day relatively flat as the Pandora Papers failed to move markets in a meaningful way.

The price of bitcoin is currently at $49,356.46, up 1.1% on-day, according to CoinGecko but up 13.9% during the seven days.

The Pandora Papers, the latest look at the shadowy vehicles the wealthy use to store their gains, are the biggest expose yet, according to the International Consortium of Investigative Journalists, which said it has 2.94 terabytes of data from 200 countries and territories around the world.

The group says the data includes “30 politicians and 130 Forbes billionaires, as well as celebrities, fraudsters, drug dealers, royal family members and leaders of religious groups around the world.”

Hong Kong’s shell corporations and OTC desks

Although the ICIJ and its media partners have only begun to trickle out their findings, it’s expected that there will be a heavy Hong Kong focus. On the ICIJ’s site, Hong Kong’s International Finance Centre, an iconic part of the city’s skyline, is prominently featured in illustrative art on the site.

Hong Kong’s former Chief Executive, C.Y. Leung, has already been named in the papers with claims that he hid wealth via shell corporations to obfuscate holdings of a Japanese real estate company from the public.

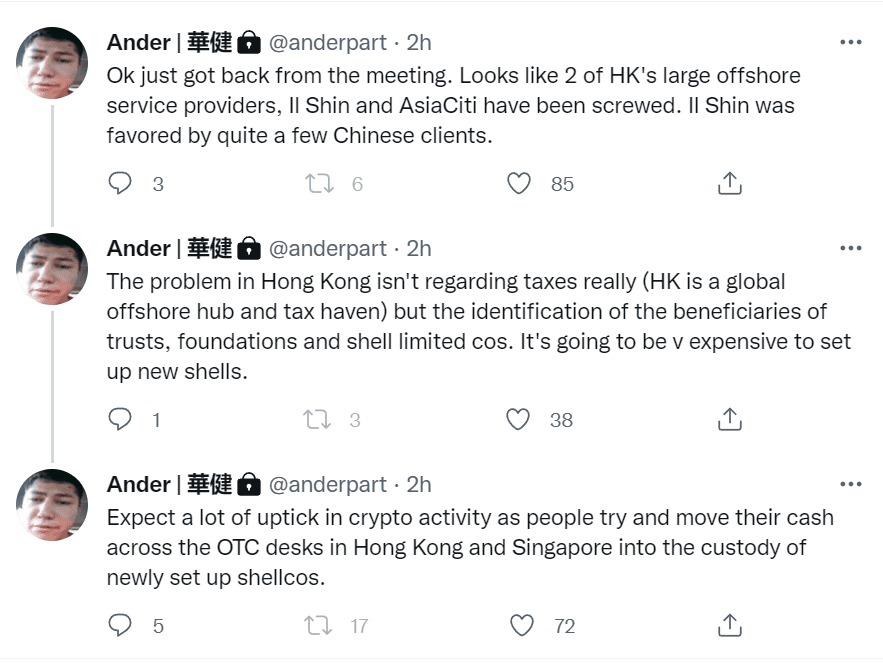

One fund manager in Hong Kong, operating under a pseudonym on Twitter, said that he expects some uptick in activity as people liquidate assets in shell companies that have been exposed by the leaks via crypto then rebuy crypto via a new shell company.

Blockworks spoke with this fund manager, while his identity or occupation could not be confirmed he did speak with authority on the finance, offshore and crypto industry in Hong Kong, suggesting that he is a fund manager or other stakeholder in the city.

“So now that the leaks can lead people to find out who the beneficial owner of the company is, you’re screwed. What you need to do is liquidate the asset, or if you already have the cash, go to any OTC desk to purchase crypto. These OTC desks have little to no KYC,” he explained. “Then you send it off to a wallet connected to the shell company.”

He also explained that many OTC desks will sell crypto on physical hardware ledgers, further obfuscating efforts to track source of funds or connections between entities. After the new shell company is set up, some shell companies will resell the crypto back to the OTC desk, thereby capitalizing the shell company while creating a legitimate transaction on the books.

“You have to use OTC desks, so the clowns at Chainalysis aren’t looking up your trades and linking it to your CEX,” he said.

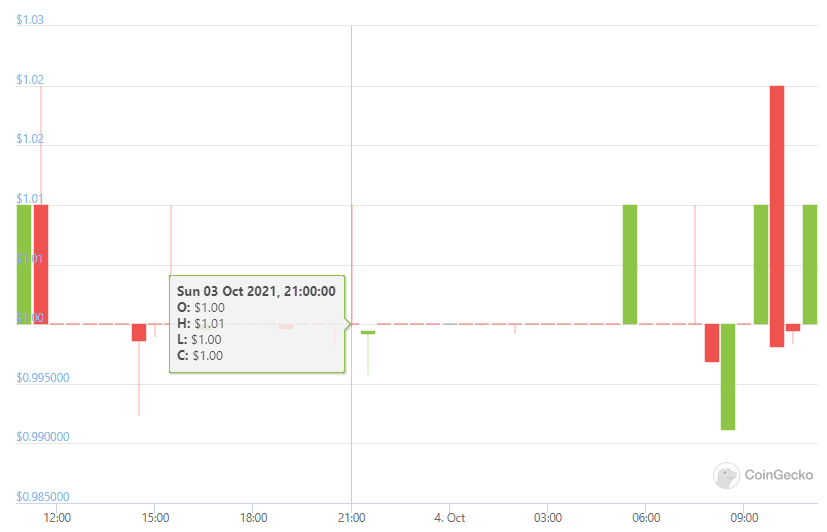

While what he described isn’t confirmed, it would explain the uptick in demand for bitcoin during the weekend and subsequent selling pressure, all in the course of 12 hours on Sunday.

Tether, used as an on and off-ramp for crypto, also followed the same pattern. It’s still trading at a slight premium, according to CoinGecko, given the spike in demand that aligned with the Hong Kong Sunday and UK business hours Monday.

“Crypto is a medium to move money from one place to another quickly,” he said. “In Asia it’s a medium to avoid the banking system. It’s like a transmission cable.”

Beijing’s moves on Hong Kong

A running theme within the politics of Hong Kong during the last year has been the erosion of the city’s separate, common law based system under pressure from Beijing. Indeed, for most of 2019 and 2020 the city was rocked by protests stemming from a broadly worded extradition bill which its critics feared could be used to drag those the Communist Party of China deemed problematic from Hong Kong to mainland China.

While there has been an uptick in crypto adoption in the city to safeguard assets from confiscation, the fund manager Blockworks spoke with believes that while there are some creating shell companies holding crypto as an insurance policy, broadly speaking the political threat is overhyped.

Contrary to what others have said, crypto isn’t being targeted by authorities in Hong Kong because of its ability to move capital out of the region or shield it from confiscation, the fund manager noted. “Look at how FTX was headquartered in Hong Kong until very recently, and they left — largely because of quarantine policies,” he said. “But you have BitMEX, Huobi, Bitfinex… everyone is in Hong Kong still.”

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.