Bitcoin Miner Core Scientific Files Bankruptcy, Stock Tanks 30%

Core Scientific plans to continue mining bitcoin throughout its bankruptcy, triggered by slumping revenue and unpayable debts

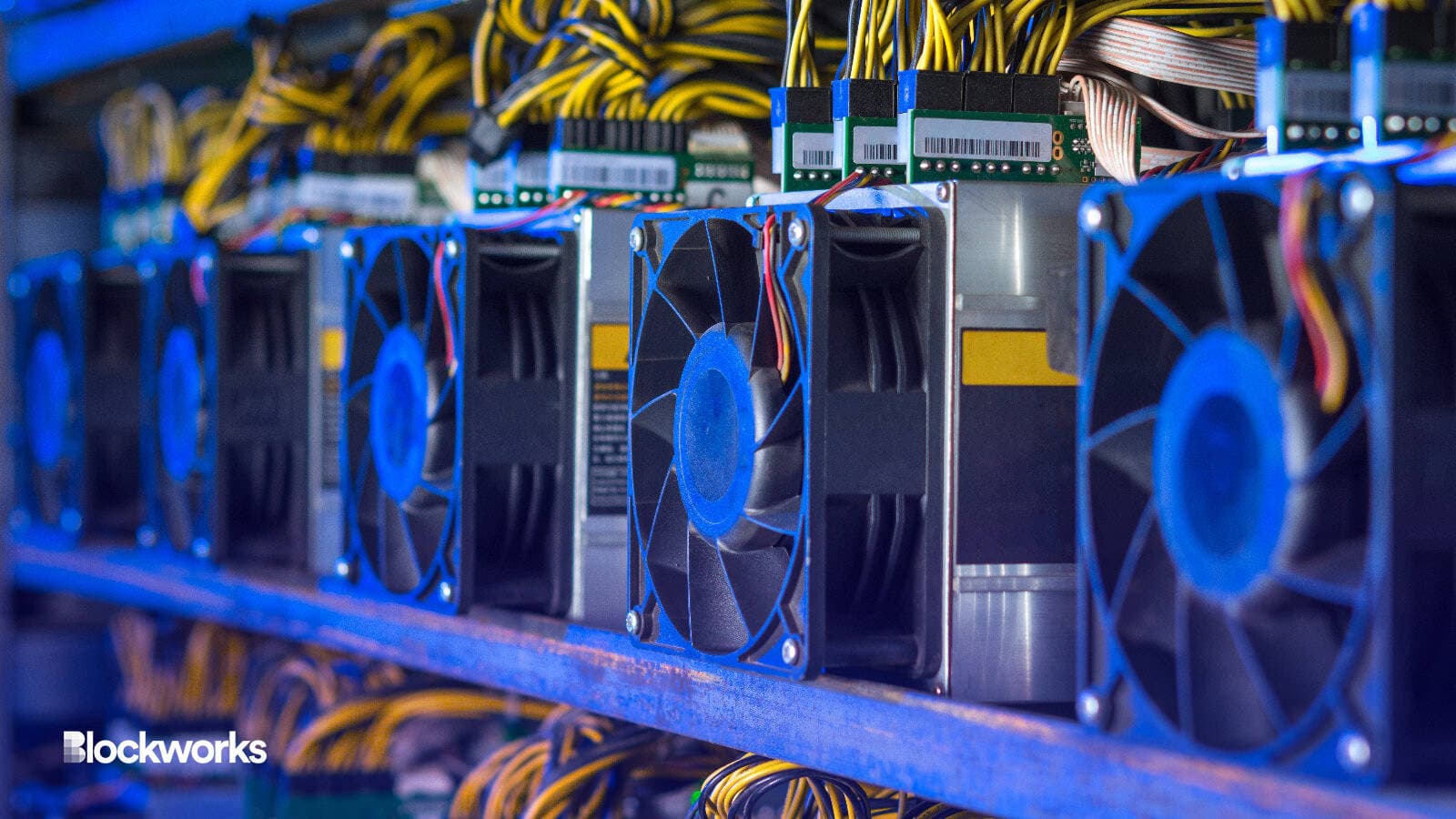

Mark Agnor/Shutterstock modified by Blockworks

Core Scientific, one of the world’s biggest bitcoin mining stocks, filed for bankruptcy on Wednesday after struggling under the weight of its debt.

The Texas-based firm’s cash flow is still positive, the company said in a press release, but it’s insufficient to repay an equipment financing loan

Core Scientific plans to continue mining while repaying the company’s majority debtholders.

The firm disclosed in a securities filing dated Nov. 21 that it didn’t have enough cash to last through 2023. It also flagged doubts about its ability to raise funds through financing or capital markets.

In that filing, Core Scientific said it expects existing cash resources to be exhausted by “the end of 2022 or sooner.” Core Scientific has now filed for Chapter 11 bankruptcy just one month later.

The firm was just one of many bitcoin mining operations to take out high-interest loans to fund rapid expansions and bolster rig inventories during the heat of last year’s bull market. Loans were often collateralized with existing ASIC reserves.

But rising electricity prices, falling crypto markets and sky-high mining difficulty left many companies, including Core Scientific, without enough revenue to cover debt obligations. Core Scientific said in October it would skip upcoming payments on several loans.

The move to restructure “was necessitated by a decline in … operating performance and liquidity suffering from the prolonged decrease in the price of bitcoin, the increase in electricity costs necessary to power … data centers, and the failure by certain of its hosting customers to honor their payment obligations,” Core Scientific said.

The firm played host to bankrupt crypto lender Celsius’ bitcoin mining operations and claims to be owed $5.4 million in unpaid fees.

Core Scientific ended October with $32.2 million in cash and just 62 BTC ($1 million), a far bleaker picture than September when it held 1,051 BTC ($17.7 million) and $29.5 million in cash.

All this has obviously weighed heavily on Core Scientific stock, which is down 98% in 2022. The firm’s share price tanked a further 30% in pre-market trading Wednesday following news of its impending bankruptcy filing.

Direct rivals Marathon and Riot have shed 88% and 83% from their share prices this year, respectively. Core Scientific didn’t return Blockworks’ request for comment by press time.

There could be further bitcoin mining bankruptcies on the horizon. London-based outfit Argo Blockchain earlier this month warned shareholders it was threatened by “insufficient cash” and made no assurances of avoiding bankruptcy.

Updated Dec. 21, 2022 at 7:00 am ET: Included details of Core Scientific’s official statement, Celsius connection.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.