Bitcoin Stock-to-Flow Diverges, Inflows Resume After Slump

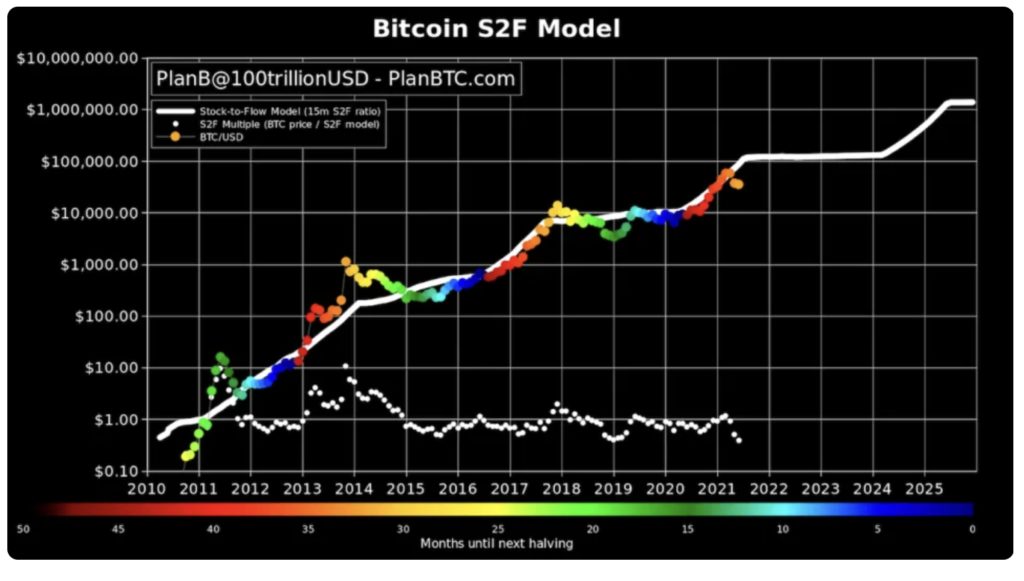

Bitcoin’s stock-to-flow model, the ratio calculation usually applied to commodities like gold and silver, is showing the largest divergence since January 2019.

Source: Shutterstock

- Bitcoin is now the furthest away from its estimated value in over two years

- The crypto selloff pushed investors out of digital asset products for weeks, but now traders are starting to reverse course

According to a major indicator for bitcoin price prediction, the stock-to-flow model, the largest digital currency is now the furthest away from its estimated value in over two years.

Bitcoin’s stock-to-flow model, the ratio calculation usually applied to commodities like gold and silver, is showing the largest divergence since January 2019. According to the model, bitcoin’s price should be about $77,900 right now, as opposed to the current price of around $34,000.

Stock-to-flow is a model that operates under the assumption that scarcity drives value. It is measured by the ratio of the current stock of a commodity to the flow of new production. Stock-to-flow can be applied to a variety of asset classes, but is most often used with store-of-value commodities that tend to retain value over long periods of time due to limited supply and flow.

Bitcoin crashed from its all-time high of $64,829 in April 2021 to just under $33,970.54 at time of publication, according to CoinGecko.

Reversing course

The market selloff pushed investors out of cryptocurrency products for weeks, but now traders are starting to reverse course.

Inflows into cryptocurrency investment vehicles resumed after four consecutive weeks of outflows, according to data from CoinShares. Last week, investors poured $63 million into digital asset products.

Investment providers Grayscale, the provider of exchange-traded product the Grayscale Bitcoin Trust, and Purpose, which runs the Purpose Bitcoin exchange-traded Fund in Canada, saw the greatest inflows.

Last week also marked the first time in nine weeks that inflows were seen across all digital assets, including bitcoin, ethereum and polkadot. The flows reveal that some investors may be gaining confidence that digital assets will rise and want to get in while prices are still low, despite the divergence in the stock-to-flow model.

“I entered at $9,000. I’m still in the money, and I’m very happy it’s coming down so I can buy more,” said Robert Kiyosaki, author of Rich Dad, Poor Dad during a July 5 interview with Yahoo Finance. Kiyosaki went on to explain that bitcoin, like gold, is a store-of-value asset and will retain value even if the dollar falls.

For the purpose of the stock-to-flow model, bitcoin is thought of as a scarce commodity because it is expensive, difficult to produce and has a limited supply. The model is almost entirely dependent upon the notion that bitcoin’s scarcity will drive its value.

Based on the stock-to-flow model, cryptocurrency hedge fund Pantera Capital announced in April 2020 that bitcoin should reach $115,000 by August 2021.

Despite the recent pullback in the market, Pantera and other bulls maintain that there is still room for the market to grow, and based on fund flows, some investors may agree.