Capitol Gains: What’s the market structure holdup? Depends who you ask

Republicans say they are waiting on Democrats. Democrats say the industry is too cozy with Republicans

Maxim Elramsisy/Ron Adar/Lissandra Melo/Shutterstock and Adobe modified by Blockworks

Democrats and Republicans hosted dueling roundtables with crypto industry executives on Wednesday in an effort to advance cryptocurrency market structure legislation.

More than three months after the House passed the CLARITY Act, the bill has yet to make meaningful progress in the Senate. According to people familiar with Wednesday’s discussions, both parties are pointing fingers.

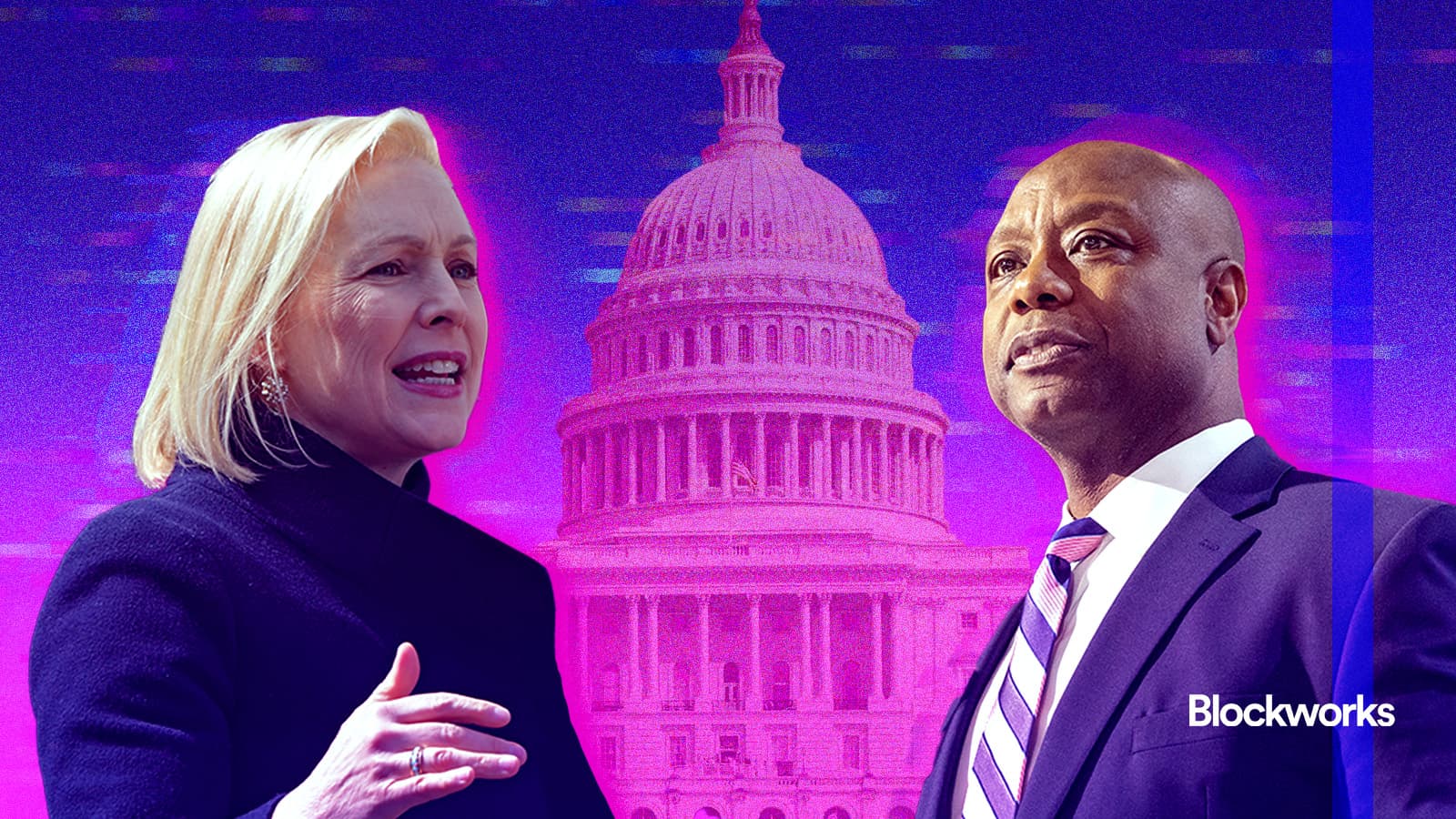

Democrats, gathered by Sen. Kirsten Gillibrand on Wednesday morning, are growing frustrated with the crypto industry’s tendency to align itself with Republicans.

“Don’t be an arm of the Republican Party, they used you all and your megaphones to f*** us,” Democrat Sen. Ruben Gallego told industry members and fellow Democrats during the roundtable discussion, according to two people in attendance.

Senate Banking Committee Chair Sen. Tim Scott, who hosted fellow Republicans and industry voices Wednesday afternoon, disagreed, saying Republicans have been waiting for Democrats to come to the table.

“Despite repeated requests for edits and redlines from Democrats, they have yet to provide formal feedback or agree to a markup date,” a spokesperson for Sen. Scott told Blockworks.

The roundtables come after Senate Banking Committee Republicans released a second discussion draft of the legislation last month. Democrats responded with a list of principles they’d like to see in the legislation. An additional Democratic proposal focused on DeFi was leaked earlier this month, furthering the divide between the two parties.

The industry’s public — and widely negative — response to this leaked document derailed negotiations between Democrats and Republicans, a person familiar with the matter told Blockworks. Democrats specifically warned industry members that the reaction thwarted the bill’s progress, the person added.

Committee Republicans originally wanted to markup the legislation in late September, but delayed “to give Democrat colleagues additional time to come to the table and substantively engage on legislative text,” the spokesperson added.

Republicans have not ruled out scheduling a markup amid the government shutdown, which has now entered its fourth week, a person familiar with the matter said.

Several Democrats are still concerned about President Trump and his family’s crypto business dealings, a person in attendance noted.

Coinbase CEO Brian Armstrong, who attended both the Democrat and Republican meetings, told reporters Wednesday that these ethical concerns are “much broader than crypto.”

The industry is still waiting on the Senate Agriculture Committee to release its market structure bill draft. This version of the legislation will focus primarily on the Commodity and Futures Trading Commission’s role in overseeing crypto markets.

The bill was “close” to the finish line before the government shutdown, a person familiar with the matter said, but with CFTC staffers who work with Congressional committees now furloughed, it’s unclear when progress could be made.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.